Region:Global

Author(s):Shubham

Product Code:KRAD0755

Pages:91

Published On:August 2025

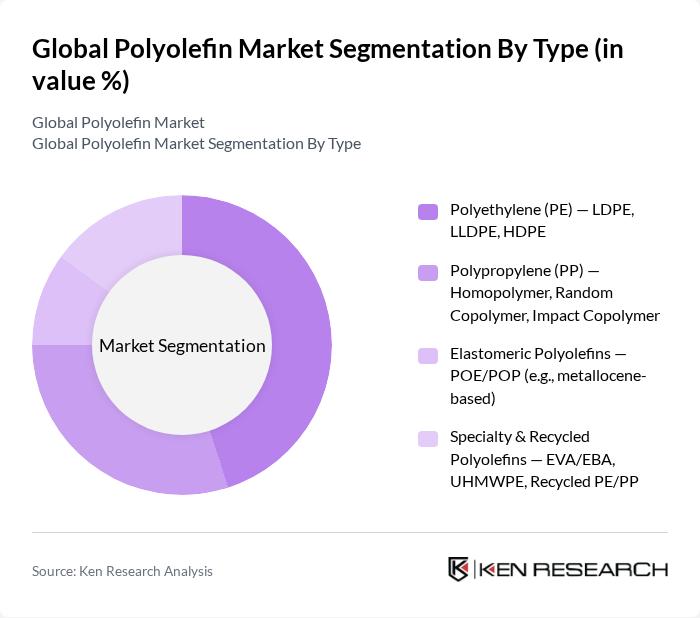

By Type:The polyolefin market is segmented into four main types: Polyethylene (PE), Polypropylene (PP), Elastomeric Polyolefins, and Specialty & Recycled Polyolefins. Among these,Polyethylene(LDPE, LLDPE, HDPE) remains the most widely consumed due to its dominance in film and rigid packaging, pipes, containers, and caps and closures. Rising e?commerce, food protection needs, and down?gauging trends continue to support PE demand across flexible and rigid formats .

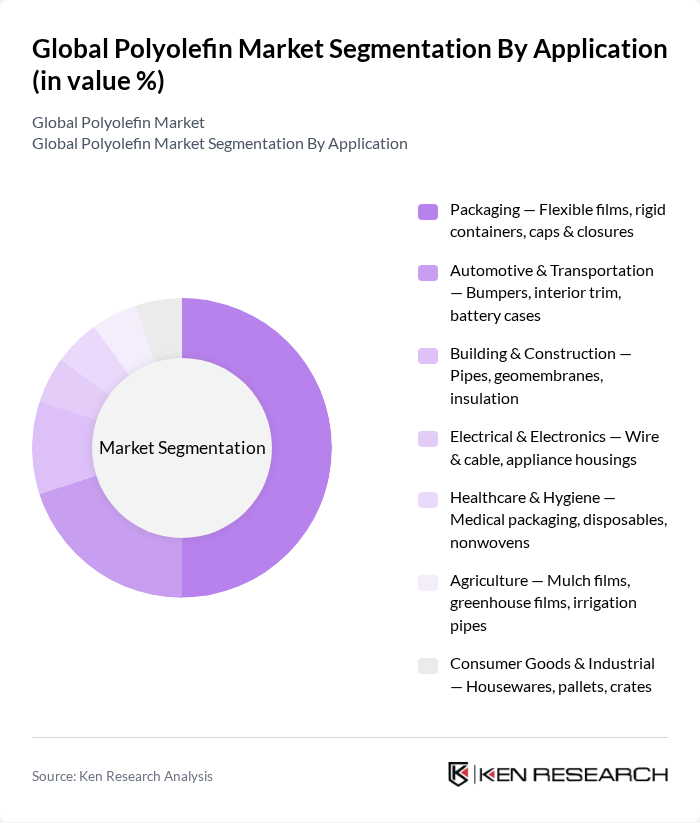

By Application:The applications of polyolefins are diverse, including packaging, automotive, building and construction, electrical and electronics, healthcare and hygiene, agriculture, and consumer goods. Thepackagingsegment holds the largest share, supported by growth in flexible films, rigid containers, and caps and closures, and reinforced by brand-owner and retailer targets for recyclable packaging and increased recycled content .

The Global Polyolefin Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical, LyondellBasell Industries N.V., SABIC, INEOS, TotalEnergies, Braskem S.A., Borealis AG, Reliance Industries Limited, Chevron Phillips Chemical, Formosa Plastics Corporation, Westlake Corporation, China Petrochemical Corporation (Sinopec), Dow Inc., Hanwha Solutions, and PetroChina Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyolefin market is poised for transformation, driven by sustainability trends and technological advancements. As consumer preferences shift towards eco-friendly products, manufacturers are increasingly investing in biodegradable polyolefins and recycling technologies. Additionally, the rise of e-commerce is expected to further enhance demand for innovative packaging solutions. Strategic partnerships among industry players will likely foster innovation, enabling the market to adapt to evolving consumer needs and regulatory landscapes, ensuring long-term growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyethylene (PE) — LDPE, LLDPE, HDPE Polypropylene (PP) — Homopolymer, Random Copolymer, Impact Copolymer Elastomeric Polyolefins — POE/POP (e.g., metallocene-based) Specialty & Recycled Polyolefins — EVA/EBA, UHMWPE, Recycled PE/PP |

| By Application | Packaging — Flexible films, rigid containers, caps & closures Automotive & Transportation — Bumpers, interior trim, battery cases Building & Construction — Pipes, geomembranes, insulation Electrical & Electronics — Wire & cable, appliance housings Healthcare & Hygiene — Medical packaging, disposables, nonwovens Agriculture — Mulch films, greenhouse films, irrigation pipes Consumer Goods & Industrial — Housewares, pallets, crates |

| By End-User | Packaging Converters & Brand Owners Automotive OEMs & Tier Suppliers Construction & Infrastructure Developers Electrical, Electronics & Appliances Healthcare, Hygiene & FMCG |

| By Distribution Channel | Direct Sales (Producers to Key Accounts) Authorized Distributors & Resin Traders Digital/Marketplace Platforms Compounders & Converters |

| By Region | North America — U.S., Canada, Mexico Europe — Germany, U.K., France, Italy, Spain, Benelux Asia-Pacific — China, India, Japan, South Korea, Southeast Asia Latin America — Brazil, Argentina, Chile Middle East & Africa — Saudi Arabia, UAE, South Africa |

| By Price Range | Commodity Grades Performance/Specialty Grades Recycled Grades |

| By Product Form | Pellets/Granules Films & Sheets Fibers & Nonwovens Pipes & Profiles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 120 | Product Managers, Packaging Engineers |

| Automotive Applications | 90 | Design Engineers, Procurement Managers |

| Textile and Nonwoven Applications | 70 | Product Development Managers, Quality Assurance Specialists |

| Construction and Infrastructure | 60 | Project Managers, Materials Engineers |

| Consumer Goods Sector | 80 | Marketing Managers, Supply Chain Analysts |

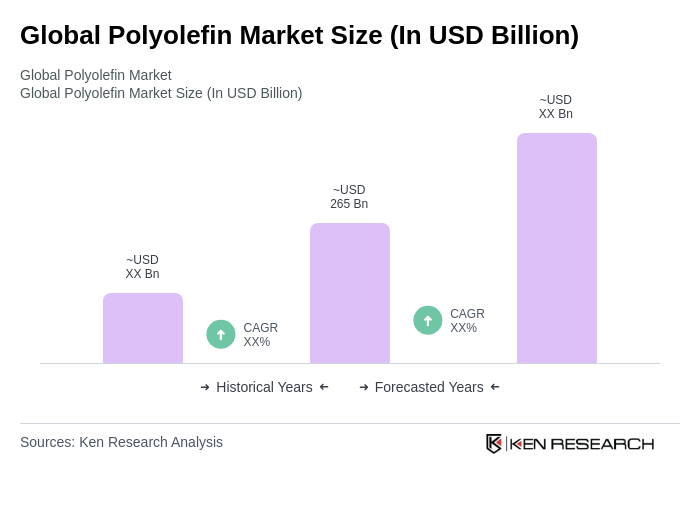

The Global Polyolefin Market is valued at approximately USD 265 billion, based on a five-year historical analysis. This valuation reflects the widespread use of polyethylene and polypropylene across various industries, including packaging, automotive, and construction.