Region:Middle East

Author(s):Rebecca

Product Code:KRAC9846

Pages:88

Published On:November 2025

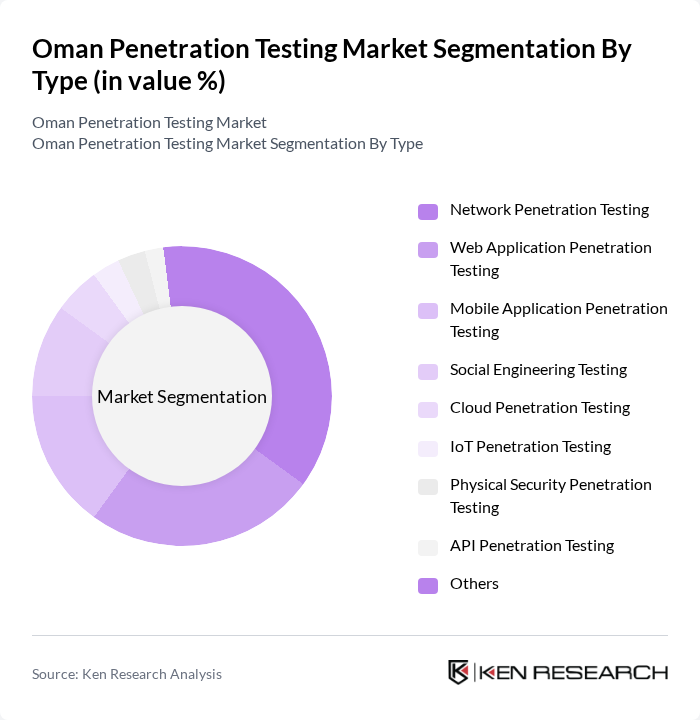

By Type:The penetration testing market in Oman is segmented into Network Penetration Testing, Web Application Penetration Testing, Mobile Application Penetration Testing, Social Engineering Testing, Cloud Penetration Testing, IoT Penetration Testing, Physical Security Penetration Testing, API Penetration Testing, and Others. Network Penetration Testing remains the most dominant segment, driven by the prevalence of network-based attacks and the critical need for organizations to secure sensitive data and maintain operational continuity. Web and mobile application testing are also experiencing increased demand due to the rapid adoption of digital platforms and cloud services.

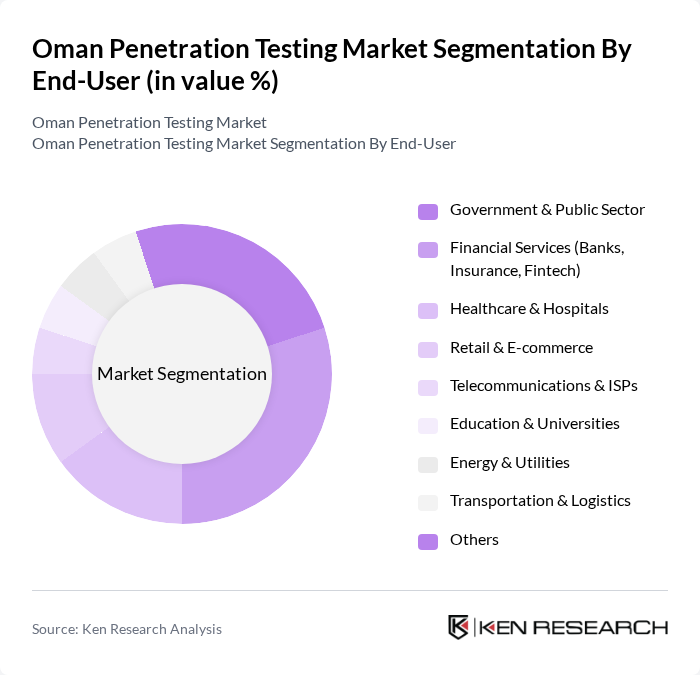

By End-User:The end-user segmentation includes Government & Public Sector, Financial Services (Banks, Insurance, Fintech), Healthcare & Hospitals, Retail & E-commerce, Telecommunications & ISPs, Education & Universities, Energy & Utilities, Transportation & Logistics, and Others. Financial Services is the leading end-user segment, reflecting stringent regulatory requirements and the sector’s exposure to sophisticated cyberattacks. Government, healthcare, and energy sectors also demonstrate strong demand for penetration testing, driven by compliance mandates and the need to protect critical infrastructure.

The Oman Penetration Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DeepStrike, Oman Data Park, Dreamlab Technologies Oman, Help AG, Raqmiyat, Factosecure, ntis Oman, Secureworks, Trustwave, Paladion Networks, Kaspersky Lab, Check Point Software Technologies, Fortinet, IBM Security, Rapid7, Qualys, McAfee, FireEye, Palo Alto Networks, Trend Micro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman penetration testing market appears promising, driven by increasing investments in cybersecurity and the ongoing digital transformation across various sectors. As organizations recognize the critical need for robust security measures, the demand for penetration testing services is expected to rise. Additionally, the integration of advanced technologies such as AI and machine learning will enhance testing methodologies, making them more efficient and effective in identifying vulnerabilities, thus shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Penetration Testing Web Application Penetration Testing Mobile Application Penetration Testing Social Engineering Testing Cloud Penetration Testing IoT Penetration Testing Physical Security Penetration Testing API Penetration Testing Others |

| By End-User | Government & Public Sector Financial Services (Banks, Insurance, Fintech) Healthcare & Hospitals Retail & E-commerce Telecommunications & ISPs Education & Universities Energy & Utilities Transportation & Logistics Others |

| By Industry Vertical | BFSI Manufacturing Energy and Utilities Transportation and Logistics IT and Telecom Government Healthcare Retail Others |

| By Service Model | On-Premises Cloud-Based Hybrid Penetration Testing as a Service (PTaaS) Others |

| By Engagement Model | Project-Based Retainer-Based Subscription-Based Continuous Testing Others |

| By Geography | Muscat Salalah Sohar Nizwa Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Penetration Testing | 50 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Assessments | 40 | Chief Information Officers, IT Directors |

| Government Agency Security Evaluations | 40 | Cybersecurity Analysts, Risk Management Officers |

| Telecommunications Vulnerability Assessments | 40 | Network Security Engineers, Operations Managers |

| Retail Sector Cybersecurity Testing | 40 | IT Managers, Security Compliance Specialists |

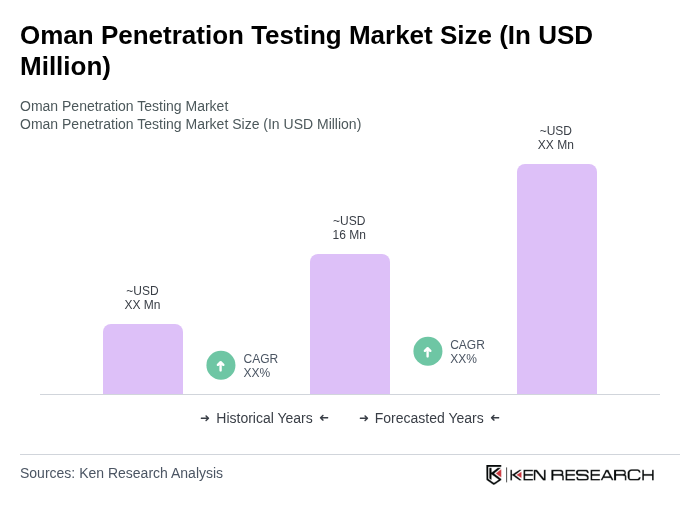

The Oman Penetration Testing Market is valued at approximately USD 16 million, reflecting a significant investment by organizations in cybersecurity measures to combat increasing cyber threats and comply with regulatory requirements.