Region:Asia

Author(s):Dev

Product Code:KRAA9500

Pages:94

Published On:November 2025

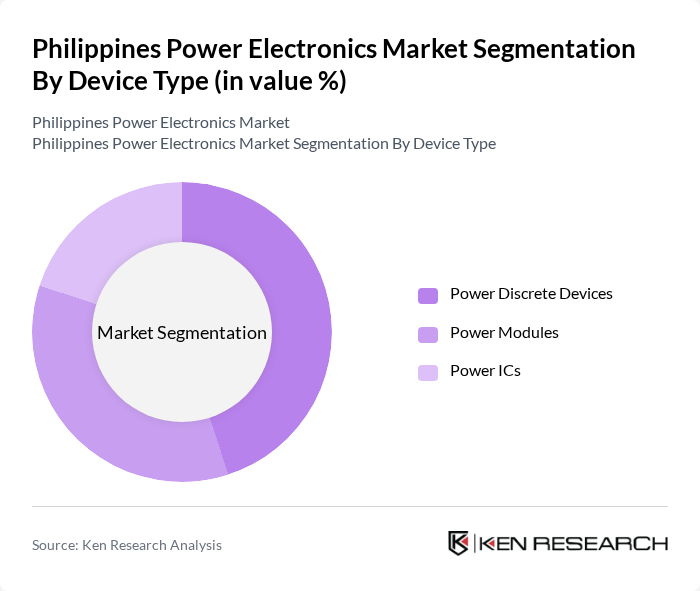

By Device Type:The market is segmented into Power Discrete Devices, Power Modules, and Power ICs. Each of these segments plays a crucial role in various applications, with Power Discrete Devices being widely used in industrial and consumer electronics due to their efficiency and reliability. Power Modules are gaining traction in renewable energy applications, while Power ICs are essential for automotive and consumer electronics .

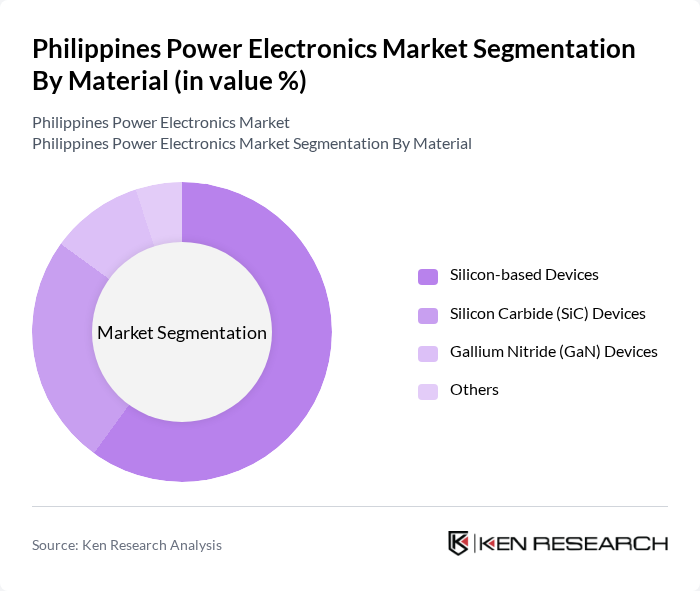

By Material:The market is categorized into Silicon, Silicon Carbide, Gallium Nitride, and Others. Silicon-based devices dominate the market due to their cost-effectiveness and widespread use in various applications. Silicon Carbide and Gallium Nitride are gaining popularity for their high efficiency and performance in demanding applications, particularly in renewable energy and automotive sectors .

The Philippines Power Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., ON Semiconductor (onsemi), Renesas Electronics Corporation, Panasonic Corporation, Broadcom Inc., Vishay Intertechnology, Inc., Microchip Technology Inc., Analog Devices, Inc., Integrated Micro-Electronics, Inc. (IMI Philippines), First Philec, Inc., Meralco Industrial Engineering Services Corporation (MIESCOR), Delta Electronics, Inc., Hitachi Energy Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines power electronics market is poised for significant growth, driven by the increasing integration of renewable energy sources and advancements in technology. The government's commitment to energy efficiency and sustainability will likely foster innovation and investment in smart grid technologies. As urbanization continues, the demand for efficient energy solutions will rise, creating opportunities for companies to develop and implement cutting-edge power electronics systems. The focus on energy storage and decentralized energy systems will further shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Device Type (Power Discrete Devices, Power Modules, Power ICs) | Power Discrete Devices Power Modules Power ICs |

| By Material (Silicon, Silicon Carbide, Gallium Nitride, Others) | Silicon-based Devices Silicon Carbide (SiC) Devices Gallium Nitride (GaN) Devices Others |

| By Application (Renewable Energy, Industrial, Automotive, Consumer Electronics, Utilities, Others) | Renewable Energy (Solar, Wind, Hydro, Bioenergy) Industrial Automation Automotive (EV/HEV, Charging Infrastructure) Consumer Electronics Utilities & Power Grid Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities Others |

| By Region (Luzon, Visayas, Mindanao) | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Applications | 100 | Project Managers, Energy Consultants |

| Consumer Electronics Market | 80 | Product Managers, R&D Engineers |

| Automotive Power Electronics | 70 | Automotive Engineers, Supply Chain Managers |

| Industrial Automation Systems | 90 | Operations Managers, Technical Directors |

| Telecommunications Equipment | 60 | Network Engineers, Product Development Leads |

The Philippines Power Electronics Market is valued at approximately USD 215 million, driven by the demand for energy-efficient devices, renewable energy solutions, and the growth of the automotive sector, particularly electric vehicles.