Region:Global

Author(s):Dev

Product Code:KRAB0355

Pages:86

Published On:August 2025

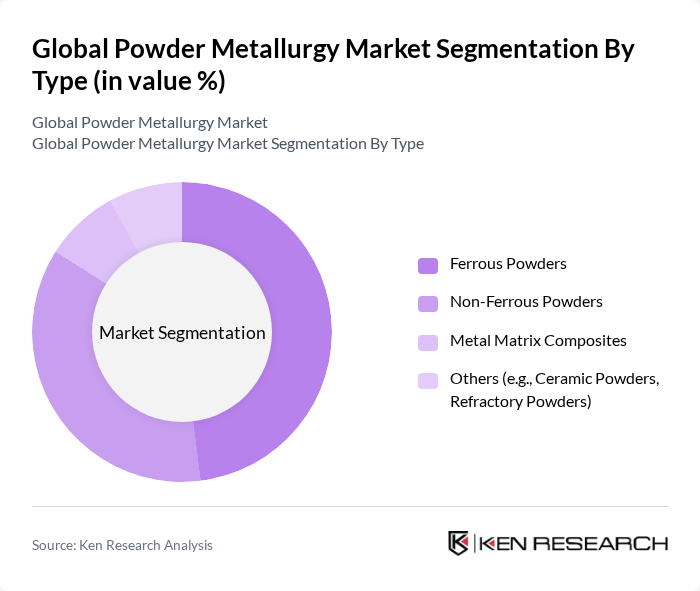

By Type:The powder metallurgy market is segmented into Ferrous Powders, Non-Ferrous Powders, Metal Matrix Composites, and Others (e.g., Ceramic Powders, Refractory Powders). Ferrous Powders dominate the market due to their extensive use in automotive and industrial applications, where strength, wear resistance, and durability are critical. Non-Ferrous Powders are gaining traction, especially in aerospace and electronics, driven by the need for lightweight and corrosion-resistant materials. Metal Matrix Composites and ceramic powders are increasingly utilized in specialized applications requiring enhanced mechanical or thermal properties .

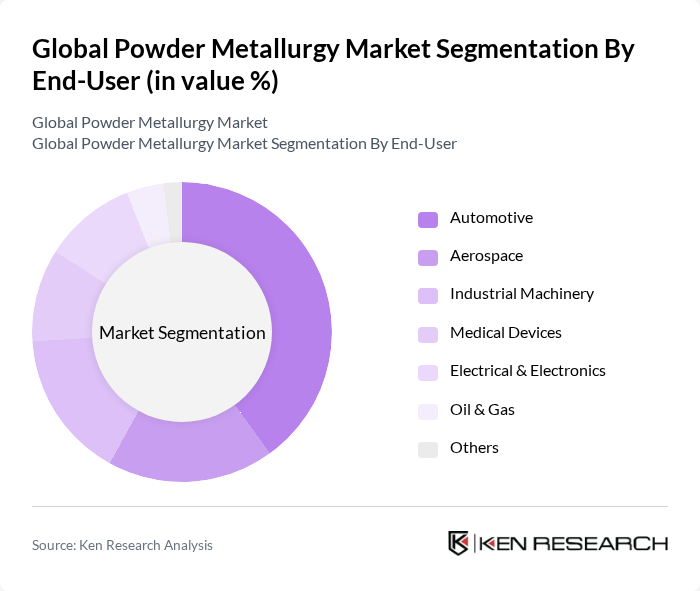

By End-User:The end-user segmentation includes Automotive, Aerospace, Industrial Machinery, Medical Devices, Electrical & Electronics, Oil & Gas, and Others. The Automotive sector is the largest consumer of powder metallurgy products, driven by the need for lightweight components that enhance fuel efficiency and support electric vehicle production. Aerospace is a significant end-user, as the industry increasingly adopts advanced materials for improved performance, safety, and fuel efficiency. Industrial machinery utilizes powder metallurgy for high-precision and wear-resistant components, while medical devices and electronics benefit from the ability to produce complex, customized parts .

The Global Powder Metallurgy Market is characterized by a dynamic mix of regional and international players. Leading participants such as GKN Powder Metallurgy, Höganäs AB, PMG Holding GmbH, Carpenter Technology Corporation, Miba AG, Schunk Group, Hitachi Metals, Ltd., Advanced Powder Products, Inc., Kymera International, Sintered Technologies, Inc., AMETEK, Inc., Metal Powder Industries Federation (MPIF), TPR Co., Ltd., Tenneco Inc. (Federal-Mogul), and Sumitomo Electric Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the powder metallurgy market appears promising, driven by technological advancements and increasing demand for sustainable manufacturing practices. As industries prioritize lightweight materials and customized solutions, the integration of Industry 4.0 technologies will enhance production efficiency and reduce waste. Furthermore, the growing focus on recycling and sustainable practices will likely lead to innovative applications, positioning powder metallurgy as a key player in the transition towards greener manufacturing processes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ferrous Powders Non-Ferrous Powders Metal Matrix Composites Others (e.g., Ceramic Powders, Refractory Powders) |

| By End-User | Automotive Aerospace Industrial Machinery Medical Devices Electrical & Electronics Oil & Gas Others |

| By Application | Structural Components Functional Components Tooling Magnetic Materials Filters Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Technology | Conventional Powder Metallurgy (Press & Sinter) Additive Manufacturing (3D Printing) Metal Injection Molding (MIM) Hot Isostatic Pressing (HIP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Powder Applications | 100 | Manufacturing Engineers, Product Development Managers |

| Aerospace Component Manufacturing | 80 | Quality Assurance Managers, Supply Chain Analysts |

| Medical Device Production | 60 | Regulatory Affairs Specialists, Production Supervisors |

| Industrial Equipment Parts | 50 | Procurement Managers, Operations Directors |

| Research and Development in Powder Metallurgy | 70 | R&D Scientists, Materials Engineers |

The Global Powder Metallurgy Market is valued at approximately USD 3 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for lightweight materials and advancements in manufacturing technologies across various industries.