Region:Central and South America

Author(s):Dev

Product Code:KRAD0519

Pages:98

Published On:August 2025

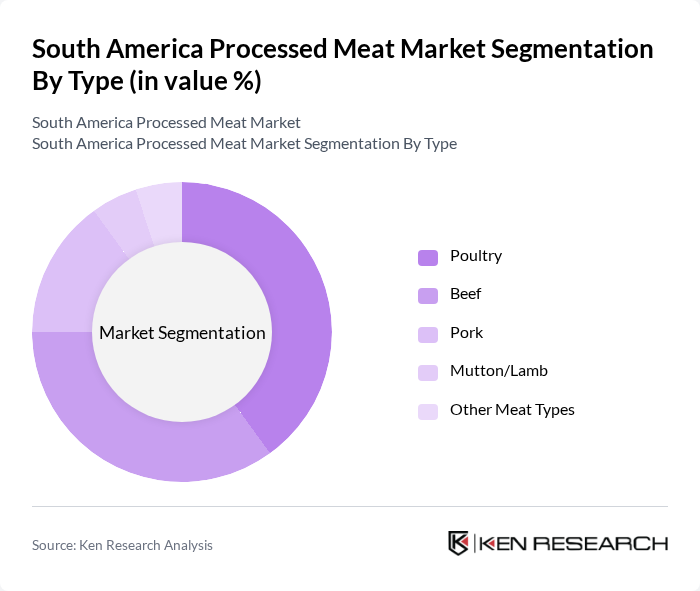

By Type:The processed meat market in South America is segmented into various types, including poultry, beef, pork, mutton/lamb, and other meat types. Among these, poultry and beef are the leading subsegments, driven by consumer preferences for versatile and protein-rich options. Poultry is favored for its perceived health benefits and lower fat content, while beef remains a staple in many South American diets, particularly in Argentina. The demand for these meat types is influenced by cultural factors, dietary trends, and the growing popularity of ready-to-eat products.

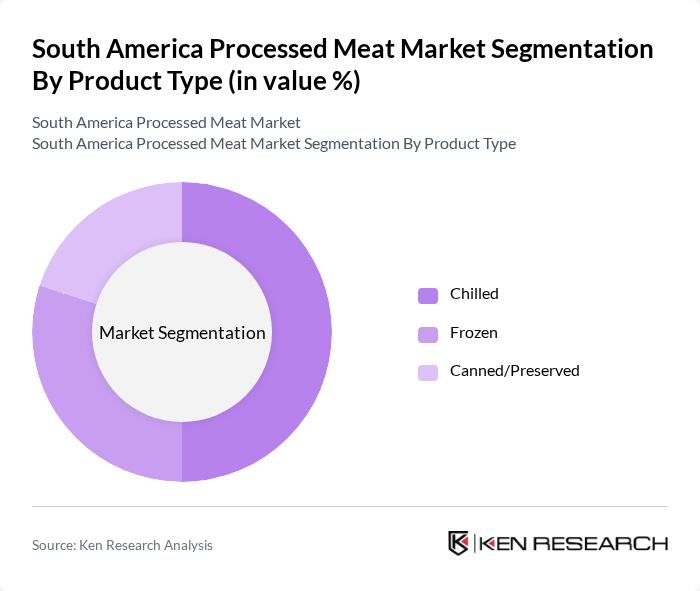

By Product Type:The processed meat market is also categorized by product type, including chilled, frozen, and canned/preserved products. Chilled products dominate the market due to their freshness and convenience, appealing to health-conscious consumers. Frozen products are gaining traction as they offer longer shelf life and ease of storage, while canned/preserved options are popular for their convenience and extended usability. The trend towards ready-to-eat meals is further propelling the growth of these product types.

The South America Processed Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as JBS S.A. (Brazil), BRF S.A. (Brazil), Marfrig Global Foods S.A. (Brazil), Minerva Foods S.A. (Brazil), Aurora Coop (Cooperativa Central Aurora Alimentos, Brazil), Seara Alimentos Ltda. (Brazil), Frigorífico Concepción S.A. (Paraguay), Molinos Río de la Plata S.A. (La Salteña/Granja del Sol processed lines, Argentina), Quickfood S.A. (Paty – a Marfrig company, Argentina), Cargill, Incorporated (Regional operations), Tyson Foods, Inc. (Regional presence via imports/partnerships), Smithfield Foods, Inc. (WH Group) (Regional pork imports/partnerships), Maple Leaf Foods Inc. (Export presence), Danish Crown A/S (Export presence), Vion Food Group (Export presence) contribute to innovation, geographic expansion, and service delivery in this space.

The South American processed meat market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. As health-conscious consumers increasingly seek organic and sustainably sourced options, manufacturers are likely to invest in product development to meet these demands. Additionally, the rise of e-commerce and online grocery shopping will further enhance market accessibility, allowing brands to reach a broader audience. Overall, the market is expected to adapt to these trends, fostering a competitive landscape that prioritizes quality and convenience.

| Segment | Sub-Segments |

|---|---|

| By Type | Poultry Beef Pork Mutton/Lamb Other Meat Types |

| By Product Type | Chilled Frozen Canned/Preserved |

| By Application/End-User | Retail/Household Foodservice (HORECA) Institutional (Hospitals, Schools, Catering) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Butcher/Delicatessen Other Distribution Channels |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging (MAP) Canned Packaging Skin/Flow Wrap and Others |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Cured/Smoked Fresh/Chilled Frozen |

| By Country | Brazil Argentina Chile Rest of South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Processed Meat Producers | 100 | Production Managers, Quality Control Supervisors |

| Retail Outlets | 120 | Store Managers, Meat Department Heads |

| Food Service Providers | 80 | Restaurant Owners, Catering Managers |

| Consumer Insights | 150 | Household Decision Makers, Health-Conscious Consumers |

| Distribution Channels | 70 | Logistics Coordinators, Supply Chain Analysts |

The South America processed meat market is valued at approximately USD 18 billion, reflecting a significant growth trend driven by increasing consumer demand for convenient and ready-to-eat food products, along with rising disposable incomes and urbanization across the region.