Region:North America

Author(s):Rebecca

Product Code:KRAA1402

Pages:80

Published On:August 2025

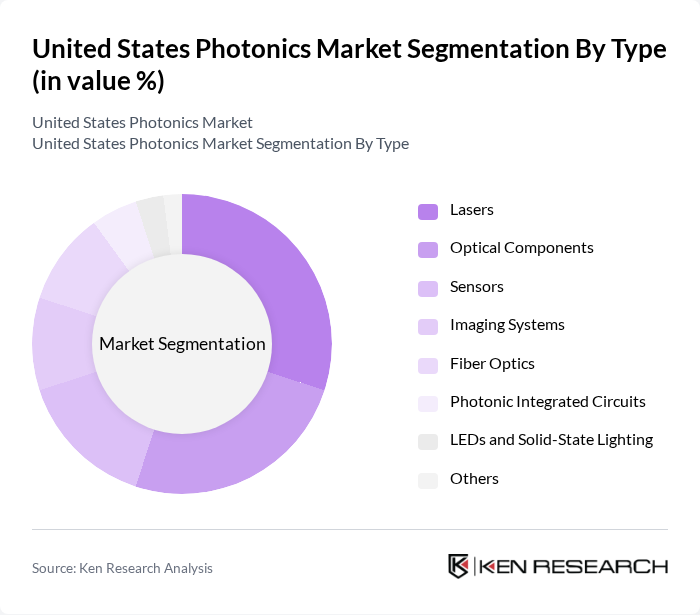

By Type:The photonics market can be segmented into various types, including lasers, optical components, sensors, imaging systems, fiber optics, photonic integrated circuits, LEDs and solid-state lighting, and others. Among these, lasers and optical components are the most dominant segments due to their extensive applications in telecommunications, healthcare, and industrial sectors. The increasing demand for high-precision instruments, the growing trend of miniaturization in technology, and the integration of photonics with artificial intelligence and machine learning further bolster the growth of these segments. The adoption of photonic integrated circuits and advanced optical sensors is also rising, driven by needs in data centers, autonomous vehicles, and smart manufacturing .

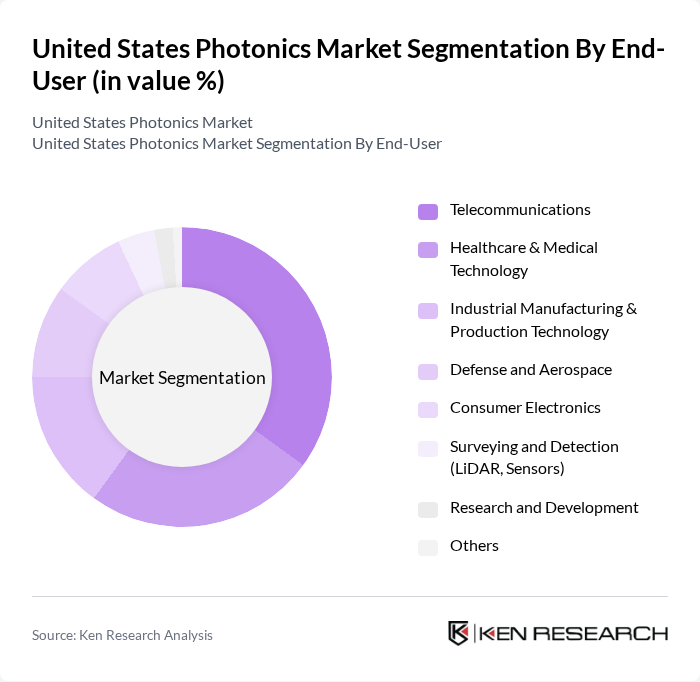

By End-User:The end-user segmentation of the photonics market includes telecommunications, healthcare & medical technology, industrial manufacturing & production technology, defense and aerospace, consumer electronics, surveying and detection (LiDAR, sensors), research and development, and others. Telecommunications and healthcare are the leading segments, driven by the increasing need for high-speed data transmission, advanced medical imaging technologies, and the growing adoption of telemedicine and remote monitoring solutions. Industrial manufacturing is also a significant segment, benefiting from automation and precision measurement technologies. The defense and aerospace sector leverages photonics for sensing, imaging, and secure communications, while consumer electronics increasingly integrate photonic components for enhanced device performance .

The United States Photonics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coherent, Inc., Thorlabs, Inc., Newport Corporation (a MKS Instruments company), Lumentum Holdings Inc., II-VI Incorporated (now part of Coherent Corp.), Intel Corporation, Hamamatsu Photonics K.K., MKS Instruments, Inc., Infinera Corporation, Ametek, Inc., Molex LLC, Zygo Corporation, Spectra-Physics (a MKS Instruments brand), Excelitas Technologies Corp., Neophotonics Corporation (now part of Lumentum Holdings) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States photonics market appears promising, driven by technological advancements and increasing applications across various sectors. As industries continue to embrace automation and digital transformation, the integration of photonics with AI and machine learning will enhance operational efficiencies. Additionally, the focus on sustainability will likely spur innovations in energy-efficient photonic devices, positioning the U.S. as a leader in the global photonics landscape while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Lasers Optical Components Sensors Imaging Systems Fiber Optics Photonic Integrated Circuits LEDs and Solid-State Lighting Others |

| By End-User | Telecommunications Healthcare & Medical Technology Industrial Manufacturing & Production Technology Defense and Aerospace Consumer Electronics Surveying and Detection (LiDAR, Sensors) Research and Development Others |

| By Application | Data Communication Sensing (Environmental, Industrial, Biomedical) Imaging & Display Technologies Lighting (LED, OLED, MicroLED) Surveying and Detection Medical Technology (Diagnostics, Therapy) Others |

| By Component | Light Sources (Lasers, LEDs) Detectors & Sensors Optical Filters & Beam Splitters Photonic Integrated Circuits Optical Fibers & Cables Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Applications | 100 | Network Engineers, Telecom Managers |

| Medical Device Manufacturing | 80 | Product Development Managers, Quality Assurance Officers |

| Industrial Automation | 60 | Automation Engineers, Operations Managers |

| Consumer Electronics | 50 | Product Managers, R&D Specialists |

| Research Institutions | 40 | Research Scientists, Lab Managers |

The United States Photonics Market is valued at approximately USD 160 billion, driven by advancements in technology and increasing demand across various sectors, including telecommunications, healthcare, and manufacturing.