Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2420

Pages:86

Published On:October 2025

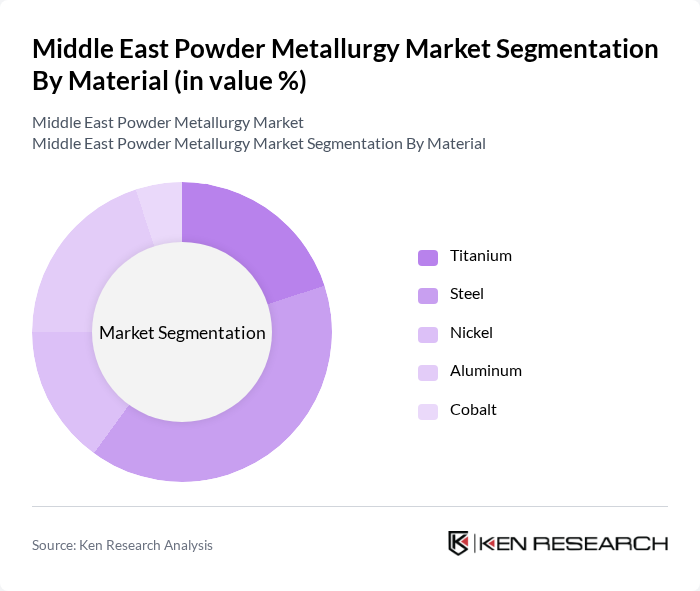

By Material:The selection of materials in powder metallurgy is critical for optimizing the mechanical, thermal, and corrosion properties of finished components. The primary materials include titanium, steel, nickel, aluminum, and cobalt. Steel remains the most widely used due to its strength, cost-effectiveness, and versatility across automotive and industrial applications. Titanium is increasingly adopted in aerospace and medical sectors for its lightweight and high strength-to-weight ratio. Aluminum is favored for automotive and electronics due to its low density and excellent conductivity. Nickel and cobalt are essential for high-temperature and wear-resistant applications, especially in energy and defense industries.

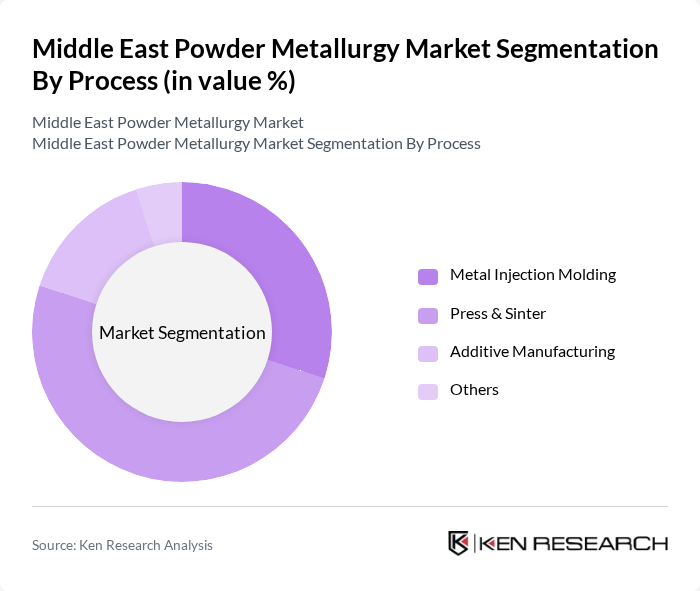

By Process:The processes utilized in powder metallurgy directly impact component precision, material utilization, and production scalability. Metal injection molding is increasingly preferred for producing intricate, high-precision parts in automotive, electronics, and medical devices. Press & sinter remains the standard for bulk production of structural components due to its cost-effectiveness and reliability. Additive manufacturing is rapidly expanding, enabling customization, rapid prototyping, and the use of advanced alloys for high-performance applications. Other processes, such as hot isostatic pressing and direct powder forging, are gaining traction for specialized industrial needs.

The Middle East Powder Metallurgy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iran Powder Metallurgy Complex, Masria for Metallurgical Powder Industry, Höganäs AB (via regional distributors), GKN Powder Metallurgy (via regional distributors), Carpenter Technology Corporation (via regional distributors), Miba AG (via regional distributors), Kymera International (via regional distributors), Advanced Powder Products (via regional distributors), Sintered Technologies (via regional distributors), TPR Metal Powder (via regional distributors), TMD Friction (via regional distributors), Tenneco Inc. (via regional distributors), Hitachi Chemical Co., Ltd. (via regional distributors), Trelleborg AB (via regional distributors), TCT Group (via regional distributors) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East powder metallurgy market appears promising, driven by technological advancements and increasing demand for lightweight materials. As industries prioritize sustainability, the adoption of eco-friendly manufacturing practices will likely accelerate. Furthermore, the integration of Industry 4.0 technologies, such as AI and IoT, is expected to enhance production efficiency and customization capabilities, positioning the region as a competitive player in the global powder metallurgy landscape.

| Segment | Sub-Segments |

|---|---|

| By Material | Titanium Steel Nickel Aluminum Cobalt |

| By Process | Metal Injection Molding Press & Sinter Additive Manufacturing Others |

| By Application | Automotive Oil & Gas Medical & Dental Industrial Machinery Electronics |

| By End-Use | OEMs Aftermarket |

| By Country | Saudi Arabia UAE Qatar Egypt Turkey Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Powder Metallurgy Applications | 100 | Manufacturing Engineers, Product Development Managers |

| Aerospace Component Manufacturing | 80 | Quality Assurance Managers, Aerospace Engineers |

| Industrial Machinery Parts Production | 60 | Operations Managers, Supply Chain Coordinators |

| Medical Device Manufacturing | 50 | Regulatory Affairs Specialists, Production Supervisors |

| Research and Development in Powder Metallurgy | 40 | R&D Directors, Materials Scientists |

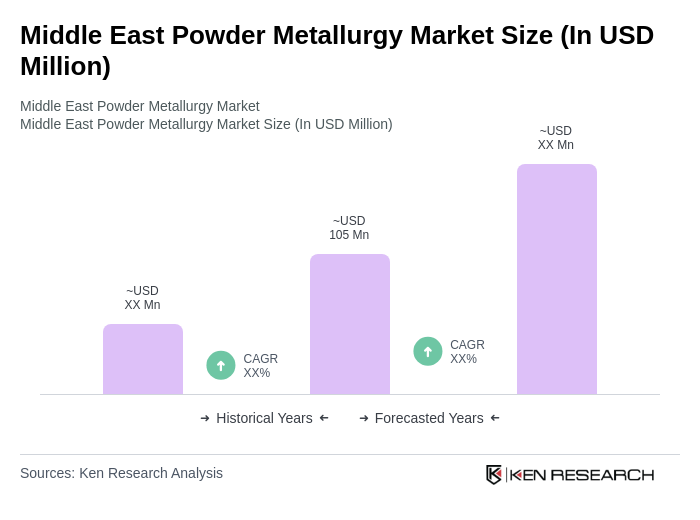

The Middle East Powder Metallurgy Market is valued at approximately USD 105 million, driven by increasing demand for lightweight and high-strength components across various sectors, including automotive, aerospace, and medical.