GCC Prefilled Syringes Market Overview

- The GCC Prefilled Syringes Market is valued at USD 90 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of chronic diseases, the rising demand for self-administration of medications, and advancements in drug delivery technologies. The convenience and accuracy offered by prefilled syringes have made them a preferred choice among healthcare providers and patients alike. The region’s focus on patient safety, infection control, and streamlined medication delivery further supports market expansion .

- Key players in this market include Saudi Arabia, the UAE, and Qatar, which dominate due to their robust healthcare infrastructure, high healthcare expenditure, and increasing investments in pharmaceutical manufacturing. The presence of leading pharmaceutical companies and a growing focus on innovative drug delivery systems further enhance their market position. Saudi Arabia, in particular, has seen a significant increase in medical device manufacturing, with over 150 licensed factories as of 2024, supported by substantial government investment and regulatory support for advanced medical technologies .

- In 2023, the Saudi Food and Drug Authority (SFDA) implemented new regulations mandating the use of prefilled syringes for certain injectable medications to improve patient safety and reduce medication errors. This regulation, known as the SFDA Medical Device Regulation, 2023, requires standardized quality controls and traceability for injectable products, aiming to enhance the overall efficiency and safety of drug delivery systems in the region .

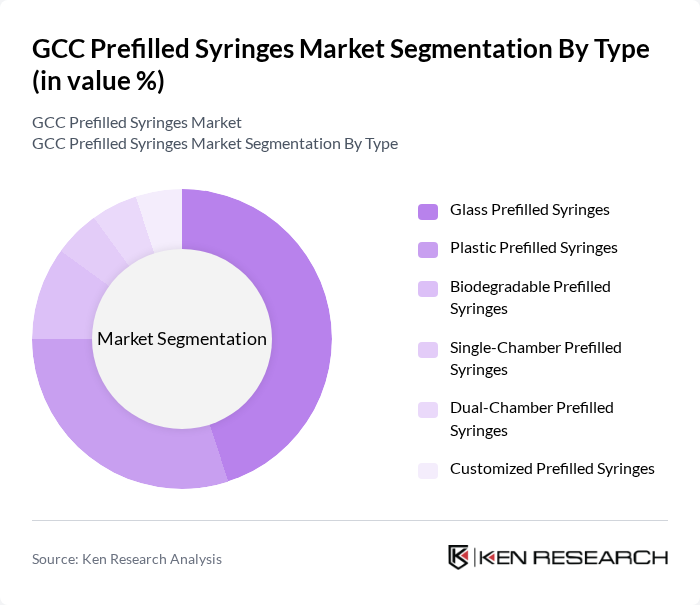

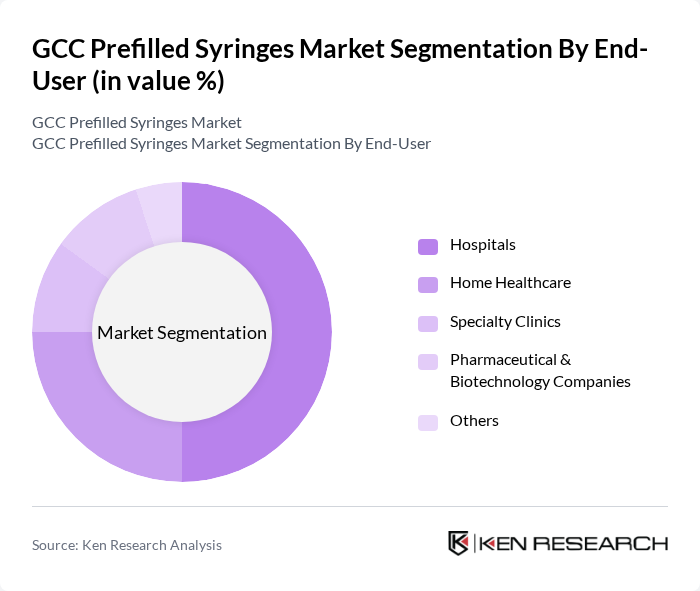

GCC Prefilled Syringes Market Segmentation

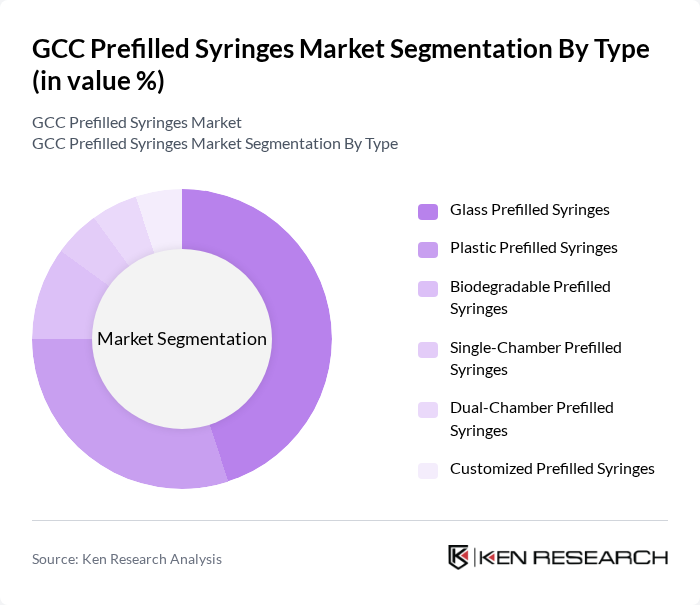

By Type:The market is segmented into various types of prefilled syringes, including Glass Prefilled Syringes, Plastic Prefilled Syringes, Biodegradable Prefilled Syringes, Single-Chamber Prefilled Syringes, Dual-Chamber Prefilled Syringes, and Customized Prefilled Syringes. Among these, Glass Prefilled Syringes are currently leading the market due to their superior chemical resistance and compatibility with a wide range of medications. The demand for Plastic Prefilled Syringes is also growing, driven by their lightweight nature and lower risk of breakage. Biodegradable options are gaining traction as sustainability becomes a priority in healthcare packaging.

By End-User:The end-user segmentation includes Hospitals, Home Healthcare, Specialty Clinics, Pharmaceutical & Biotechnology Companies, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of surgical procedures and the need for efficient medication delivery systems. Home healthcare is also witnessing significant growth as patients prefer self-administration of medications in a comfortable environment. Pharmaceutical companies are focusing on developing innovative prefilled syringe solutions to enhance patient compliance and safety.

GCC Prefilled Syringes Market Competitive Landscape

The GCC Prefilled Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company, Gerresheimer AG, Schott AG, West Pharmaceutical Services, Inc., Medtronic plc, Sandoz International GmbH, F. Hoffmann-La Roche Ltd, Sanofi S.A., Pfizer Inc., Amgen Inc., Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Eli Lilly and Company, Novartis AG, Bristol-Myers Squibb Company, Nipro Corporation, Terumo Corporation, Arab Medical Equipment Company (AMECO), Gulf Inject LLC, Hikma Pharmaceuticals PLC contribute to innovation, geographic expansion, and service delivery in this space.

GCC Prefilled Syringes Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The GCC region is witnessing a significant rise in chronic diseases, with diabetes cases projected to reach 12.2 million in the future, according to the International Diabetes Federation. This surge necessitates effective drug delivery systems, such as prefilled syringes, to manage treatment regimens. Additionally, the World Health Organization reported that cardiovascular diseases are responsible for 40% of deaths in the region, further driving the demand for efficient medication administration methods.

- Rising Demand for Self-Administration of Medications:The trend towards self-administration of medications is gaining momentum, particularly in the GCC, where the home healthcare market is expected to grow to $5.4 billion in the future. This shift is driven by the increasing preference for patient autonomy and convenience, as well as the need for chronic disease management. Prefilled syringes facilitate this trend by providing a user-friendly solution that enhances adherence to treatment protocols, thereby improving patient outcomes.

- Technological Advancements in Syringe Manufacturing:Innovations in syringe manufacturing technology are enhancing the quality and safety of prefilled syringes. For instance, the introduction of advanced materials and automated production processes has led to a reduction in contamination risks and improved product reliability. The GCC's investment in healthcare technology is projected to reach $10 billion in the future, fostering an environment conducive to the development of high-quality prefilled syringes that meet evolving healthcare needs.

Market Challenges

- High Manufacturing Costs:The production of prefilled syringes involves significant capital investment, with costs estimated at around $1.5 million for setting up a manufacturing facility. This high barrier to entry can deter new players from entering the market, limiting competition and innovation. Additionally, the rising prices of raw materials, such as glass and plastics, further exacerbate manufacturing costs, impacting the overall pricing strategy for prefilled syringes in the GCC.

- Stringent Regulatory Requirements:The regulatory landscape for medical devices in the GCC is complex, with stringent requirements imposed by health authorities. Compliance with ISO standards and local regulations can prolong the approval process for new products, often taking up to 18 months. This regulatory burden can hinder market entry for manufacturers and slow down the introduction of innovative prefilled syringe solutions, ultimately affecting market growth and accessibility for patients.

GCC Prefilled Syringes Market Future Outlook

The future of the GCC prefilled syringes market appears promising, driven by the increasing focus on personalized medicine and the expansion of home healthcare services. As healthcare systems evolve, the demand for innovative drug delivery solutions will likely rise, particularly with the integration of smart technologies. Furthermore, the growing emphasis on patient safety and compliance will propel the adoption of prefilled syringes, ensuring that they remain a vital component of modern healthcare delivery in the region.

Market Opportunities

- Expansion in Emerging Markets:The GCC region presents significant opportunities for market expansion, particularly in countries like Saudi Arabia and the UAE, where healthcare spending is projected to reach $50 billion in the future. This growth is driven by government initiatives aimed at improving healthcare infrastructure, creating a favorable environment for the adoption of prefilled syringes in various therapeutic areas.

- Development of Biodegradable Prefilled Syringes:The increasing environmental concerns surrounding plastic waste present an opportunity for the development of biodegradable prefilled syringes. With the global market for biodegradable plastics expected to reach $6.5 billion in the future, manufacturers in the GCC can capitalize on this trend by innovating sustainable solutions that meet both regulatory standards and consumer preferences for eco-friendly products.