Region:Global

Author(s):Dev

Product Code:KRAA1539

Pages:85

Published On:August 2025

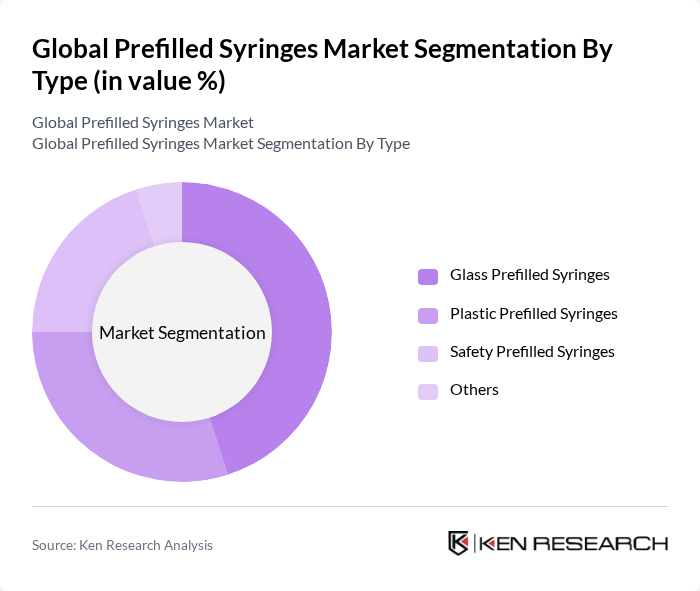

By Type:The prefilled syringes market can be segmented into various types, including Glass Prefilled Syringes, Plastic Prefilled Syringes, Safety Prefilled Syringes, and Others. Among these, Glass Prefilled Syringes are the most widely used due to their inert nature and established compatibility for biologics and vaccines. Plastic/Polymer (e.g., COP/Cyclic Olefin Polymer) Prefilled Syringes are gaining traction for their lightweight, break resistance, and reduced tungsten/metal contamination risks, supporting high-viscosity biologics and advanced delivery systems. Safety Prefilled Syringes are increasingly preferred for reducing needlestick injuries in hospitals and home care, aligned with occupational safety requirements and human factors design trends .

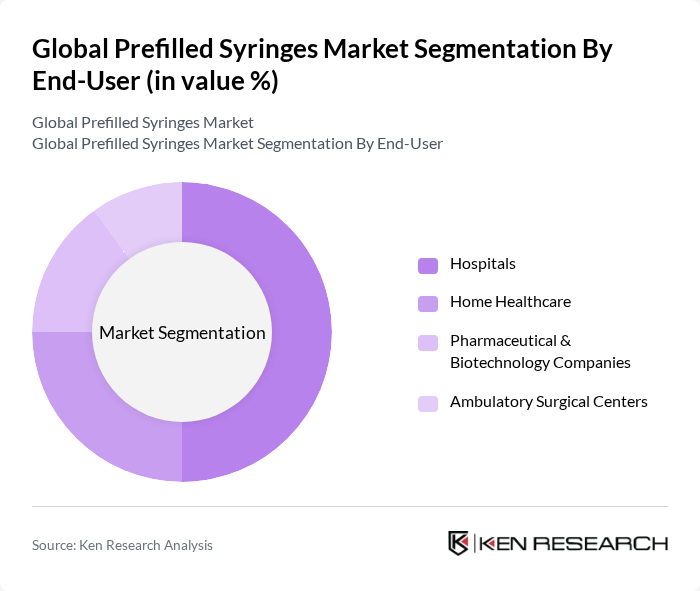

By End-User:The market can also be segmented based on end-users, which include Hospitals, Home Healthcare, Pharmaceutical & Biotechnology Companies, and Ambulatory Surgical Centers. Hospitals are the largest end-user segment, driven by high volumes of injectable administrations and safety/efficiency benefits. Home healthcare is growing rapidly with self-administration for chronic conditions and biologics. Pharmaceutical and biotechnology companies are significant users for combination product development and commercial fill-finish, while ambulatory surgical centers employ prefilled formats for efficiency and infection control .

The Global Prefilled Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Gerresheimer AG, Schott Pharma AG & Co. KGaA, West Pharmaceutical Services, Inc., Nipro Corporation, Terumo Corporation, Catalent, Inc., SHL Medical AG, Owen Mumford Ltd., Haselmeier GmbH (a Sulzer company), AptarGroup, Inc. (Aptar Pharma), Stevanato Group S.p.A., Ypsomed AG, Baxter International Inc. (BioPharma Solutions), Recipharm AB contribute to innovation, geographic expansion, and service delivery in this space .

The future of the prefilled syringes market appears promising, driven by ongoing advancements in technology and increasing healthcare demands. The shift towards personalized medicine is expected to enhance the adoption of prefilled syringes, as tailored therapies require precise delivery methods. Additionally, the growing trend of home healthcare services will likely boost the market, as patients increasingly seek convenient and effective self-administration options for their medications, ensuring sustained growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Prefilled Syringes Plastic Prefilled Syringes Safety Prefilled Syringes Others |

| By End-User | Hospitals Home Healthcare Pharmaceutical & Biotechnology Companies Ambulatory Surgical Centers |

| By Application | Vaccines & Immunization Diabetes (Insulins, GLP-1, etc.) Oncology & Immuno-oncology Autoimmune & Inflammatory Diseases |

| By Distribution Channel | Direct Sales to Pharma/CMOs Tender/Institutional Procurement Hospital & Specialty Pharmacies Online/B2B Platforms |

| By Region | North America Europe Asia-Pacific Latin America |

| By Payload Capacity | Low Volume (?1 mL; incl. 0.5 mL/1 mL long) Medium Volume (1.1 mL to 5 mL) High Volume (>5 mL; incl. 10 mL) |

| By Packaging Type | Single-Dose, Ready-to-Fill/Ready-to-Use (RTF/RTU) Multi-Dose & Dual-Chamber Prefilled Syringes Syringe & Safety Systems (Needle-Safety, Shielding) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Product Development Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 100 | Doctors, Nurses, Pharmacists |

| Medical Device Distributors | 80 | Supply Chain Managers, Sales Representatives |

| Research Institutions | 70 | Clinical Researchers, Lab Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Prefilled Syringes Market is valued at approximately USD 8.0 billion, reflecting a consistent trend in the high single-digit billion range. This valuation is supported by the increasing prevalence of chronic diseases and the growing demand for self-injection systems.