Region:Asia

Author(s):Rebecca

Product Code:KRAC3970

Pages:83

Published On:October 2025

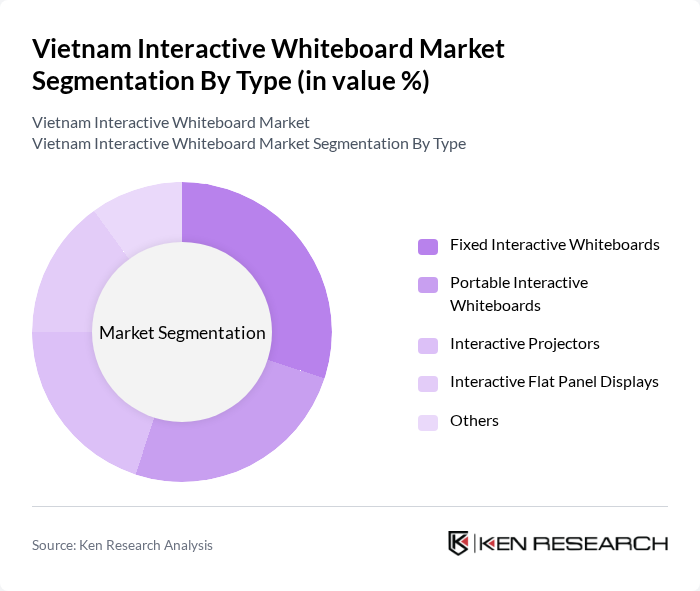

By Type:The market is segmented into Fixed Interactive Whiteboards, Portable Interactive Whiteboards, Interactive Projectors, Interactive Flat Panel Displays, and Others. Each type addresses distinct user needs and preferences, with fixed boards preferred for permanent installations in classrooms and conference rooms, portable boards offering flexibility for multi-room use, interactive projectors enabling touch-based collaboration on any surface, and flat panel displays providing advanced features such as 4K resolution and integrated software for enhanced interactivity.

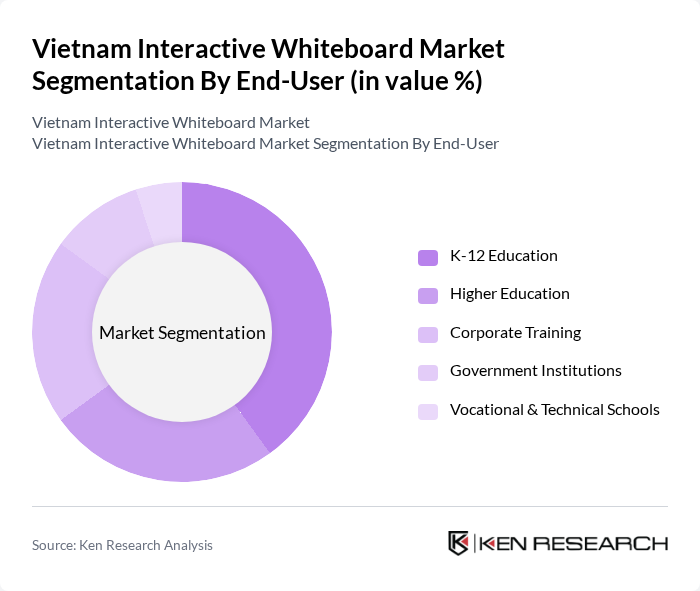

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Training, Government Institutions, and Vocational & Technical Schools. K-12 and higher education segments lead adoption due to government mandates and curriculum modernization, while corporate training and government institutions utilize interactive whiteboards for collaborative meetings and digital presentations. Vocational and technical schools increasingly leverage these tools for hands-on, skills-based instruction.

The Vietnam Interactive Whiteboard Market is characterized by a dynamic mix of regional and international players. Leading participants such as SMART Technologies ULC, Promethean Limited, Seiko Epson Corporation, BenQ Corporation, Hitachi, Ltd., Samsung Electronics Co., Ltd., LG Electronics Inc., Newline Interactive, Inc., ViewSonic Corporation, AVer Information Inc., Ricoh Company, Ltd., Panasonic Corporation, Cisco Systems, Inc., Microsoft Corporation, Google LLC, Boxlight Corporation, Vietnet Distribution JSC, FPT Corporation, Edusmart Vietnam, Polycom Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam interactive whiteboard market appears promising, driven by ongoing government support and increasing investments in educational technology. As schools continue to embrace hybrid learning models, the demand for interactive whiteboards is expected to rise. Furthermore, the integration of gamification and cloud-based solutions into educational practices will enhance user engagement and accessibility, paving the way for a more interactive and effective learning environment in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Interactive Whiteboards Portable Interactive Whiteboards Interactive Projectors Interactive Flat Panel Displays Others |

| By End-User | K-12 Education Higher Education Corporate Training Government Institutions Vocational & Technical Schools |

| By Application | Classroom Learning Business Presentations Remote Learning Collaborative Workspaces Others |

| By Sales Channel | Direct Sales Online Retail Distributors/Resellers System Integrators Others |

| By Distribution Mode | Retail Stores E-commerce Platforms Direct B2B Sales Tender-Based Procurement Others |

| By Price Range | Low-End Mid-Range High-End |

| By Policy Support | Government Subsidies Tax Incentives Grants for Educational Technology Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Primary Education Institutions | 100 | School Principals, IT Coordinators |

| Secondary Education Institutions | 80 | Teachers, Curriculum Developers |

| Tertiary Education Institutions | 60 | University Administrators, Faculty Members |

| Government Education Departments | 40 | Policy Makers, Educational Planners |

| EdTech Solution Providers | 50 | Product Managers, Sales Directors |

The Vietnam Interactive Whiteboard Market is valued at approximately USD 120 million, reflecting significant growth driven by the increasing adoption of technology in education and government initiatives aimed at enhancing digital learning environments.