Region:Global

Author(s):Rebecca

Product Code:KRAB0280

Pages:93

Published On:August 2025

By Material Type:

The material type segmentation includes Polyethylene Terephthalate (PET) Bottles, High-Density Polyethylene (HDPE) Bottles, Low-Density Polyethylene (LDPE) Bottles, Polypropylene (PP) Bottles, Polyvinyl Chloride (PVC) Bottles, and Others (e.g., Polystyrene, Bioplastics). Among these,PET bottles dominate the marketdue to their lightweight, durability, and recyclability. The growing consumer preference for bottled water and soft drinks continues to propel demand for PET bottles, making them the leading choice for manufacturers and consumers. In 2024, PET accounted for over 60% of global plastic bottle production, reflecting its widespread adoption in beverage and food packaging .

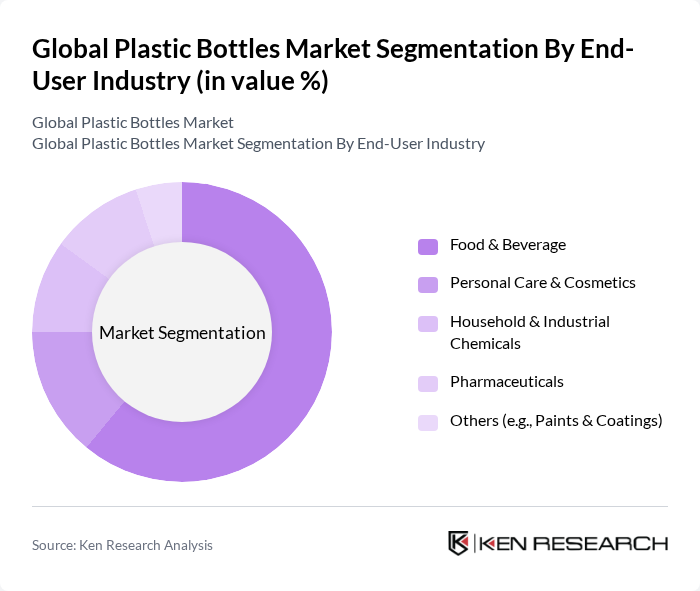

By End-User Industry:

The end-user industry segmentation includes Food & Beverage, Personal Care & Cosmetics, Household & Industrial Chemicals, Pharmaceuticals, and Others (e.g., Paints & Coatings). TheFood & Beverage sector is the largest consumerof plastic bottles, driven by rising demand for bottled water, soft drinks, and juices. This sector's growth is supported by changing consumer lifestyles, urbanization, and the increasing trend of convenience packaging. In 2024, the food and beverages industry accounted for over 60% of global plastic bottle consumption, followed by personal care, household chemicals, and pharmaceuticals .

The Global Plastic Bottles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Berry Global, Inc., Plastipak Holdings, Inc., Graham Packaging Company, RPC Group Plc, The Coca-Cola Company, PepsiCo, Inc., Unilever PLC, Nestlé S.A., Pactiv Evergreen Inc., Silgan Holdings Inc., Huhtamaki Oyj, ALPLA Werke Alwin Lehner GmbH & Co KG, INEOS Group Limited, and Tetra Pak International S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the plastic bottles market is poised for transformation, driven by technological advancements and evolving consumer preferences. As sustainability becomes a priority, manufacturers are likely to invest in innovative materials and recycling technologies. Additionally, the expansion of e-commerce will facilitate greater distribution of eco-friendly products. Companies that adapt to these trends and prioritize sustainable practices are expected to thrive, while those resistant to change may face declining market relevance in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Polyethylene Terephthalate (PET) Bottles High-Density Polyethylene (HDPE) Bottles Low-Density Polyethylene (LDPE) Bottles Polypropylene (PP) Bottles Polyvinyl Chloride (PVC) Bottles Others (e.g., Polystyrene, Bioplastics) |

| By End-User Industry | Food & Beverage Personal Care & Cosmetics Household & Industrial Chemicals Pharmaceuticals Others (e.g., Paints & Coatings) |

| By Application | Bottled Water Carbonated Soft Drinks Juices & Energy Drinks Dairy Products Alcoholic Beverages Others |

| By Sales Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Direct Sales |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Price Range | Economy Mid-Range Premium |

| By Sustainability Features | Recyclable Bottles Biodegradable Bottles Reusable Bottles Bottles with Recycled Content Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Industry Insights | 100 | Product Managers, Marketing Directors |

| Personal Care Packaging Trends | 60 | Brand Managers, Packaging Engineers |

| Household Product Distribution | 50 | Supply Chain Managers, Retail Buyers |

| Recycling and Sustainability Initiatives | 40 | Sustainability Officers, Environmental Compliance Managers |

| Market Trends in Emerging Economies | 45 | Market Analysts, Regional Sales Managers |

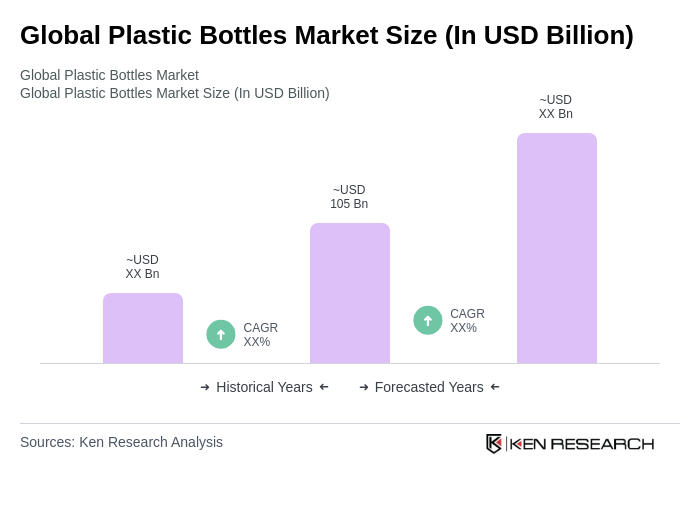

The Global Plastic Bottles Market is valued at approximately USD 105 billion, driven by increasing demand for bottled beverages and heightened sustainability awareness. This valuation is based on a five-year historical analysis of market trends and consumer preferences.