Region:Global

Author(s):Shubham

Product Code:KRAB0756

Pages:86

Published On:August 2025

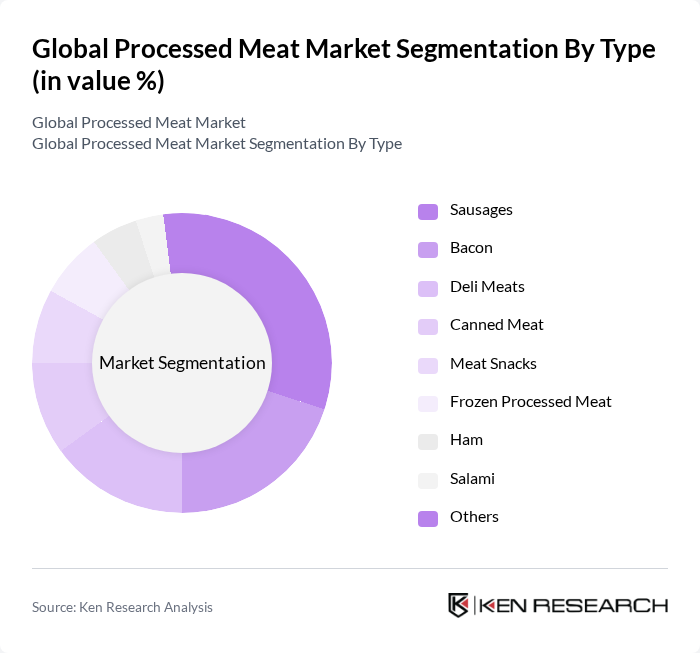

By Type:The processed meat market is segmented into various types, including sausages, bacon, deli meats, canned meat, meat snacks, frozen processed meat, ham, salami, and others. Among these, sausages and deli meats are particularly popular due to their versatility and convenience, making them a staple in many households. The demand for bacon has also surged, driven by its popularity in breakfast meals and as a flavor enhancer in various dishes. The market continues to see innovation in product formats, such as low-sodium and organic options, in response to evolving consumer health preferences .

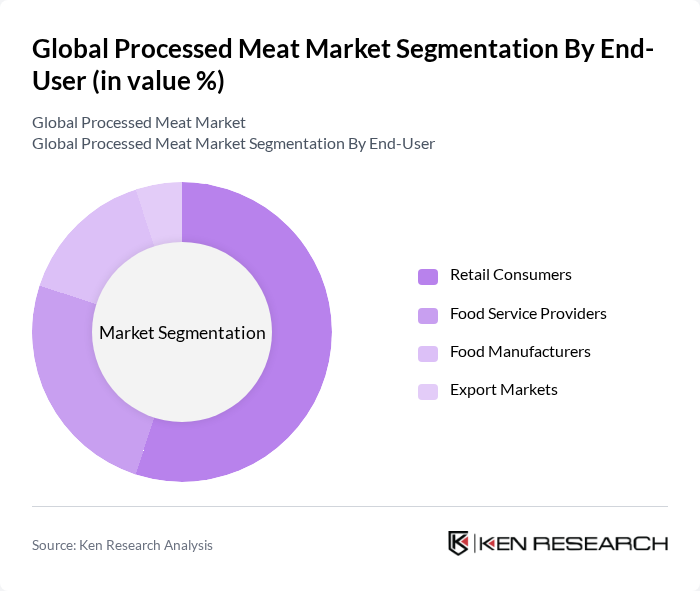

By End-User:The processed meat market is segmented by end-user into retail consumers, food service providers, food manufacturers, and export markets. Retail consumers dominate the market, driven by the increasing trend of home cooking, demand for ready-to-eat meals, and the influence of urbanization. Food service providers, including restaurants and catering services, also contribute significantly to the market, as they seek high-quality processed meat products to enhance their menu offerings. The export market continues to grow, particularly in emerging economies where demand for Western-style processed meats is rising .

The Global Processed Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tyson Foods, Inc., JBS S.A., Smithfield Foods, Inc., Hormel Foods Corporation, BRF S.A., Pilgrim's Pride Corporation, Maple Leaf Foods Inc., Perdue Farms, Inc., Seaboard Foods LLC, Danish Crown A/S, WH Group Limited, Cargill, Inc., Atria Plc, Vion Food Group, and Conagra Brands, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the processed meat market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for gourmet and artisanal products rises, companies are likely to invest in innovative processing techniques to enhance product quality. Additionally, the increasing focus on sustainability will push manufacturers to adopt ethical sourcing practices, aligning with consumer values and potentially expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sausages Bacon Deli Meats Canned Meat Meat Snacks Frozen Processed Meat Ham Salami Others |

| By End-User | Retail Consumers Food Service Providers Food Manufacturers Export Markets |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Foodservice Channels |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Canned Packaging Others |

| By Product Form | Fresh Frozen Cooked Cured Smoked |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Processed Meat Sales | 120 | Store Managers, Category Buyers |

| Food Service Industry Insights | 90 | Restaurant Owners, Catering Managers |

| Consumer Preferences in Processed Meat | 140 | General Consumers, Health-Conscious Shoppers |

| Processed Meat Export Market | 80 | Export Managers, Trade Analysts |

| Health and Nutrition Perspectives | 70 | Nutritionists, Dietitians |

The Global Processed Meat Market is valued at approximately USD 698 billion, reflecting a significant increase in consumption driven by consumer demand for convenience foods, rising disposable incomes, and a shift towards protein-rich diets.