Region:Global

Author(s):Dev

Product Code:KRAB0451

Pages:87

Published On:August 2025

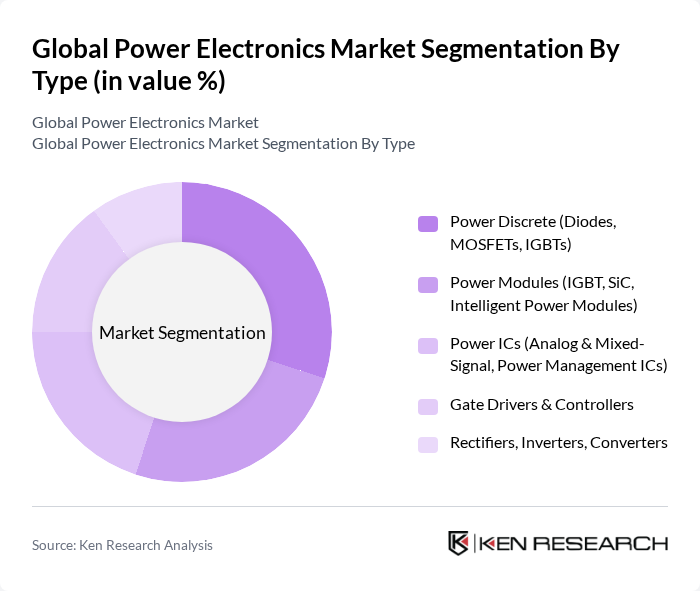

By Type:The power electronics market can be segmented into various types, including Power Discrete, Power Modules, Power ICs, Gate Drivers & Controllers, and Rectifiers, Inverters, and Converters. Each of these subsegments plays a crucial role in the overall market dynamics, catering to different applications and industries. Notably, demand is rising for wide?bandgap devices (SiC/GaN) across discrete and module categories due to higher efficiency and switching performance in EVs, renewables, and fast charging .

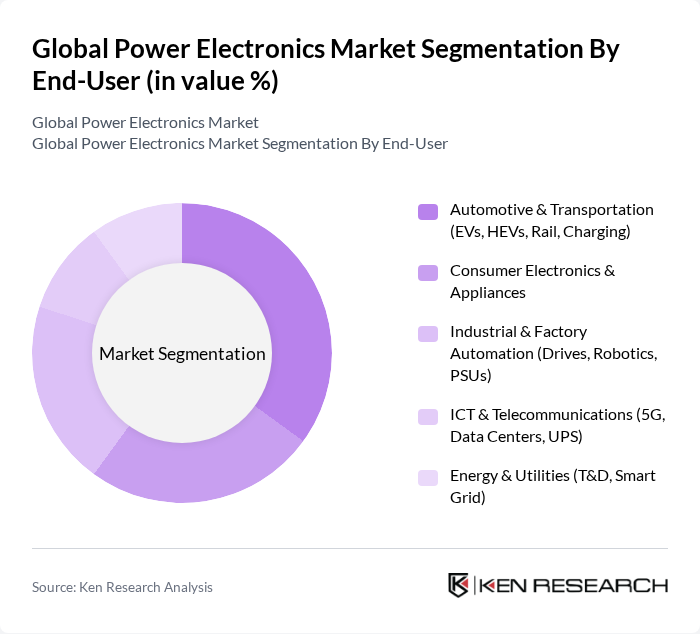

By End-User:The end-user segmentation of the power electronics market includes Automotive & Transportation, Consumer Electronics & Appliances, Industrial & Factory Automation, ICT & Telecommunications, and Energy & Utilities. Each of these sectors has unique requirements and applications for power electronics, influencing their market share and growth potential. Automotive & Transportation is a leading demand center due to traction inverters, onboard chargers, DC?DC converters, and charging infrastructure, while renewable integration and smart grids bolster Energy & Utilities .

The Global Power Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics N.V., onsemi (ON Semiconductor Corporation), NXP Semiconductors N.V., Mitsubishi Electric Corporation, ABB Ltd., Schneider Electric SE, Renesas Electronics Corporation, Broadcom Inc., Hitachi, Ltd., Panasonic Holdings Corporation, Toshiba Electronic Devices & Storage Corporation, Analog Devices, Inc., Wolfspeed, Inc. (Cree, Inc.), ROHM Co., Ltd., Vishay Intertechnology, Inc., Fuji Electric Co., Ltd., Littelfuse, Inc., Microchip Technology Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the power electronics market appears promising, driven by technological innovations and increasing regulatory support for clean energy initiatives. As industries adopt more energy-efficient solutions, the demand for advanced power electronics will likely rise. Additionally, the integration of IoT technologies in power systems is expected to enhance operational efficiency and reliability. Companies that invest in sustainable practices and innovative technologies will be well-positioned to capitalize on emerging opportunities in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Power Discrete (Diodes, MOSFETs, IGBTs) Power Modules (IGBT, SiC, Intelligent Power Modules) Power ICs (Analog & Mixed-Signal, Power Management ICs) Gate Drivers & Controllers Rectifiers, Inverters, Converters |

| By End-User | Automotive & Transportation (EVs, HEVs, Rail, Charging) Consumer Electronics & Appliances Industrial & Factory Automation (Drives, Robotics, PSUs) ICT & Telecommunications (5G, Data Centers, UPS) Energy & Utilities (T&D, Smart Grid) |

| By Application | Renewable Energy & Storage (Solar Inverters, Wind Converters, BESS) Electric Mobility Powertrain (Traction Inverters, OBC, DC-DC) Power Supply & UPS Motor Drives & Industrial Controls Fast Charging Infrastructure (AC/DC, DCFC) |

| By Component | Semiconductor Material: Silicon (Si) Semiconductor Material: Silicon Carbide (SiC) Semiconductor Material: Gallium Nitride (GaN) Passive & Magnetic Components (Capacitors, Inductors, Transformers) |

| By Sales Channel | Direct (OEM/Tier-1) Authorized Distributors Online/Platform Sales |

| By Distribution Mode | Contracted Supply (LTAs, Foundry/IDM) Spot/Franchise Distribution E-commerce |

| By Policy Support | Energy-Efficiency Standards (e.g., DOE, Ecodesign) EV & Charging Incentives Renewable Portfolio Standards & FITs/RECs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Power Electronics | 100 | Design Engineers, Product Managers |

| Industrial Automation Systems | 80 | Operations Managers, Technical Directors |

| Consumer Electronics Applications | 90 | R&D Managers, Product Development Leads |

| Renewable Energy Solutions | 70 | Project Managers, Sustainability Officers |

| Telecommunications Equipment | 60 | Network Engineers, Procurement Specialists |

The Global Power Electronics Market is valued at approximately USD 50 billion, driven by the increasing demand for energy-efficient solutions, the rise of electric vehicles, and advancements in renewable energy technologies.