Region:Global

Author(s):Rebecca

Product Code:KRAD0222

Pages:86

Published On:August 2025

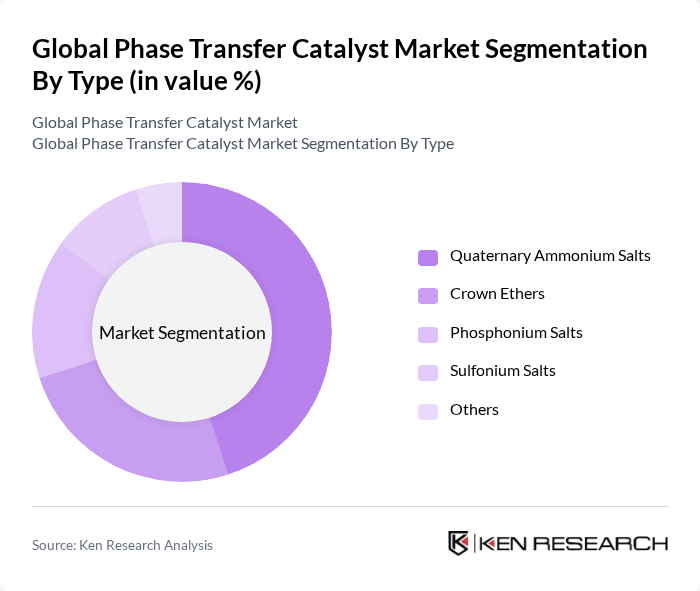

By Type:The phase transfer catalyst market is segmented into Quaternary Ammonium Salts, Crown Ethers, Phosphonium Salts, Sulfonium Salts, and Others. Among these, Quaternary Ammonium Salts hold the largest share due to their versatility, cost-effectiveness, and efficiency in facilitating reactions between organic and inorganic phases. Their widespread application in pharmaceuticals, agrochemicals, and specialty chemicals further solidifies their leading position .

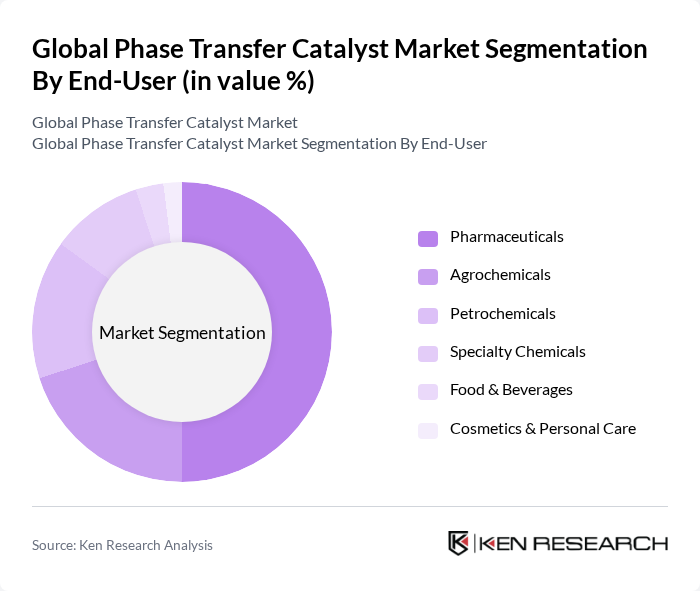

By End-User:The market is further segmented by end-user industries, including Pharmaceuticals, Agrochemicals, Petrochemicals, Specialty Chemicals, Food & Beverages, and Cosmetics & Personal Care. The Pharmaceuticals sector remains the largest consumer of phase transfer catalysts, driven by the need for efficient synthesis processes, compliance with green chemistry mandates, and the growing demand for innovative drug formulations. Agrochemicals and petrochemicals also represent significant end-use segments due to the catalysts' role in crop protection and process optimization .

The Global Phase Transfer Catalyst Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Evonik Industries AG, Johnson Matthey PLC, Solvay S.A., Dow Chemical Company, Albemarle Corporation, Mitsubishi Chemical Corporation, Haldor Topsoe A/S, W.R. Grace & Co., Arkema S.A., Air Products and Chemicals, Inc., Lanxess AG, Afton Chemical Corporation, Taminco Corporation, Tokyo Chemical Industry Co., Ltd., Nippon Chemical Industrial Co., Ltd., Dishman Carbogen Amcis Ltd., Tatva Chintan Pharma Chem Ltd., Central Drug House (P) Ltd., Pacific Organics Pvt. Ltd., Otto Chemie Pvt. Ltd., Volant-Chem Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phase transfer catalyst market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly solutions, the demand for biodegradable catalysts is expected to rise. Furthermore, advancements in catalyst recycling technologies will likely enhance efficiency and reduce waste, creating new avenues for growth. Collaborations between industry players and research institutions will also foster innovation, ensuring that the market remains dynamic and responsive to emerging trends and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Quaternary Ammonium Salts Crown Ethers Phosphonium Salts Sulfonium Salts Others |

| By End-User | Pharmaceuticals Agrochemicals Petrochemicals Specialty Chemicals Food & Beverages Cosmetics & Personal Care |

| By Application | Organic Synthesis Polymerization Extraction Processes Catalytic Oxidation/Reduction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Process Engineers |

| Agrochemical Sector | 80 | Product Development Scientists, Regulatory Affairs Specialists |

| Polymer Manufacturing | 60 | Production Supervisors, Quality Control Analysts |

| Environmental Applications | 50 | Sustainability Managers, Environmental Engineers |

| Academic and Research Institutions | 40 | Professors, Research Scientists |

The Global Phase Transfer Catalyst Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for efficient chemical processes across various industries, including pharmaceuticals and agrochemicals.