Region:Global

Author(s):Dev

Product Code:KRAA1692

Pages:84

Published On:August 2025

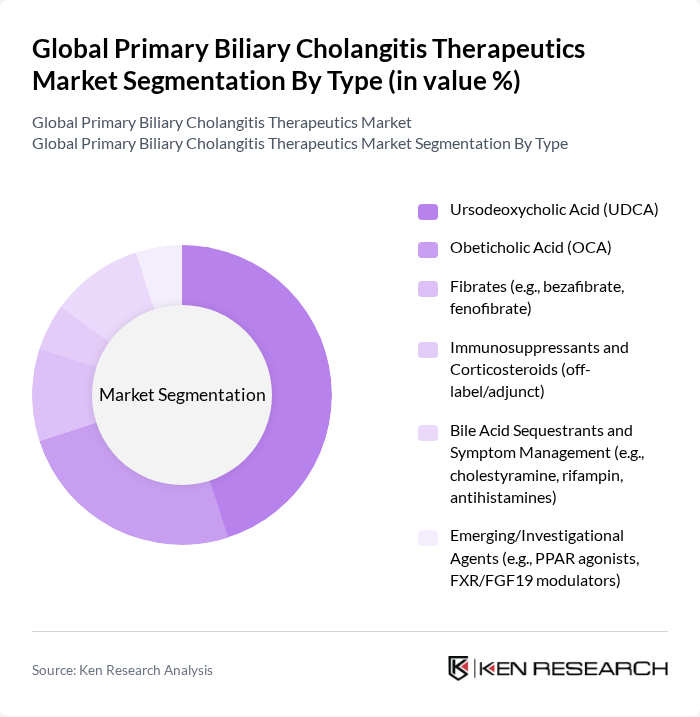

By Type:The market is segmented into various types of therapeutics, including Ursodeoxycholic Acid (UDCA), Obeticholic Acid (OCA), fibrates, immunosuppressants, bile acid sequestrants, and emerging agents. Among these, Ursodeoxycholic Acid (UDCA) is the most widely used treatment due to its established efficacy and safety profile. The increasing adoption of UDCA in clinical practice is driven by its ability to improve liver function and delay disease progression, making it a preferred choice for both physicians and patients.

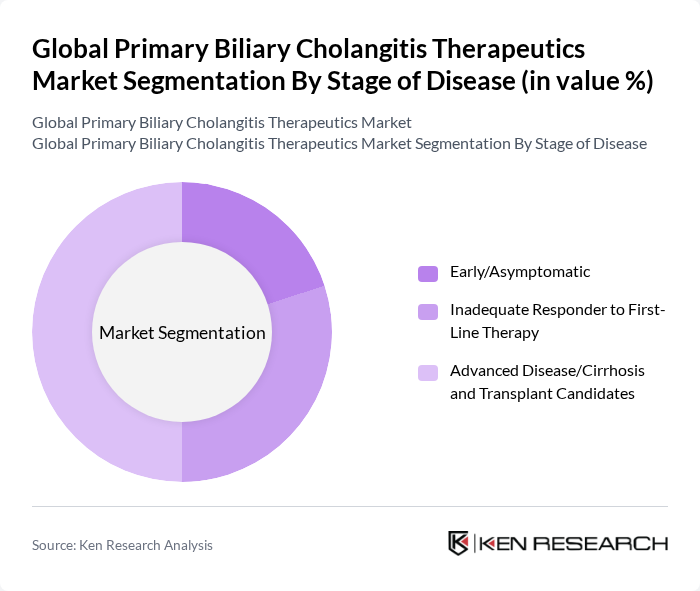

By Stage of Disease:The segmentation by disease stage includes early/asymptomatic, inadequate responders to first-line therapy, and advanced disease/cirrhosis. The advanced disease stage is currently the most significant segment due to the high unmet medical need and the complexity of treatment required for patients with severe liver damage. This segment is characterized by a growing demand for specialized therapies that can manage complications and improve quality of life for patients awaiting liver transplants.

The Global Primary Biliary Cholangitis Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intercept Pharmaceuticals, Inc., Gilead Sciences, Inc., Zydus Lifesciences Limited, Dr. Falk Pharma GmbH, AbbVie Inc., Viatris Inc., SOBI AB (Swedish Orphan Biovitrum AB), Ipsen Biopharmaceuticals, Choleskit Therapeutics, Apellis Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Mirum Pharmaceuticals, Inc., Calliditas Therapeutics AB, Albireo Pharma (a subsidiary of Ipsen), Novartis AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PBC therapeutics market appears promising, driven by ongoing innovations in treatment options and a growing emphasis on personalized medicine. As the healthcare landscape evolves, the integration of digital health solutions and telemedicine is expected to enhance patient engagement and adherence. Additionally, the increasing collaboration between pharmaceutical companies and research institutions will likely accelerate the development of novel therapies, addressing unmet medical needs and improving patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ursodeoxycholic Acid (UDCA) Obeticholic Acid (OCA) Fibrates (e.g., bezafibrate, fenofibrate) Immunosuppressants and Corticosteroids (off-label/adjunct) Bile Acid Sequestrants and Symptom Management (e.g., cholestyramine, rifampin, antihistamines) Emerging/Investigational Agents (e.g., PPAR agonists, FXR/FGF19 modulators) |

| By Stage of Disease | Early/Asymptomatic Inadequate Responder to First-Line Therapy Advanced Disease/Cirrhosis and Transplant Candidates |

| By Route of Administration | Oral Parenteral/Injectable |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By End-User | Hospitals Specialty Clinics (Hepatology/Gastroenterology) Homecare Settings |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age Group Gender Comorbidities and Autoimmune History |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hepatology Clinics | 120 | Hepatologists, Nurse Practitioners |

| Pharmaceutical Companies | 90 | Product Managers, Clinical Research Directors |

| Patient Advocacy Groups | 60 | Patient Representatives, Community Outreach Coordinators |

| Healthcare Payers | 70 | Health Economists, Policy Analysts |

| Clinical Research Organizations | 60 | Clinical Trial Managers, Regulatory Affairs Specialists |

The Global Primary Biliary Cholangitis Therapeutics Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing prevalence of primary biliary cholangitis (PBC) and advancements in therapeutic options.