Region:Global

Author(s):Dev

Product Code:KRAC8776

Pages:88

Published On:November 2025

By Equipment Type:The equipment type segmentation includes various categories such as blister packaging equipment, bottling equipment, labeling machines, cartoning machines, filling machines, sealing machines, strip packaging machines, wrapping machines, and others. Among these, blister packaging equipment is currently the leading sub-segment due to its widespread use in the pharmaceutical industry for packaging tablets and capsules, ensuring product safety and extending shelf life. The demand for blister packaging is driven by consumer preferences for convenience and the need for effective dosage management. The filling machines segment is also gaining prominence due to the high global demand for solid oral dosage forms and advancements in packaging technologies .

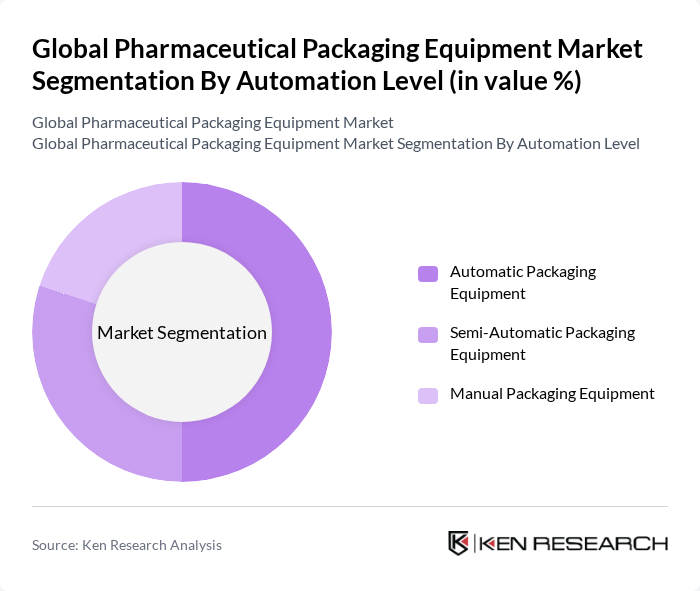

By Automation Level:The automation level segmentation includes automatic packaging equipment, semi-automatic packaging equipment, and manual packaging equipment. Automatic packaging equipment is the dominant sub-segment, driven by the increasing need for efficiency and precision in pharmaceutical packaging processes. The trend towards automation is fueled by the demand for higher production rates, reduced labor costs, and compliance with stringent regulatory standards, making automatic solutions more appealing to manufacturers .

The Global Pharmaceutical Packaging Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Körber AG (formerly Bosch Packaging Technology), IMA Group, Marchesini Group, Uhlmann Group, Romaco Pharmatechnik GmbH, Krones AG, MULTIVAC Group, Optima Packaging Group GmbH, Sealed Air Corporation, SCHOTT AG, ACG Worldwide, Sidel Group, Tetra Pak Group, Cama Group, ACG Pam Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical packaging equipment market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As automation and smart packaging solutions gain traction, companies will increasingly invest in innovative technologies to enhance efficiency and reduce costs. Additionally, the emphasis on sustainability will continue to shape packaging strategies, with a growing number of firms adopting eco-friendly materials and practices to meet regulatory demands and consumer expectations, ensuring a competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Blister Packaging Equipment Bottling Equipment Labeling Machines Cartoning Machines Filling Machines Sealing Machines Strip Packaging Machines Wrapping Machines Others |

| By Automation Level | Automatic Packaging Equipment Semi-Automatic Packaging Equipment Manual Packaging Equipment |

| By Packaging Type | Primary Packaging Equipment Secondary Packaging Equipment Tertiary Packaging Equipment |

| By Formulation | Solid Dosage Forms (Tablets & Capsules) Liquid Dosage Forms (Syrups & Suspensions) Semi-Solid Dosage Forms (Ointments, Creams) Injectable Drugs Inhalable & Nasal Sprays Others |

| By End-User | Pharmaceutical Manufacturers Contract Manufacturing Organizations (CMOs) Biopharmaceutical Companies Research Institutions Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Production Managers, Quality Assurance Leads |

| Packaging Suppliers | 60 | Sales Directors, Product Development Managers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Specialists |

| Logistics and Distribution Firms | 50 | Supply Chain Managers, Operations Directors |

| End-User Healthcare Facilities | 50 | Pharmacy Managers, Procurement Officers |

The Global Pharmaceutical Packaging Equipment Market is valued at approximately USD 10.71 billion, reflecting a significant growth driven by the demand for efficient and safe packaging solutions in the pharmaceutical industry.