Region:Global

Author(s):Shubham

Product Code:KRAA3201

Pages:98

Published On:August 2025

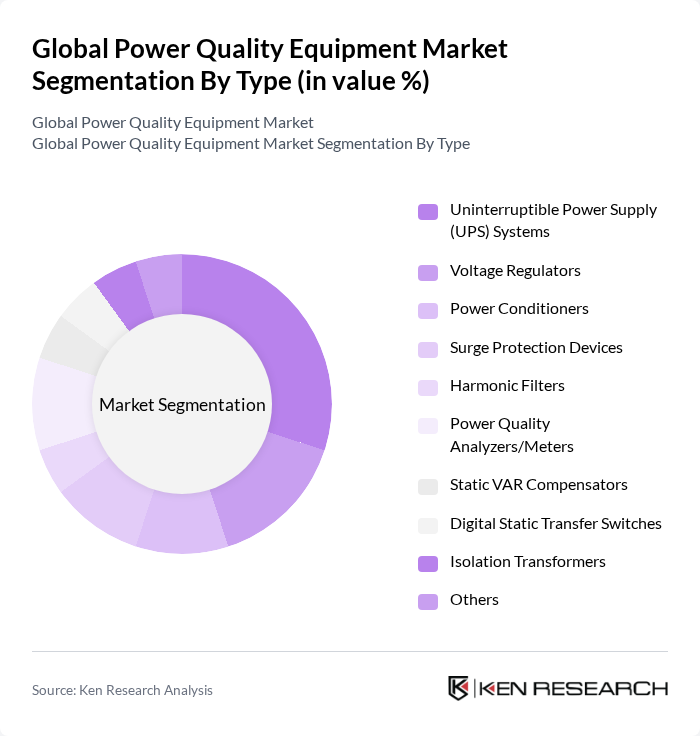

By Type:The market is segmented into various types of power quality equipment, including Voltage Regulators, Power Conditioners, Surge Protectors, Harmonic Filters, UPS Systems, Power Quality Analyzers, Synchronous Condensers, Static VAR Compensators, Isolation Transformers, Digital Static Transfer Switches, Power Distribution Units, and Others. Each of these sub-segments plays a crucial role in ensuring the stability and reliability of electrical systems. Voltage regulators and UPS systems are particularly critical in industrial and commercial applications, while surge protectors and harmonic filters are increasingly adopted to protect sensitive electronics and improve energy efficiency .

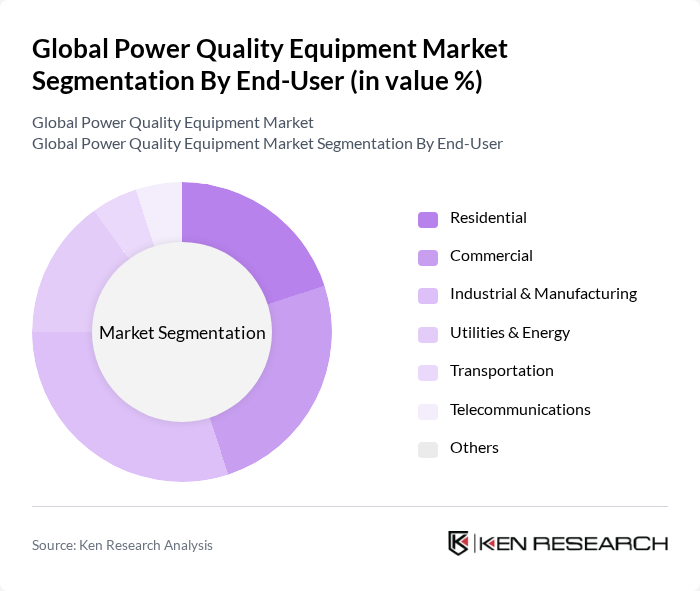

By End-User:The end-user segmentation includes Residential, Commercial, Industrial & Manufacturing, Utilities & Energy, Transportation, and Telecommunications. Each sector has unique requirements for power quality equipment, driven by the need for reliable power supply and operational efficiency. The industrial and manufacturing segment holds the largest share, reflecting the high demand for stable power in production environments, while utilities and energy sectors are rapidly adopting advanced solutions to support grid modernization and renewable integration .

The Global Power Quality Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric SE, Siemens AG, Eaton Corporation plc, ABB Ltd., General Electric Company, Emerson Electric Co., Mitsubishi Electric Corporation, Vertiv Holdings Co., Delta Electronics, Inc., Tripp Lite (now part of Eaton), CyberPower Systems, Inc., Phoenix Contact GmbH & Co. KG, Legrand SA, Toshiba Corporation, Socomec Group S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the power quality equipment market in None is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. As industries adopt smart grid technologies, the integration of IoT will enhance monitoring and management capabilities. Furthermore, the emphasis on sustainability will push companies to invest in energy-efficient solutions, aligning with global trends. This evolving landscape presents opportunities for innovation and collaboration among stakeholders, ensuring a resilient power quality infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Type | Voltage Regulators Power Conditioners Surge Protectors Harmonic Filters UPS Systems Power Quality Analyzers Synchronous Condensers Static VAR Compensators Isolation Transformers Digital Static Transfer Switches Power Distribution Units Others |

| By End-User | Residential Commercial Industrial & Manufacturing Utilities & Energy Transportation Telecommunications |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Data Centers Manufacturing Facilities Commercial Buildings Renewable Energy Systems Transportation Infrastructure Utility Networks |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Power Quality Solutions | 120 | Plant Managers, Electrical Engineers |

| Commercial Power Quality Equipment | 90 | Facility Managers, Operations Directors |

| Residential Power Quality Devices | 60 | Homeowners, Electrical Contractors |

| Data Center Power Quality Systems | 50 | IT Managers, Data Center Operators |

| Renewable Energy Integration Solutions | 40 | Renewable Energy Engineers, Project Managers |

The Global Power Quality Equipment Market is valued at approximately USD 33 billion, driven by the increasing demand for reliable power supply, renewable energy integration, and energy efficiency across various sectors.