Region:Middle East

Author(s):Dev

Product Code:KRAD1606

Pages:80

Published On:November 2025

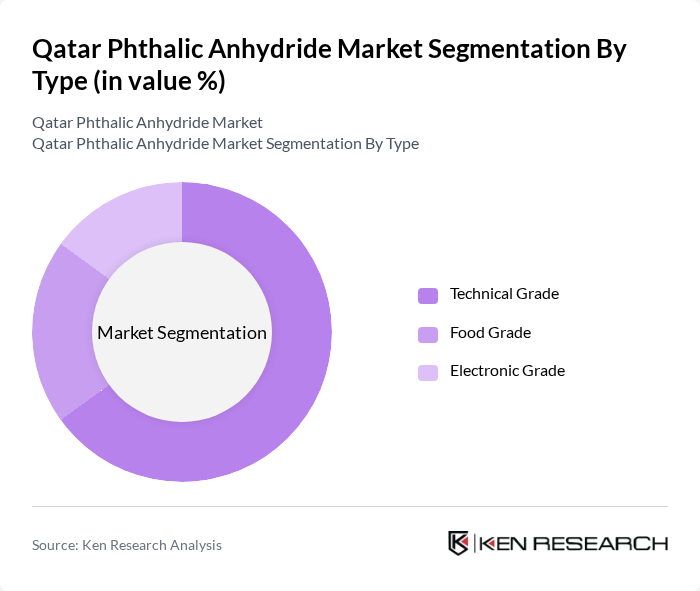

By Type:The market is segmented into Technical Grade, Food Grade, and Electronic Grade.Technical Gradeis the most widely used due to its applications in industrial processes, especially in the production of plasticizers and resins. TheFood Gradesegment, while smaller, is essential for specialized food packaging applications, ensuring compliance with health and safety regulations. TheElectronic Gradeis a niche segment, serving high-purity requirements in electronics manufacturing.

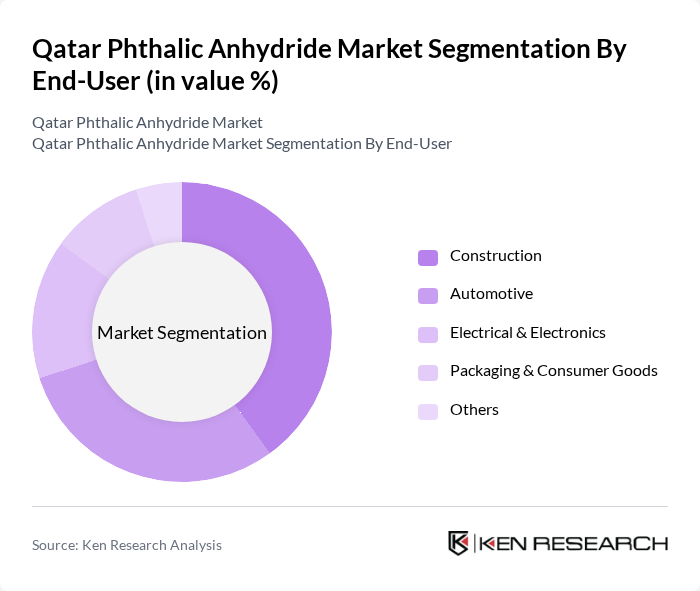

By End-User:The end-user segments include Construction, Automotive, Electrical & Electronics, Packaging & Consumer Goods, and Others. TheConstructionsector is the largest consumer of phthalic anhydride, driven by demand for plasticizers in concrete and building materials. TheAutomotiveindustry follows, utilizing phthalic anhydride in coatings and interior components. TheElectrical & Electronicssector also contributes significantly, particularly in insulation materials and specialty polymers.Packaging & Consumer GoodsandOthersrepresent smaller but stable demand segments.

The Qatar Phthalic Anhydride Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, ExxonMobil Corporation, I G Petrochemicals Ltd., Mitsubishi Gas Chemical Company, Inc., KLJ Group, Qatar Chemicals & Petrochemicals Company (Q-Chem), Gulf Petrochemical Industries Company (GPIC), Qatar Petrochemical Company (QAPCO), Qatar Fuel Additives Company (QAFAC), Solvay S.A., Huntsman Corporation, INEOS Group, Eastman Chemical Company, Polynt-Reichhold Group, and Perstorp Holding AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phthalic anhydride market in Qatar appears promising, driven by increasing demand from key sectors such as construction and automotive. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly production methods and bio-based alternatives. Additionally, the expansion into emerging markets in the Middle East and North Africa will provide new growth avenues. Strategic partnerships with local firms will enhance production capabilities and market reach, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Technical Grade Food Grade Electronic Grade |

| By End-User | Construction Automotive Electrical & Electronics Packaging & Consumer Goods Others |

| By Application | Plasticizers Unsaturated Polyester Resins (UPRs) Alkyd Resins Dyes & Pigments Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Doha Al Rayyan Umm Salal Others |

| By Product Form | Flake Molten Others |

| By Regulatory Compliance | REACH Compliance ISO Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastics Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Coatings and Paints Industry | 80 | Product Development Managers, Procurement Specialists |

| Construction Materials Sector | 70 | Project Managers, Supply Chain Coordinators |

| Automotive Components Manufacturing | 60 | Operations Managers, R&D Engineers |

| Regulatory and Compliance Bodies | 40 | Environmental Compliance Officers, Policy Analysts |

The Qatar Phthalic Anhydride Market is valued at approximately USD 165 million, driven by increasing demand in sectors such as construction and automotive, as well as the growth of unsaturated polyester resins production.