Region:Global

Author(s):Shubham

Product Code:KRAB0785

Pages:86

Published On:August 2025

By Type:The photonics market is segmented into Light Emitting Diodes (LEDs), Lasers, Optical Sensors, Photonic Crystals, Fiber Optics, Waveguides, Optical Modulators, Optical Interconnects, Wavelength Division Multiplexing (WDM) Filters, Photo Detectors, Amplifiers, and Others. Among these, Light Emitting Diodes (LEDs) lead the market due to their widespread application in lighting and display technologies, driven by the demand for energy-efficient solutions and the proliferation of smart devices. Lasers and optical sensors are also experiencing significant growth, propelled by advancements in autonomous vehicles, industrial automation, and medical diagnostics.

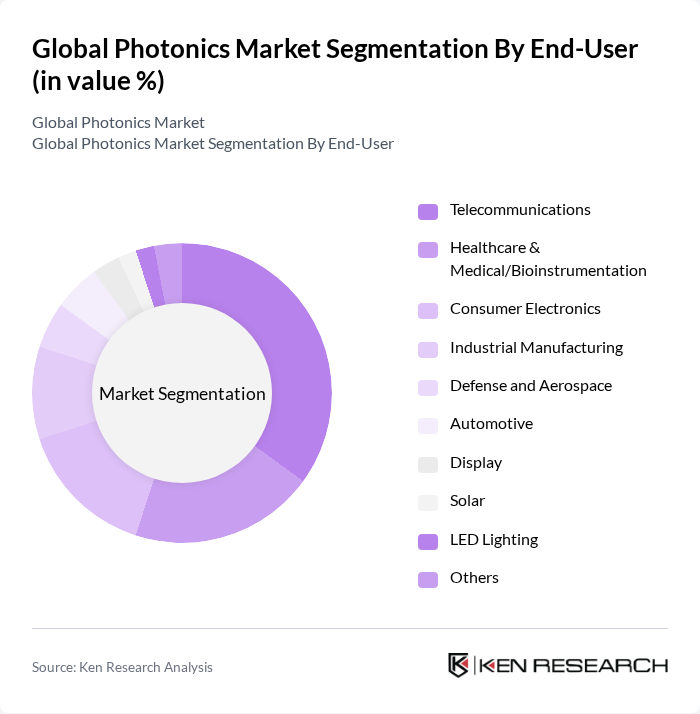

By End-User:The end-user segments of the photonics market include Telecommunications, Healthcare & Medical/Bioinstrumentation, Consumer Electronics, Industrial Manufacturing, Defense and Aerospace, Automotive, Display, Solar, LED Lighting, and Others. The Telecommunications sector is the largest end-user, driven by the increasing demand for high-speed internet, data transmission technologies, and the rollout of 5G infrastructure. Healthcare and medical applications are also expanding rapidly, supported by innovations in imaging, diagnostics, and bioinstrumentation.

The Global Photonics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thorlabs, Inc., Coherent Corp., Newport Corporation (a MKS Instruments company), Hamamatsu Photonics K.K., Lumentum Holdings Inc., II-VI Incorporated (now Coherent Corp.), OptoTech Optikmaschinen GmbH, AMETEK, Inc., Jenoptik AG, MKS Instruments, Inc., LASER COMPONENTS GmbH, Soraa, Inc., Oclaro, Inc. (now part of Lumentum Holdings Inc.), PicoQuant GmbH, NKT Photonics A/S, IPG Photonics Corporation, Trumpf GmbH + Co. KG, Finisar Corporation (now part of II-VI/Coherent Corp.), Broadcom Inc. (Optoelectronics Division), Sumitomo Electric Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the photonics market appears promising, driven by increasing integration of photonics in various sectors, including telecommunications and consumer electronics. The rise of smart cities and the Internet of Things (IoT) is expected to further enhance the demand for photonics solutions. Additionally, advancements in quantum technologies are likely to open new avenues for growth, fostering innovation and collaboration across industries, which will be crucial for maintaining competitive advantages in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Emitting Diodes (LEDs) Lasers Optical Sensors Photonic Crystals Fiber Optics Waveguides Optical Modulators Optical Interconnects WDM Filters Photo Detectors Amplifiers Others |

| By End-User | Telecommunications Healthcare & Medical/Bioinstrumentation Consumer Electronics Industrial Manufacturing Defense and Aerospace Automotive Display Solar LED Lighting Others |

| By Application | Communication Sensing Imaging Lighting Display Technologies Metrology Safety and Defense Technology Medical and Healthcare High-Performance Computing (HPC) Others |

| By Component | Active Components Passive Components Optical Components Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low-End Products Mid-Range Products High-End Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Photonics Solutions | 100 | Network Engineers, Telecom Product Managers |

| Healthcare Imaging Technologies | 80 | Medical Device Engineers, Radiology Managers |

| Industrial Laser Applications | 70 | Manufacturing Engineers, Production Managers |

| Consumer Electronics Photonics | 90 | Product Development Managers, Electronics Engineers |

| Research and Development in Photonics | 40 | Research Scientists, University Professors |

The Global Photonics Market is valued at approximately USD 980 billion, driven by advancements in laser technologies, telecommunications, and healthcare applications, as well as the demand for energy-efficient lighting solutions and consumer electronics.