Region:Global

Author(s):Rebecca

Product Code:KRAD2946

Pages:85

Published On:November 2025

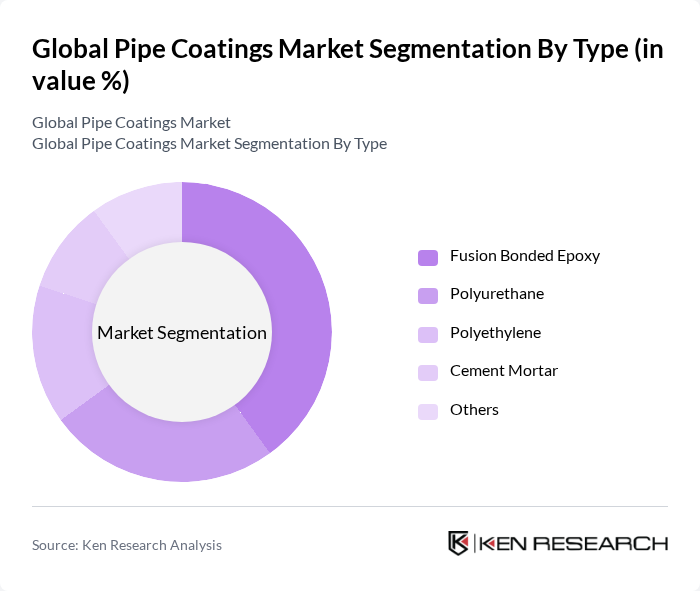

By Type:The pipe coatings market is segmented into various types, including Fusion Bonded Epoxy, Polyurethane, Polyethylene, Cement Mortar, and Others. Among these, Fusion Bonded Epoxy is the leading subsegment due to its excellent adhesion properties and resistance to corrosion and chemicals. This type of coating is widely used in the oil and gas sector, where durability and performance are critical. The increasing adoption of Fusion Bonded Epoxy in various applications is driven by its long-lasting performance and cost-effectiveness.

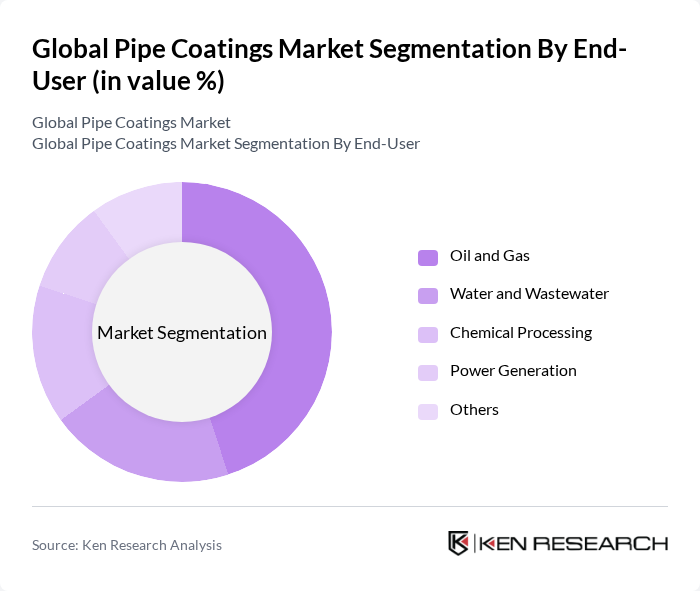

By End-User:The end-user segmentation includes Oil and Gas, Water and Wastewater, Chemical Processing, Power Generation, and Others. The Oil and Gas sector is the dominant end-user, accounting for a significant portion of the market. This is attributed to the extensive use of pipe coatings in exploration, production, and transportation processes, where protection against corrosion and environmental factors is paramount. The increasing investments in oil and gas infrastructure globally are further driving the demand for specialized coatings in this sector.

The Global Pipe Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel, PPG Industries, Sherwin-Williams, BASF, Jotun, Hempel, 3M, DuPont, Carboline, RPM International, Tnemec Company, Valspar, KTA-Tator, Hempel A/S, Covestro AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pipe coatings market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly materials, the demand for innovative coatings that meet environmental standards will rise. Additionally, the integration of smart technologies in coating applications is expected to enhance performance and monitoring capabilities, leading to improved maintenance practices. These trends will likely shape the market landscape, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fusion Bonded Epoxy Polyurethane Polyethylene Cement Mortar Others |

| By End-User | Oil and Gas Water and Wastewater Chemical Processing Power Generation Others |

| By Application | Onshore Pipelines Offshore Pipelines Industrial Pipelines Municipal Pipelines Others |

| By Coating Method | Spray Coating Brush Coating Dip Coating Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Material Type | Thermoplastics Thermosetting Plastics Metals Others |

| By Performance Characteristics | Corrosion Resistance Temperature Resistance Chemical Resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Pipeline Coatings | 100 | Project Managers, Procurement Specialists |

| Water & Wastewater Pipe Coatings | 80 | Environmental Engineers, Utility Managers |

| Industrial Pipe Coatings | 90 | Manufacturing Engineers, Quality Control Managers |

| Construction & Infrastructure Coatings | 70 | Construction Managers, Site Supervisors |

| Marine & Offshore Coatings | 60 | Marine Engineers, Coating Specialists |

The Global Pipe Coatings Market is valued at approximately USD 12 billion, driven by the increasing demand for corrosion-resistant coatings across various industries, including oil and gas, water and wastewater, and chemical processing.