Region:Asia

Author(s):Rebecca

Product Code:KRAA9406

Pages:88

Published On:November 2025

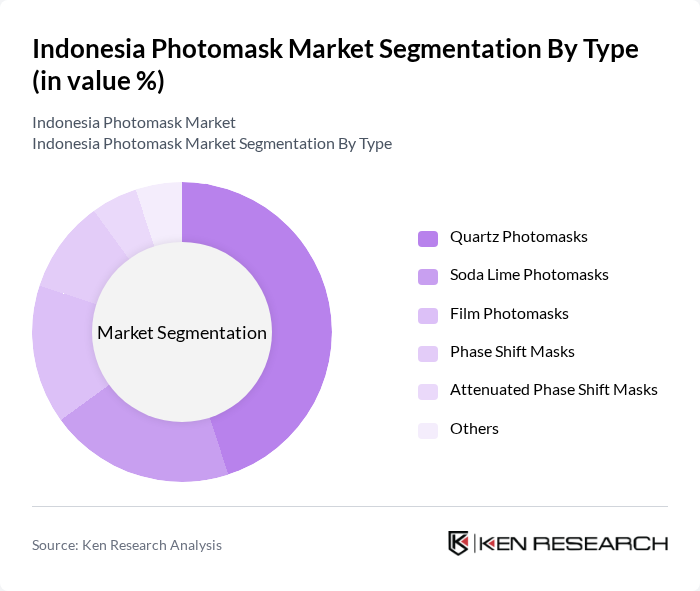

By Type:The photomask market can be segmented into various types, including Quartz Photomasks, Soda Lime Photomasks, Film Photomasks, Phase Shift Masks, Attenuated Phase Shift Masks, and Others. Each type serves specific applications in semiconductor manufacturing and display technologies. Among these, Quartz Photomasks are the most widely used due to their superior optical properties, high thermal stability, and durability, making them essential for high-precision applications in advanced semiconductor lithography and flat panel display production.

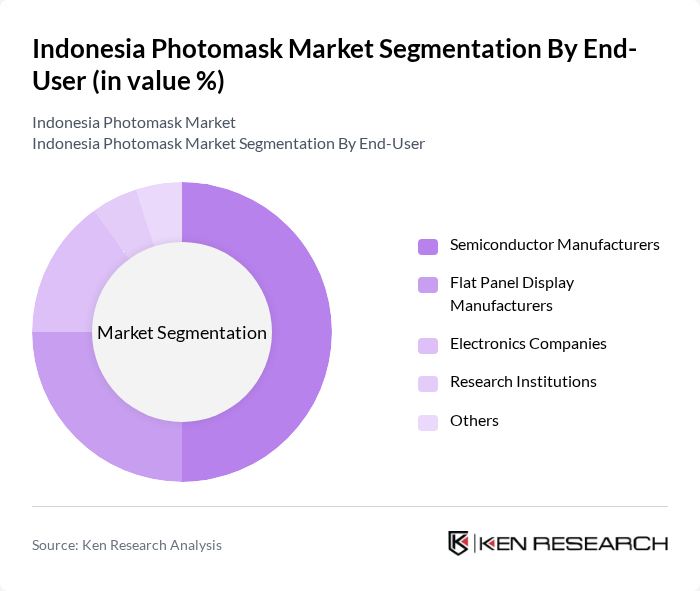

By End-User:The end-user segmentation includes Semiconductor Manufacturers, Flat Panel Display Manufacturers, Electronics Companies, Research Institutions, and Others. Semiconductor Manufacturers are the leading end-users, driven by the increasing demand for integrated circuits, microchips, and advanced packaging in various electronic devices. Growth in this segment is fueled by technological advancements, miniaturization trends, and the rising need for high-performance computing across consumer electronics and automotive applications.

The Indonesia Photomask Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Indonesia Photomask, PT. Surya Semesta Internusa, PT. Astra Graphia Tbk, PT. Samsung Electronics Indonesia, PT. LG Electronics Indonesia, PT. Panasonic Gobel Indonesia, PT. Photronics Indonesia, PT. Dai Nippon Printing Indonesia, PT. Toppan Photomasks Indonesia, PT. Hoya Lens Indonesia, PT. Intel Indonesia, PT. NXP Semiconductors Indonesia, PT. STMicroelectronics Indonesia, PT. Texas Instruments Indonesia, PT. Renesas Electronics Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian photomask market appears promising, driven by technological advancements and increasing demand for semiconductors. As the government continues to invest in the electronics sector, local manufacturers are likely to enhance their capabilities. Furthermore, the integration of automation and AI in production processes will streamline operations, improving efficiency. The growing focus on sustainability will also encourage the development of eco-friendly photomask technologies, positioning Indonesia as a competitive player in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Quartz Photomasks Soda Lime Photomasks Film Photomasks Phase Shift Masks Attenuated Phase Shift Masks Others |

| By End-User | Semiconductor Manufacturers Flat Panel Display Manufacturers Electronics Companies Research Institutions Others |

| By Application | Integrated Circuits Flat Panel Displays MEMS Devices LED Manufacturing Optical Devices Others |

| By Material | Quartz Soda Lime Glass Others |

| By Technology | Optical Lithography Electron Beam Lithography Laser Lithography Others |

| By Region | Java Sumatra Bali Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Fabrication Plants | 100 | Production Managers, Process Engineers |

| Photomask Suppliers | 60 | Sales Directors, Product Managers |

| Research & Development Departments | 50 | R&D Managers, Technology Analysts |

| Industry Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-User Electronics Manufacturers | 70 | Supply Chain Managers, Procurement Specialists |

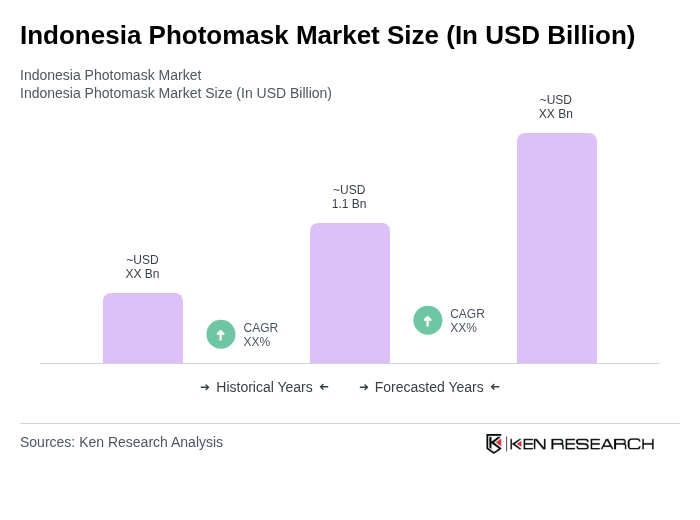

The Indonesia Photomask Market is valued at approximately USD 1.1 billion, driven by the increasing demand for advanced semiconductor manufacturing and the expansion of the electronics industry, particularly in urban centers like Jakarta, Surabaya, and Bandung.