Region:Global

Author(s):Geetanshi

Product Code:KRAA2814

Pages:92

Published On:August 2025

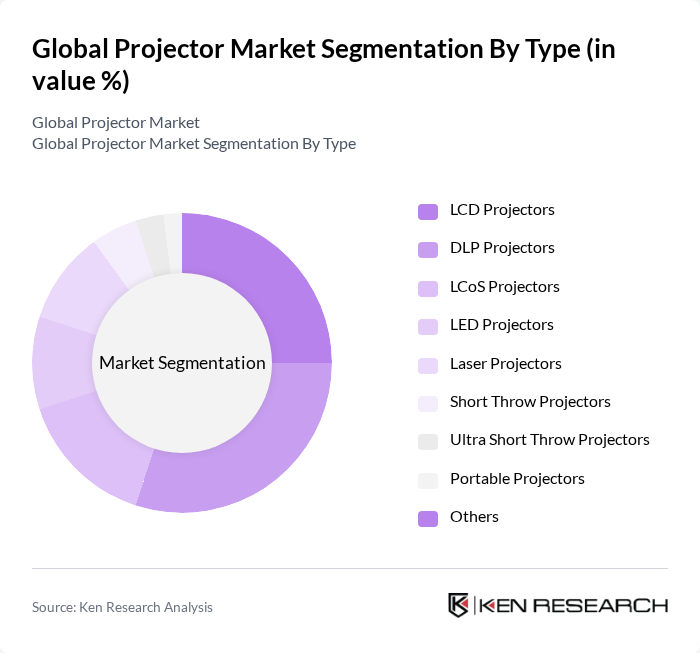

By Type:The projector market is segmented into LCD Projectors, DLP Projectors, LCoS Projectors, LED Projectors, Laser Projectors, Short Throw Projectors, Ultra Short Throw Projectors, Portable Projectors, and Others. LCD and DLP projectors remain the most widely adopted due to their balance of cost and image quality, while laser and LED projectors are gaining traction for their longevity and energy efficiency. Portable and short-throw models are increasingly popular in educational and small business environments for their flexibility and ease of installation.

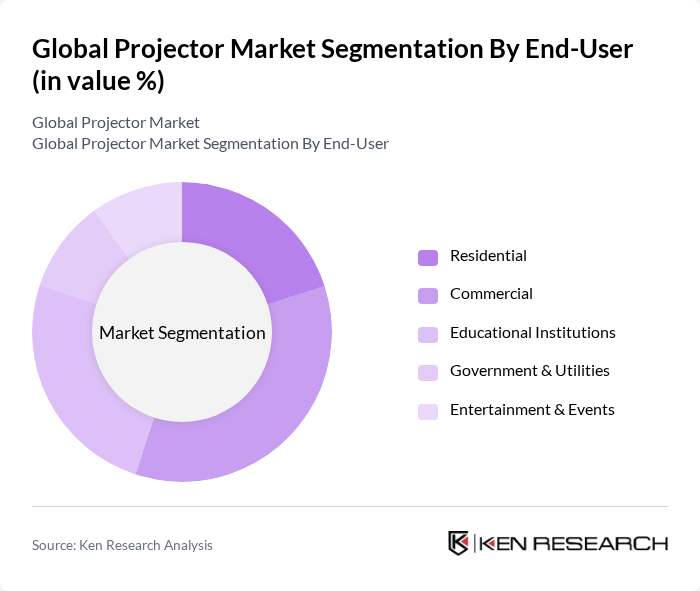

By End-User:The end-user segmentation comprises Residential, Commercial, Educational Institutions, Government & Utilities, and Entertainment & Events. Commercial and educational sectors continue to lead demand, driven by the need for effective presentation tools and interactive learning environments. The entertainment segment is also expanding, propelled by the popularity of home theaters and event-based projection solutions.

The Global Projector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epson America, Inc., BenQ Corporation, Sony Corporation, Panasonic Corporation, ViewSonic Corporation, NEC Display Solutions, Ltd., Optoma Technology, Inc., LG Electronics, Inc., Canon Inc., Dell Technologies Inc., Sharp Corporation, InFocus Corporation, Christie Digital Systems USA, Inc., Acer Inc., Ricoh Company, Ltd., Barco NV, Hitachi Digital Media Group, Xiaomi Corporation, Casio Computer Co., Ltd., Vivitek Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the projector market appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart technologies, such as IoT and AI, is expected to enhance user experiences significantly. Additionally, the growing trend of remote work and virtual collaboration will likely increase demand for portable and interactive projectors. As companies and educational institutions continue to prioritize effective communication and engagement, the projector market is poised for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | LCD Projectors DLP Projectors LCoS Projectors LED Projectors Laser Projectors Short Throw Projectors Ultra Short Throw Projectors Portable Projectors Others |

| By End-User | Residential Commercial Educational Institutions Government & Utilities Entertainment & Events |

| By Application | Home Theater Business Presentations Educational Purposes Event Management Gaming & Simulation |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Projectors Mid-Range Projectors Premium Projectors |

| By Technology | K Technology HD Technology Standard Definition Technology Interactive Technology Wireless Connectivity |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Sector Projector Usage | 100 | IT Managers, AV Coordinators |

| Educational Institutions Projector Adoption | 90 | School Administrators, IT Directors |

| Home Entertainment Projector Market | 60 | Home Theater Enthusiasts, Retail Sales Staff |

| Event Management and Rental Services | 50 | Event Planners, Rental Service Managers |

| AV Integration and Installation Services | 40 | AV Technicians, Project Managers |

The Global Projector Market is valued at approximately USD 13 billion, driven by increasing demand for high-quality visual displays across sectors such as education, corporate, and entertainment, particularly due to the rise in remote working and online learning.