Region:Asia

Author(s):Dev

Product Code:KRAA8371

Pages:87

Published On:November 2025

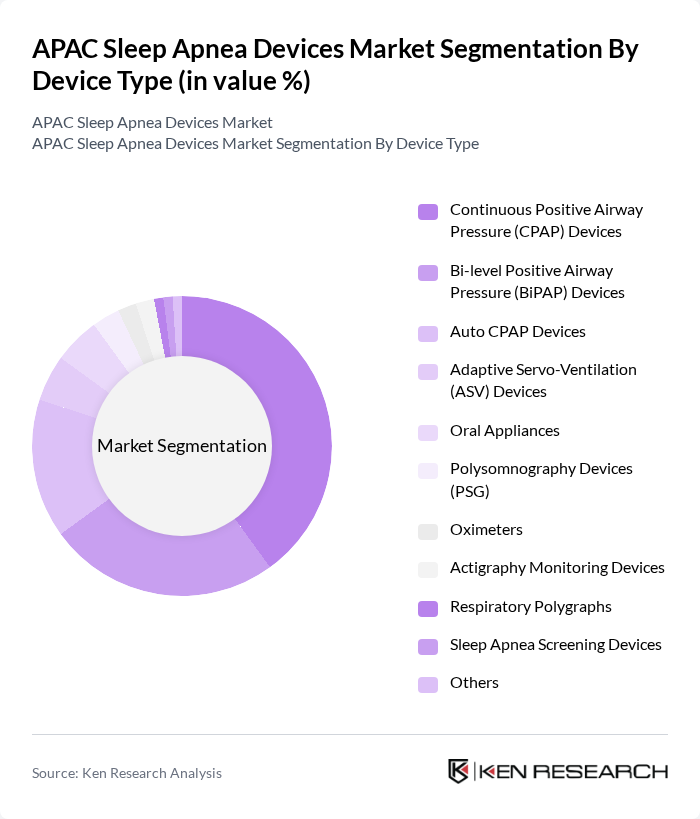

By Device Type:The device type segmentation includes various categories of devices used for diagnosing and treating sleep apnea. The most prominent sub-segments are Continuous Positive Airway Pressure (CPAP) Devices and Bi-level Positive Airway Pressure (BiPAP) Devices, which are widely adopted due to their effectiveness in managing sleep apnea symptoms. The market is also seeing growth in Auto CPAP Devices and Adaptive Servo-Ventilation (ASV) Devices, driven by technological advancements and increasing patient comfort. Oral Appliances and Polysomnography Devices (PSG) are also gaining traction as alternative treatment options, while the integration of digital health technologies and remote monitoring is further enhancing device adoption .

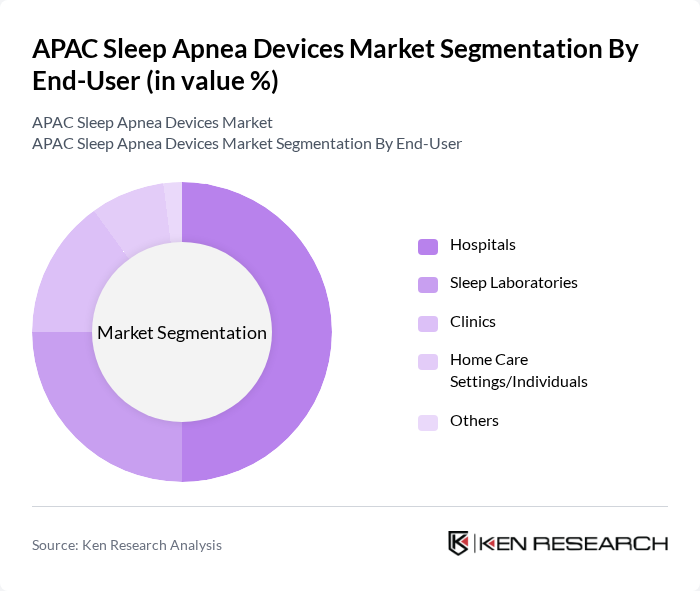

By End-User:The end-user segmentation encompasses various settings where sleep apnea devices are utilized. Hospitals and sleep laboratories are the primary users, as they provide comprehensive diagnostic and treatment services. Home care settings are also increasingly adopting these devices due to the convenience and comfort they offer to patients. Clinics and other healthcare facilities contribute to the market as well, but to a lesser extent. The growing trend of at-home sleep testing, telemedicine integration, and remote patient monitoring is significantly influencing the market dynamics .

The APAC Sleep Apnea Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as ResMed, Philips Respironics, Fisher & Paykel Healthcare, Medtronic, SomnoMed, BMC Medical Co., Ltd., Drive DeVilbiss Healthcare, Natus Medical Incorporated, Apex Medical Corp., Nihon Kohden Corporation, OMRON Healthcare, Inspire Medical Systems, Itamar Medical, Weinmann Emergency Medical Technology GmbH + Co. KG, Curative Medical Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC sleep apnea devices market appears promising, driven by technological innovations and increasing healthcare investments. The integration of artificial intelligence in device functionality is expected to enhance patient monitoring and treatment personalization. Additionally, the expansion of telemedicine services will facilitate remote diagnosis and management, making treatment more accessible. As awareness continues to grow, the market is likely to see a surge in demand for both traditional and innovative treatment options, fostering a healthier population.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Continuous Positive Airway Pressure (CPAP) Devices Bi-level Positive Airway Pressure (BiPAP) Devices Auto CPAP Devices Adaptive Servo-Ventilation (ASV) Devices Oral Appliances Polysomnography Devices (PSG) Oximeters Actigraphy Monitoring Devices Respiratory Polygraphs Sleep Apnea Screening Devices Others |

| By End-User | Hospitals Sleep Laboratories Clinics Home Care Settings/Individuals Others |

| By Distribution Channel | Direct Tender Retail Sales (Offline Retail) Online Retail Others |

| By Region | North Asia (China, Japan, South Korea) Southeast Asia (Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines, etc.) South Asia (India, Bangladesh, Sri Lanka, Pakistan, etc.) Oceania (Australia, New Zealand) Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Severity of Condition | Mild Sleep Apnea Moderate Sleep Apnea Severe Sleep Apnea Others |

| By Treatment Type | Device-Based Treatment Lifestyle Changes Surgical Options Others |

The APAC Sleep Apnea Devices Market is valued at approximately USD 5.5 billion, driven by the rising prevalence of sleep apnea, increased awareness of sleep disorders, and advancements in treatment technologies.