Region:Global

Author(s):Dev

Product Code:KRAA2623

Pages:94

Published On:August 2025

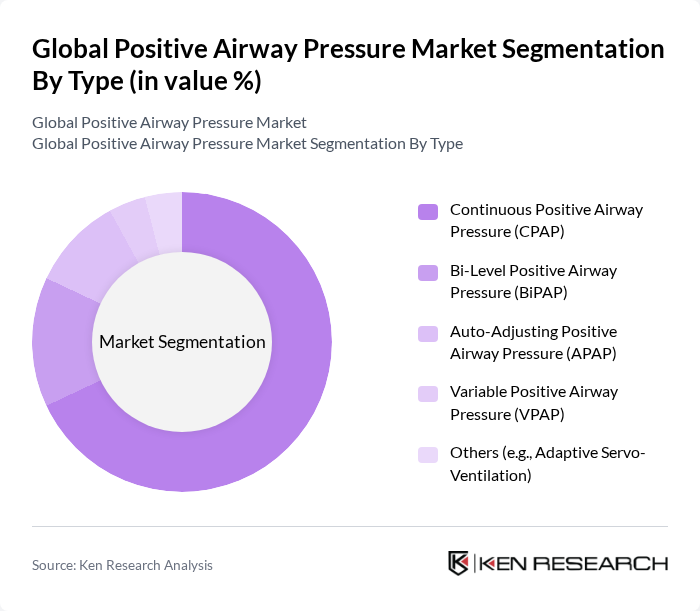

By Type:The market is segmented into various types of Positive Airway Pressure devices, including Continuous Positive Airway Pressure (CPAP), Bi-Level Positive Airway Pressure (BiPAP), Auto-Adjusting Positive Airway Pressure (APAP), Variable Positive Airway Pressure (VPAP), and others such as Adaptive Servo-Ventilation. Among these, CPAP devices dominate the market due to their widespread use in treating obstructive sleep apnea, which is increasingly recognized as a significant health issue. The simplicity and effectiveness of CPAP therapy make it the preferred choice for both patients and healthcare providers .

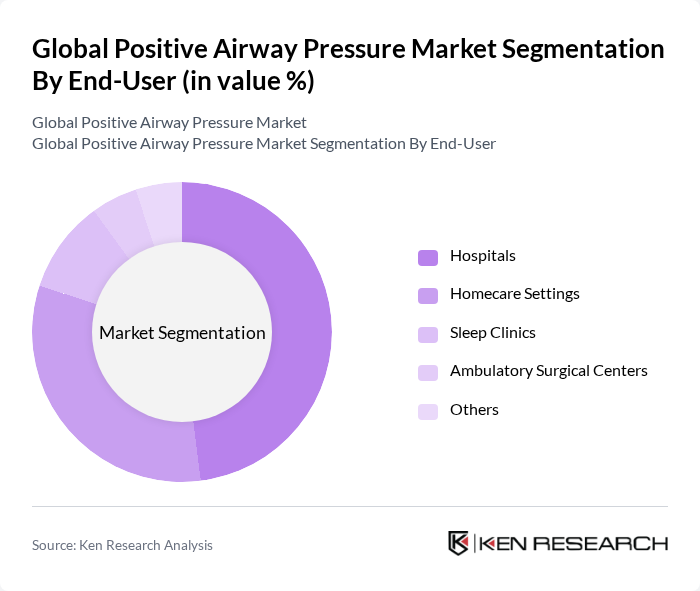

By End-User:The market is categorized by end-users, including hospitals, homecare settings, sleep clinics, ambulatory surgical centers, and others. Hospitals are the leading end-user segment, primarily due to the high volume of patients requiring treatment for sleep disorders and respiratory issues. The increasing trend of hospital admissions for sleep-related conditions and the availability of specialized sleep centers contribute to the dominance of this segment .

The Global Positive Airway Pressure Market is characterized by a dynamic mix of regional and international players. Leading participants such as ResMed Inc., Philips Respironics (Koninklijke Philips N.V.), Fisher & Paykel Healthcare Limited, Drive DeVilbiss Healthcare (Medical Depot, Inc.), Invacare Corporation, BMC Medical Co., Ltd., Wellell Inc. (formerly Apex Medical Corp.), Somnetics International, Inc. (Transcend), Medtronic plc, 3B Medical, Inc. (React Health), Nidek Medical Products, Inc., Löwenstein Medical GmbH & Co. KG, Koike Medical Co., Ltd., Curative Medical Inc., Sleepnet Corporation, Servona GmbH, Armstrong Medical Inc., Smiths Group plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PAP market in the None region appears promising, driven by ongoing technological innovations and a growing emphasis on home healthcare solutions. As telemedicine becomes more integrated into healthcare systems, remote monitoring of PAP therapy is expected to enhance patient compliance and outcomes. Additionally, the increasing demand for personalized medicine will likely lead to tailored PAP solutions, further expanding market opportunities and improving patient experiences in managing sleep apnea.

| Segment | Sub-Segments |

|---|---|

| By Type | Continuous Positive Airway Pressure (CPAP) Bi-Level Positive Airway Pressure (BiPAP) Auto-Adjusting Positive Airway Pressure (APAP) Variable Positive Airway Pressure (VPAP) Others (e.g., Adaptive Servo-Ventilation) |

| By End-User | Hospitals Homecare Settings Sleep Clinics Ambulatory Surgical Centers Others |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Stores Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Age Group | Pediatric Adult Geriatric |

| By Device Features | Humidification Integrated Monitoring & Connectivity Noise Reduction Portability/Travel-Friendly |

| By Price Range | Low-End Mid-Range High-End |

| By Application | Obstructive Sleep Apnea Chronic Obstructive Pulmonary Disease (COPD) Respiratory Failure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Respiratory Therapists, Sleep Specialists |

| PAP Device Manufacturers | 80 | Product Managers, R&D Directors |

| Patients Using PAP Therapy | 100 | Individuals diagnosed with sleep apnea |

| Insurance Providers | 60 | Claims Analysts, Policy Underwriters |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Specialists |

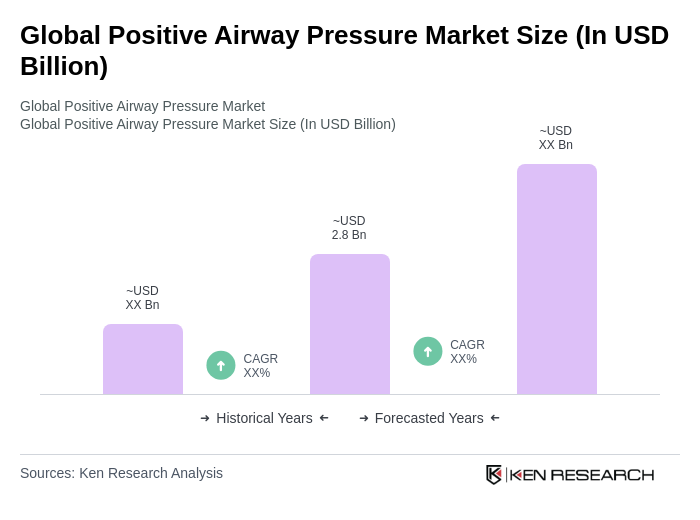

The Global Positive Airway Pressure Market is valued at approximately USD 2.8 billion, driven by the increasing prevalence of sleep apnea and respiratory disorders, along with advancements in PAP technology and heightened awareness of sleep health.