Region:Global

Author(s):Dev

Product Code:KRAC0540

Pages:90

Published On:August 2025

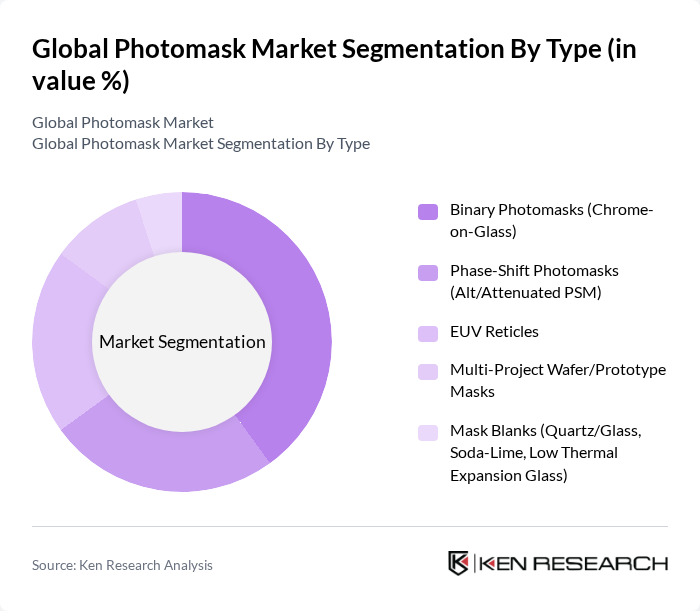

By Type:The photomask market is segmented into various types, including Binary Photomasks (Chrome-on-Glass), Phase-Shift Photomasks (Alt/Attenuated PSM), EUV Reticles, Multi-Project Wafer/Prototype Masks, and Mask Blanks (Quartz/Glass, Soda-Lime, Low Thermal Expansion Glass). Among these, Binary Photomasks are the most widely used due to their cost-effectiveness and suitability for a range of applications in semiconductor manufacturing.

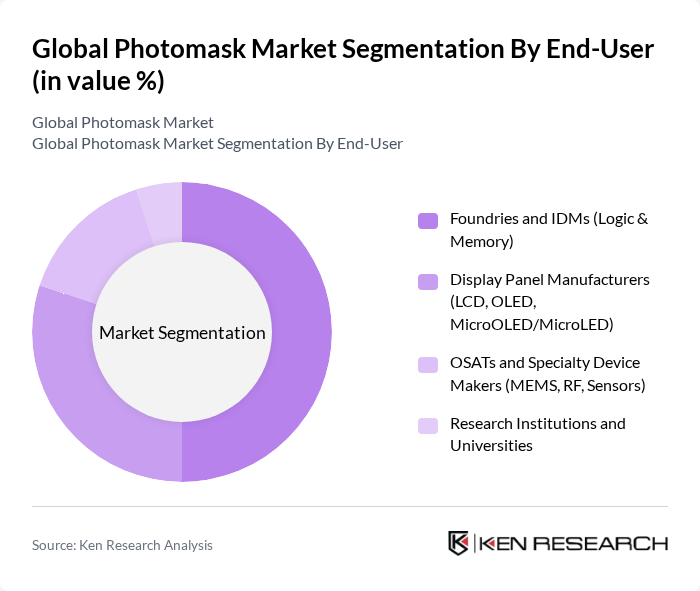

By End-User:The end-user segmentation includes Foundries and IDMs (Logic & Memory), Display Panel Manufacturers (LCD, OLED, MicroOLED/MicroLED), OSATs and Specialty Device Makers (MEMS, RF, Sensors), and Research Institutions and Universities. Foundries and IDMs dominate the market due to the high volume of photomasks required for logic and memory chip production, driven by the increasing demand for advanced computing and mobile devices.

The Global Photomask Market is characterized by a dynamic mix of regional and international players. Leading participants such as Photronics, Inc., HOYA Corporation (Mask Blanks), Toppan Photomasks, Inc. (a division of TOPPAN Holdings), Dai Nippon Printing Co., Ltd. (DNP), SK-Electronics Co., Ltd., Taiwan Mask Corporation (TMC), Compugraphics International Ltd. (Photomask solutions), LG Innotek Co., Ltd. (Display photomasks), Lasertec Corporation (Mask inspection/metrology), ASML Holding N.V. (EUV systems and computational lithography), KLA Corporation (Reticle inspection), Canon Inc. (Lithography and mask aligners), Nikon Corporation (Lithography equipment), Xinyaqiang Silicon Chemistry Co., Ltd. (Mask materials), and Qingdao UPM Photomask Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the photomask market appears promising, driven by technological advancements and increasing demand across various sectors. As semiconductor manufacturers continue to innovate, the integration of EUV lithography and smaller feature sizes will become more prevalent. Additionally, the focus on sustainability will push companies to develop eco-friendly photomasks, aligning with global environmental goals. The expansion into emerging markets will also present new opportunities for growth, as these regions adopt advanced technologies and increase their semiconductor production capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Binary Photomasks (Chrome-on-Glass) Phase-Shift Photomasks (Alt/Attenuated PSM) EUV Reticles Multi-Project Wafer/Prototype Masks Mask Blanks (Quartz/Glass, Soda-Lime, Low Thermal Expansion Glass) |

| By End-User | Foundries and IDMs (Logic & Memory) Display Panel Manufacturers (LCD, OLED, MicroOLED/MicroLED) OSATs and Specialty Device Makers (MEMS, RF, Sensors) Research Institutions and Universities |

| By Application | Integrated Circuits (Logic, DRAM, NAND) Flat Panel Displays MEMS and Sensors Photonics and Advanced Packaging (RDL/Interposers) |

| By Sales Channel | Direct (Captive and Contract) Sales Authorized Distributors/Agents Strategic Supply Agreements/Long-Term Agreements (LTAs) |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Technology Node | Sub-20nm (EUV/ArF Immersion) –65nm (ArF/KrF) ?90nm (Legacy/Analog/Power/Discrete) |

| By Others | Custom/One-off Mask Services Niche Applications (Compound Semiconductors, Power, SiC/GaN) Emerging Technologies (MicroLED, Advanced Packaging, EUV High-NA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing Firms | 120 | Production Managers, Process Engineers |

| Photomask Suppliers | 90 | Sales Directors, Product Managers |

| Research Institutions | 60 | Research Scientists, Technology Analysts |

| End-User Industries (e.g., Consumer Electronics) | 60 | Product Development Managers, Supply Chain Analysts |

| Industry Associations | 40 | Policy Makers, Industry Experts |

The Global Photomask Market is valued at approximately USD 5 billion, driven by the increasing demand for advanced semiconductor manufacturing technologies, particularly in integrated circuits and display production.