Region:Global

Author(s):Shubham

Product Code:KRAD0774

Pages:96

Published On:August 2025

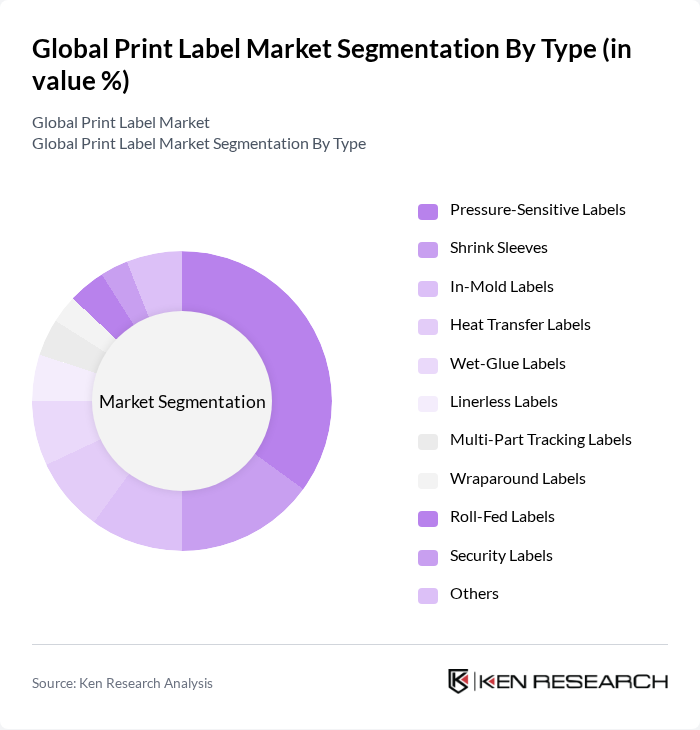

By Type:The print label market can be segmented into Pressure-Sensitive Labels, Shrink Sleeves, In-Mold Labels, Heat Transfer Labels, Wet-Glue Labels, Linerless Labels, Multi-Part Tracking Labels, Wraparound Labels, Roll-Fed Labels, Security Labels, and Others. Among these, Pressure-Sensitive Labels hold the largest share due to their versatility, ease of application, and suitability for a wide range of industries, including food and beverage, pharmaceuticals, and logistics. Shrink Sleeves and In-Mold Labels are also witnessing increased adoption in premium packaging and consumer goods .

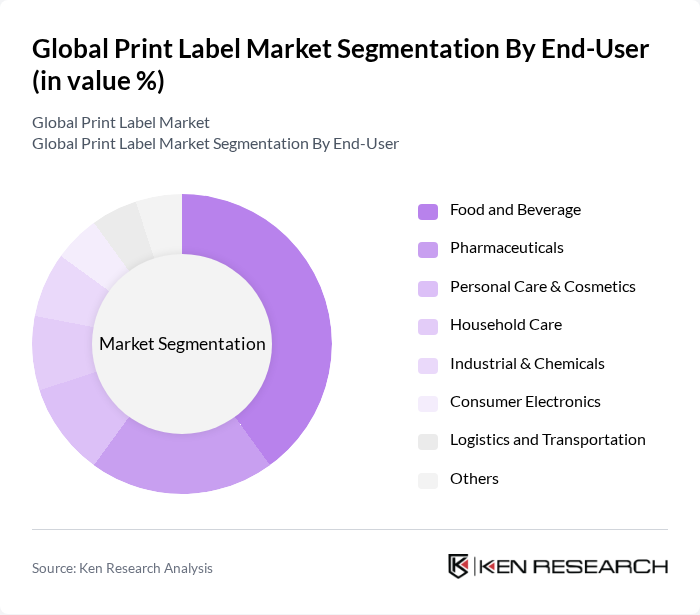

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Personal Care & Cosmetics, Household Care, Industrial & Chemicals, Consumer Electronics, Logistics and Transportation, and Others. The Food and Beverage sector is the largest consumer of print labels, driven by branding, regulatory compliance for nutritional and safety information, and traceability requirements. Pharmaceuticals and Personal Care are also major end-users due to stringent labeling standards and the need for anti-counterfeit measures .

The Global Print Label Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avery Dennison Corporation, CCL Industries Inc., UPM Raflatac, Multi-Color Corporation, Sato Holdings Corporation, Brady Corporation, 3M Company, Mondi Group, Ahlstrom-Munksjö Oyj, Autajon Group, Fortis Solutions Group, WS Packaging Group, Tadbik Ltd., TSC Auto ID Technology Co., Ltd., and Labelmakers contribute to innovation, geographic expansion, and service delivery in this space.

The print label market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital printing technologies continue to improve, manufacturers will increasingly adopt on-demand printing solutions, enhancing customization capabilities. Additionally, the integration of smart labeling technologies, such as QR codes and NFC, will provide new avenues for consumer engagement. These trends indicate a shift towards more interactive and personalized labeling experiences, aligning with the growing demand for sustainability and innovation in packaging solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Pressure-Sensitive Labels Shrink Sleeves In-Mold Labels Heat Transfer Labels Wet-Glue Labels Linerless Labels Multi-Part Tracking Labels Wraparound Labels Roll-Fed Labels Security Labels Others |

| By End-User | Food and Beverage Pharmaceuticals Personal Care & Cosmetics Household Care Industrial & Chemicals Consumer Electronics Logistics and Transportation Others |

| By Application | Product Labeling Shipping and Logistics Brand Promotion Compliance and Safety Inventory Management Anti-Counterfeiting Smart Labels (RFID, NFC, QR) Others |

| By Material | Paper Film (Plastic/Polymer) Vinyl Polypropylene Biodegradable/Bio-based Materials Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Labeling | 90 | Brand Managers, Packaging Engineers |

| Pharmaceutical Labeling | 60 | Regulatory Affairs Specialists, Quality Control Managers |

| Consumer Goods Packaging | 70 | Marketing Directors, Product Managers |

| Industrial Labeling Solutions | 50 | Operations Managers, Supply Chain Coordinators |

| Sustainable Labeling Practices | 40 | Sustainability Officers, Innovation Managers |

The Global Print Label Market is valued at approximately USD 49 billion, driven by increasing demand for packaged goods, e-commerce expansion, and compliance labeling across various industries.