Region:Global

Author(s):Dev

Product Code:KRAB0349

Pages:88

Published On:August 2025

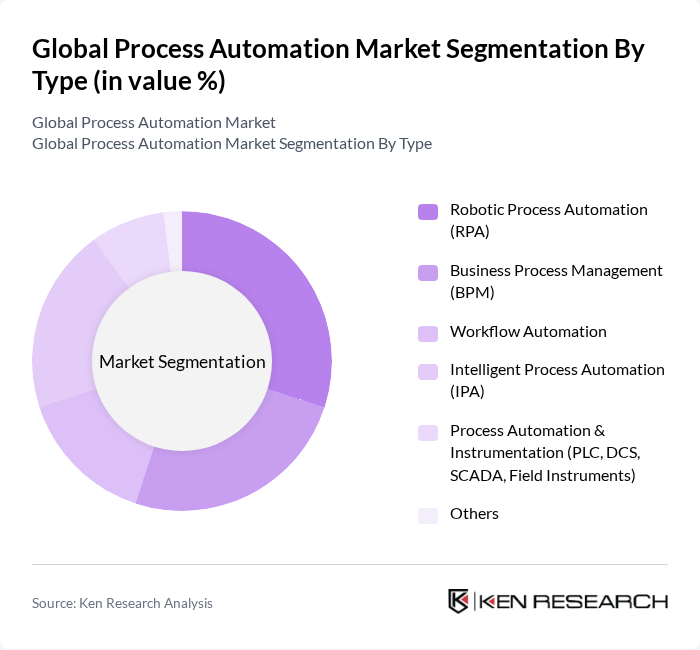

By Type:The market is segmented into various types, including Robotic Process Automation (RPA), Business Process Management (BPM), Workflow Automation, Intelligent Process Automation (IPA), Process Automation & Instrumentation (PLC, DCS, SCADA, Field Instruments), and Others. Each segment addresses specific business needs:

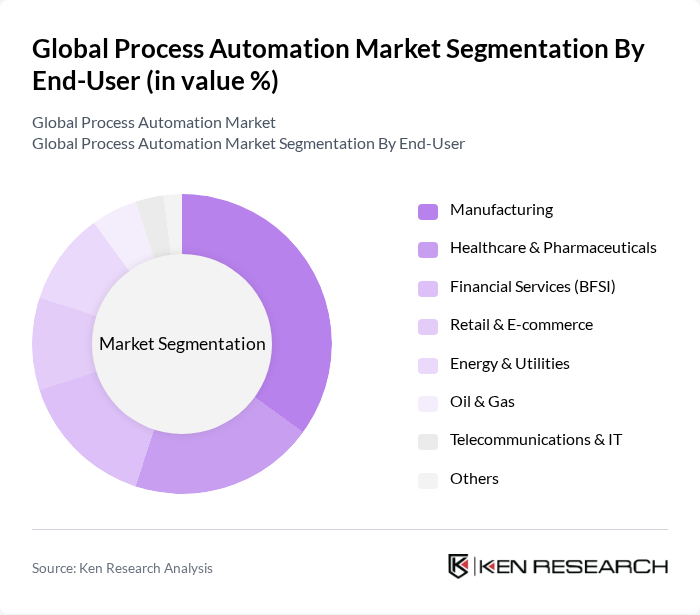

By End-User:The end-user segmentation includes Manufacturing, Healthcare & Pharmaceuticals, Financial Services (BFSI), Retail & E-commerce, Energy & Utilities, Oil & Gas, Telecommunications & IT, and Others. Each sector utilizes process automation to improve efficiency, reduce costs, and enhance service delivery:

The Global Process Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Rockwell Automation, Inc., Honeywell International Inc., Schneider Electric SE, Emerson Electric Co., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, KUKA AG, PTC Inc., Automation Anywhere, Inc., UiPath Inc., Blue Prism Group PLC, SAP SE, Oracle Corporation, Dassault Systèmes SE, Eaton Corporation plc, Cognizant Technology Solutions Corporation, IBM Corporation, Tata Consultancy Services Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the process automation market is poised for significant transformation, driven by advancements in artificial intelligence and machine learning. As organizations increasingly adopt these technologies, the focus will shift towards enhancing predictive analytics and decision-making capabilities. Additionally, the growing emphasis on sustainability will lead to the development of eco-friendly automation solutions, aligning with global environmental goals. Companies that embrace these trends will likely gain a competitive advantage, positioning themselves as leaders in the evolving landscape of process automation.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotic Process Automation (RPA) Business Process Management (BPM) Workflow Automation Intelligent Process Automation (IPA) Process Automation & Instrumentation (PLC, DCS, SCADA, Field Instruments) Others |

| By End-User | Manufacturing Healthcare & Pharmaceuticals Financial Services (BFSI) Retail & E-commerce Energy & Utilities Oil & Gas Telecommunications & IT Others |

| By Industry | Automotive Food & Beverage Chemicals Power Generation Water & Wastewater Others |

| By Component | Software Services Hardware (PLCs, DCS, SCADA, Sensors, Actuators, Field Instruments) Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Sales Channel | Direct Sales Distributors/VARs Online Sales System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation Solutions | 150 | Plant Managers, Automation Engineers |

| Healthcare Process Automation | 100 | Healthcare Administrators, IT Managers |

| Logistics and Supply Chain Automation | 80 | Supply Chain Managers, Operations Directors |

| Energy Sector Automation | 60 | Energy Analysts, Project Managers |

| Food and Beverage Automation | 70 | Quality Control Managers, Production Supervisors |

The Global Process Automation Market is valued at approximately USD 95 billion, driven by the increasing demand for operational efficiency, cost reduction, and the adoption of advanced technologies like AI and IoT.