Region:Middle East

Author(s):Dev

Product Code:KRAD0523

Pages:87

Published On:August 2025

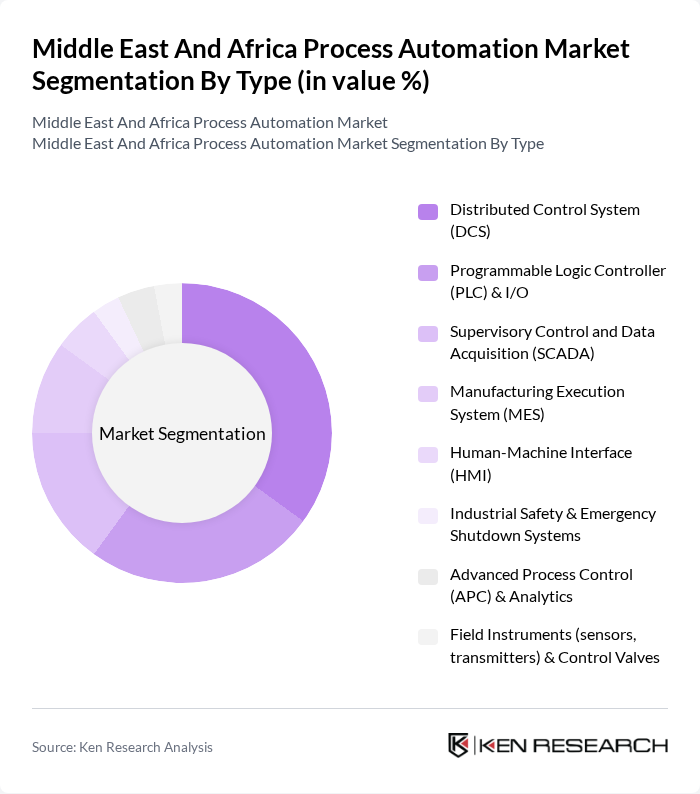

By Type:The market is segmented into various types of process automation technologies, each catering to specific operational needs. The dominant sub-segments include Distributed Control Systems (DCS) and Programmable Logic Controllers (PLC), which are widely adopted for their reliability and efficiency in managing complex industrial processes. The increasing trend towards digital transformation and Industry 4.0 initiatives is further propelling the demand for these technologies.

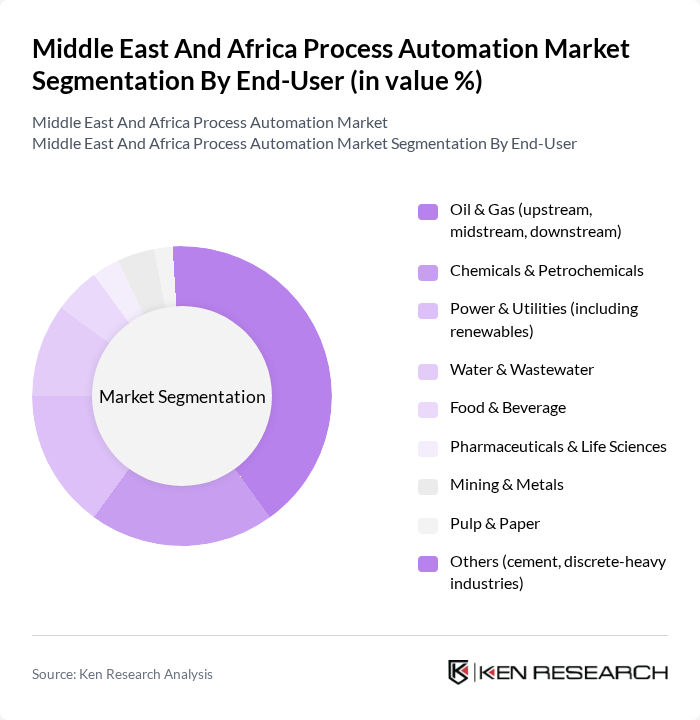

By End-User:The end-user segmentation highlights the diverse applications of process automation across various industries. The oil and gas sector remains the largest consumer, driven by the need for enhanced operational efficiency and safety. Other significant sectors include chemicals and petrochemicals, power and utilities, and water and wastewater management, all of which are increasingly adopting automation technologies to streamline operations and comply with regulatory standards.

The Middle East And Africa Process Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric SE, Honeywell International Inc., Rockwell Automation, Inc., Yokogawa Electric Corporation, Emerson Electric Co., Mitsubishi Electric Corporation, General Electric Company (GE Vernova, GE Digital), KUKA AG, FANUC Corporation, Omron Corporation, National Instruments Corporation (NI), B&R Industrial Automation GmbH (ABB Group), Aspen Technology, Inc. (AspenTech), AVEVA Group plc, Endress+Hauser Group, Schneider Electric – AVEVA (industrial software), Azbil Corporation, Pepperl+Fuchs SE, Phoenix Contact GmbH & Co. KG, Hitachi, Ltd. (Hitachi Energy; Hitachi Industrial), Baker Hughes (process & turbomachinery controls), SAMSON AG, Schneider Electric – Triconex (Safety Instrumented Systems) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the process automation market in the Middle East and Africa appears promising, driven by technological advancements and increasing investments in digital infrastructure. As industries embrace automation, the focus will shift towards integrating AI and machine learning to enhance operational capabilities. Furthermore, the growing emphasis on sustainability will encourage companies to adopt eco-friendly automation solutions, aligning with global environmental goals and regulations, thereby fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Distributed Control System (DCS) Programmable Logic Controller (PLC) & I/O Supervisory Control and Data Acquisition (SCADA) Manufacturing Execution System (MES) Human-Machine Interface (HMI) Industrial Safety & Emergency Shutdown Systems Advanced Process Control (APC) & Analytics Field Instruments (sensors, transmitters) & Control Valves |

| By End-User | Oil & Gas (upstream, midstream, downstream) Chemicals & Petrochemicals Power & Utilities (including renewables) Water & Wastewater Food & Beverage Pharmaceuticals & Life Sciences Mining & Metals Pulp & Paper Others (cement, discrete-heavy industries) |

| By Application | Process Control & Monitoring Batch & Quality Management Asset Performance Management & Predictive Maintenance Production Scheduling & Supply Chain Visibility Safety, Compliance & Cybersecurity |

| By Component | Hardware (controllers, instruments, valves, drives) Software (SCADA/MES/APC, analytics, historian) Services (EPC, integration, maintenance, training) |

| By Sales Channel | Direct (OEMs and vendor direct sales) System Integrators & EPCs Distributors/Value-Added Resellers |

| By Communication Protocol | Wired (HART, Profibus/Profinet, Modbus, Foundation Fieldbus) Wireless (WirelessHART, ISA100, Wi?Fi, 5G/Private LTE) |

| By Country | Saudi Arabia United Arab Emirates Qatar South Africa Egypt Nigeria Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation Solutions | 140 | Production Managers, Automation Engineers |

| Oil & Gas Process Automation | 100 | Operations Managers, Safety Managers |

| Healthcare Automation Systems | 80 | Healthcare Administrators, IT Managers |

| Logistics and Supply Chain Automation | 120 | Logistics Managers, Supply Chain Analysts |

| Smart Building Automation | 90 | Facility Managers, Building Engineers |

The Middle East and Africa Process Automation Market is valued at approximately USD 6.1 billion, reflecting a significant growth trend driven by the increasing demand for automation solutions across various industries, including oil and gas, manufacturing, and utilities.