Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3058

Pages:88

Published On:October 2025

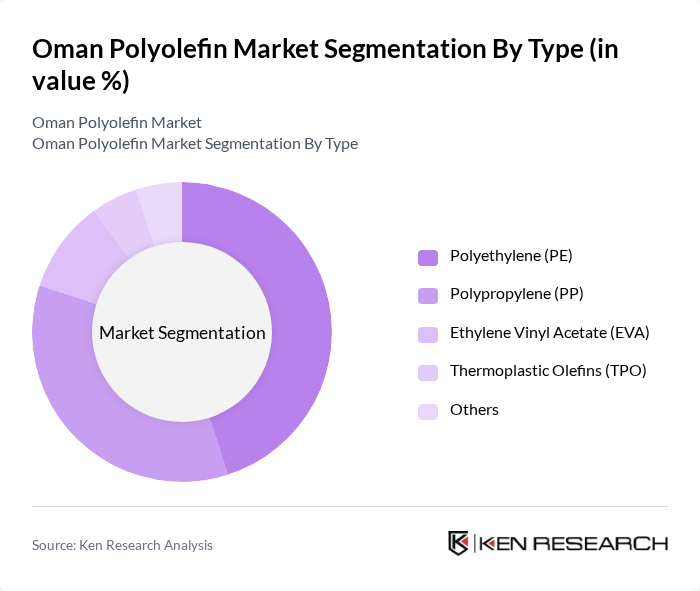

By Type:The Oman polyolefin market is segmented into Polyethylene (PE), Polypropylene (PP), Ethylene Vinyl Acetate (EVA), Thermoplastic Olefins (TPO), and Others. Polyethylene and polypropylene are the most widely used, serving packaging, automotive, and construction industries. Ethylene Vinyl Acetate and Thermoplastic Olefins are primarily utilized in specialty applications such as flexible films, wire insulation, and automotive interiors.

Polyethylene (PE) is the dominant type, widely adopted in packaging due to its flexibility, durability, and moisture resistance. The surge in demand for lightweight, cost-effective packaging—especially in food and beverage—continues to drive PE consumption. Its versatility in films, containers, and industrial wraps makes it the preferred choice for manufacturers seeking efficient and sustainable packaging solutions.

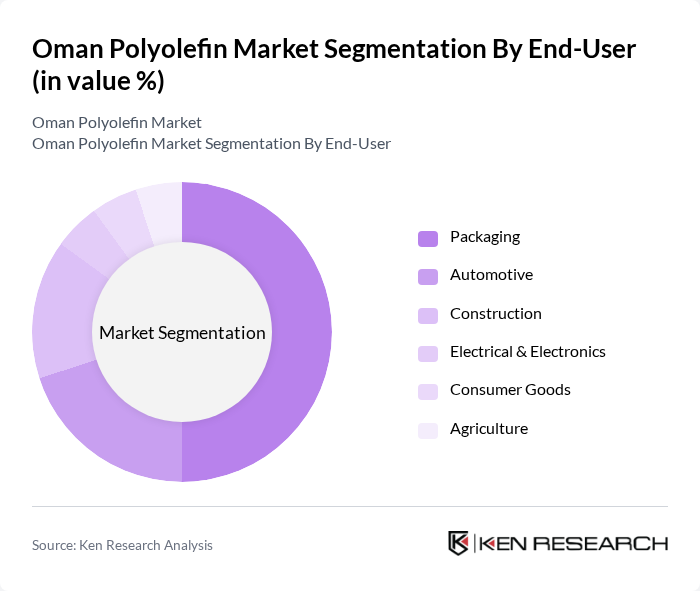

By End-User:The end-user segmentation includes Packaging, Automotive, Construction, Electrical & Electronics, Consumer Goods, and Agriculture. Each sector has distinct requirements and contributes uniquely to polyolefin demand. Packaging leads, followed by automotive and construction, with notable growth in sustainable and specialty applications.

Packaging remains the leading end-user segment, accounting for half of total market demand. The expansion of e-commerce and retail, alongside rising consumer preference for sustainable and innovative packaging, has accelerated polyolefin adoption. Lightweight properties and product integrity preservation make polyolefins essential for food packaging. The market is also positively influenced by regulatory shifts toward eco-friendly materials and recycled content.

The Oman Polyolefin Market is characterized by a dynamic mix of regional and international players. Leading participants such as OQ (Oman Oil & Orpic Group), Oman Polypropylene LLC, Sohar Polymer Company, Gulf Plastic Industries Co. SAOC, Al Jazeera Plastic Factory LLC, National Petrochemical Industrial Company (NPIC), Oman Plastics Industries LLC, Muscat Polymers Pvt. Ltd., Al-Batinah Plastic Products SAOC, Oman Plastic Industries LLC, Al-Mahrouqa Plastic Factory, Oman Cables Industry SAOG, Gulf International Chemicals SAOG, Al-Fahim Group, Oman National Engineering & Investment Company (ONEIC) contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The Oman polyolefin market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As manufacturers adopt innovative production techniques, efficiency is expected to improve, reducing costs and environmental impact. Additionally, the increasing focus on biodegradable alternatives will likely reshape product offerings, catering to environmentally conscious consumers. The government's commitment to enhancing industrial capabilities will further support market growth, positioning Oman as a competitive player in the regional polyolefin landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyethylene (PE) Polypropylene (PP) Ethylene Vinyl Acetate (EVA) Thermoplastic Olefins (TPO) Others |

| By End-User | Packaging Automotive Construction Electrical & Electronics Consumer Goods Agriculture |

| By Application | Films and Sheets Injection Molding Blow Molding Extrusion Coating Fiber Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Economy Mid-Range Premium |

| By Region | Muscat Salalah Sohar Others |

| By Product Form | Granules Powders Films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Stakeholders | 100 | Procurement Managers, Product Development Heads |

| Automotive Sector Manufacturers | 60 | Supply Chain Managers, Engineering Directors |

| Construction Material Suppliers | 50 | Sales Managers, Operations Directors |

| Polyolefin Distributors | 40 | Distribution Managers, Business Development Executives |

| Research and Development Experts | 40 | R&D Managers, Technical Directors |

The Oman Polyolefin Market is valued at approximately USD 150 million, driven by increasing demand for polyethylene and polypropylene in various sectors, including packaging, automotive, and construction applications.