Region:Global

Author(s):Dev

Product Code:KRAA1689

Pages:95

Published On:August 2025

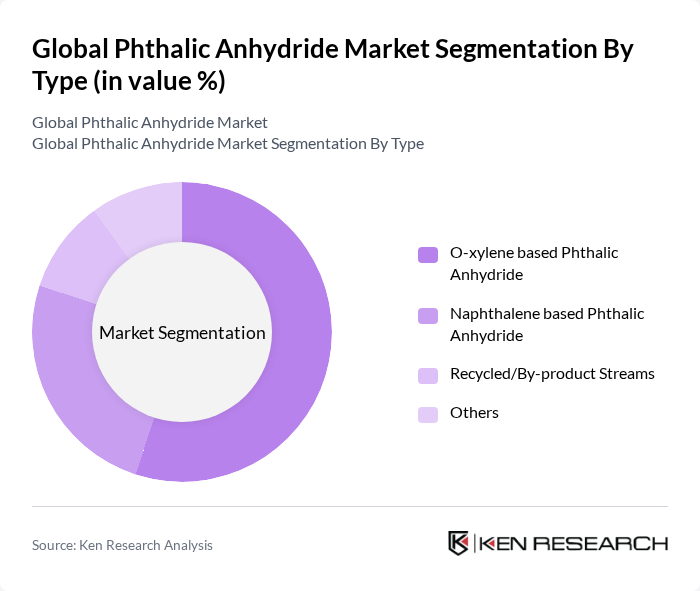

By Type:The market is segmented into O-xylene based Phthalic Anhydride, Naphthalene based Phthalic Anhydride, Recycled/By-product Streams, and Others. O-xylene based Phthalic Anhydride remains widely used due to established process economics and raw material availability for plasticizer production serving construction and automotive.

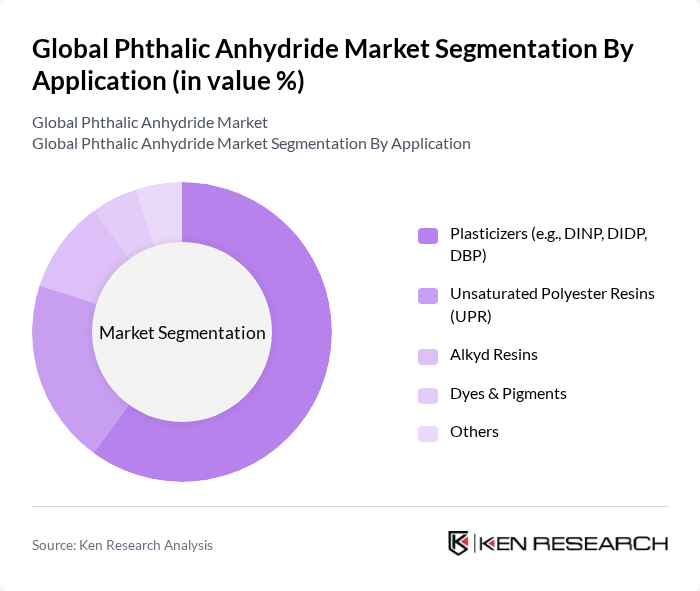

By Application:The applications of phthalic anhydride include Plasticizers (e.g., DINP, DIDP, DBP), Unsaturated Polyester Resins (UPR), Alkyd Resins, Dyes & Pigments, and Others. The Plasticizers segment dominates, supported by demand for flexible, durable materials in construction (PVC profiles, flooring, cables) and automotive (interiors, sealants), with UPR and alkyds also material to composites and coatings.

The Global Phthalic Anhydride Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, I G Petrochemicals Limited, Aekyung Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, LANXESS AG, Polynt Group, Eastman Chemical Company, Perstorp Holding AB, UPC Technology Corporation, ExxonMobil Chemical Company, Nan Ya Plastics Corporation, Shandong Hongxin Chemical Co., Ltd., Thirumalai Chemicals Limited, Anhui Jinhe Industrial Co., Ltd., and IG Petrochemical Company (India) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phthalic anhydride market appears promising, driven by increasing demand in various sectors, including automotive and construction. As industries shift towards sustainable practices, manufacturers are likely to invest in eco-friendly production methods. Additionally, technological advancements in production processes are expected to enhance efficiency and reduce costs. The market is also poised for growth as emerging economies expand their industrial bases, creating new opportunities for phthalic anhydride applications in diverse sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | O-xylene based Phthalic Anhydride Naphthalene based Phthalic Anhydride Recycled/By-product Streams Others |

| By Application | Plasticizers (e.g., DINP, DIDP, DBP) Unsaturated Polyester Resins (UPR) Alkyd Resins Dyes & Pigments Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Electrical & Electronics Packaging & Consumer Goods Others |

| By Distribution Channel | Direct (Producer to OEM) Distributors/Traders Online/B2B Platforms Retail/Regional Stockists Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Formula-based (linked to o-xylene/naphthalene) Spot/Market-based Pricing Contract/Tiered Pricing Others |

| By Product Form | Flake/Solid Molten/Liquid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Development Engineers, Procurement Managers |

| Construction Materials | 80 | Project Managers, Material Suppliers |

| Coatings and Adhesives | 90 | Formulation Chemists, Quality Control Managers |

| Plastics Manufacturing | 70 | Operations Managers, Supply Chain Analysts |

| Pharmaceutical Applications | 40 | Regulatory Affairs Specialists, R&D Managers |

The Global Phthalic Anhydride Market is valued at approximately USD 4.2 billion, based on a five-year historical analysis. This valuation reflects the significant demand for phthalic anhydride in various applications, particularly in plasticizers and construction materials.