Region:Global

Author(s):Shubham

Product Code:KRAA1777

Pages:80

Published On:August 2025

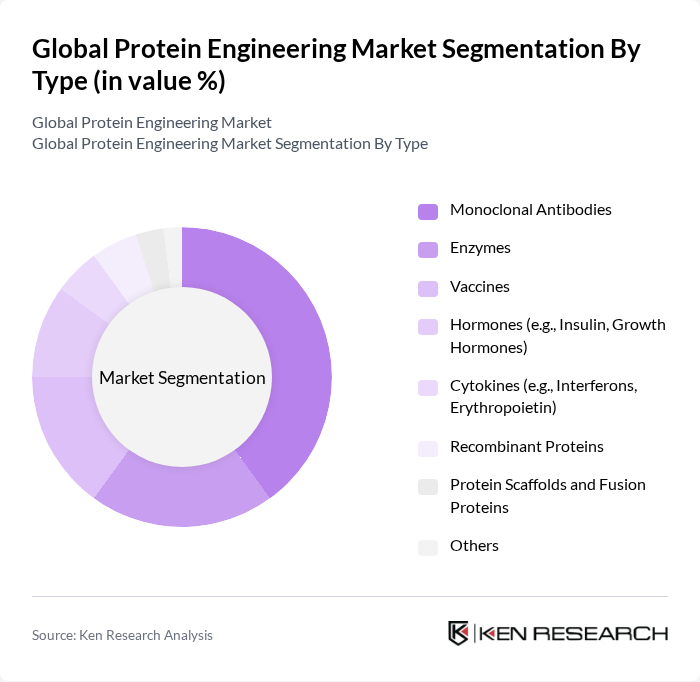

By Type:The protein engineering market is segmented into various types, including Monoclonal Antibodies, Enzymes, Vaccines, Hormones, Cytokines, Recombinant Proteins, Protein Scaffolds and Fusion Proteins, and Others. Among these, Monoclonal Antibodies are leading the market due to their widespread application in therapeutics, particularly in oncology and autoimmune diseases. The increasing prevalence of these conditions and continued innovation in antibody formats (e.g., bispecifics, antibody–drug conjugates) drive demand for targeted therapies, making monoclonal antibodies a preferred choice for both healthcare providers and patients.

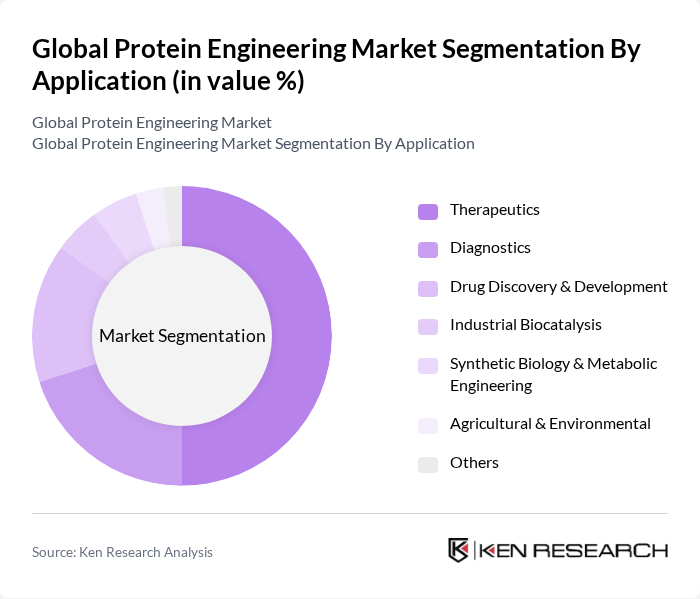

By Application:The applications of protein engineering include Therapeutics, Diagnostics, Drug Discovery & Development, Industrial Biocatalysis, Synthetic Biology & Metabolic Engineering, Agricultural & Environmental, and Others. Therapeutics is the dominant application segment, driven by the increasing demand for biologics and personalized medicine; AI-driven protein design and improved expression systems are enhancing discovery speed and manufacturability, reinforcing therapeutics leadership.

The Global Protein Engineering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Genentech, Inc. (a member of the Roche Group), Merck KGaA (MilliporeSigma), Thermo Fisher Scientific Inc., Ginkgo Bioworks Holdings, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Novozymes A/S (Novonesis), Takara Bio Inc., Abcam plc, Charles River Laboratories International, Inc., Eppendorf SE, Merck & Co., Inc. (MSD), Danaher Corporation (Cytiva & Beckman Coulter Life Sciences), GenScript Biotech Corporation, Bruker Corporation, Codexis, Inc., Twist Bioscience Corporation, WuXi AppTec Co., Ltd., Sartorius AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the protein engineering market appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence in protein design is expected to enhance efficiency and accuracy, while the shift towards sustainable practices will likely reshape production methods. Additionally, the focus on precision medicine will create tailored therapeutic solutions, further expanding the market. As these trends evolve, they will foster a dynamic environment for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Enzymes Vaccines Hormones (e.g., Insulin, Growth Hormones) Cytokines (e.g., Interferons, Erythropoietin) Recombinant Proteins Protein Scaffolds and Fusion Proteins Others |

| By Application | Therapeutics Diagnostics Drug Discovery & Development Industrial Biocatalysis Synthetic Biology & Metabolic Engineering Agricultural & Environmental Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic & Research Institutions Contract Research Organizations (CROs) Contract Development & Manufacturing Organizations (CDMOs) Government Research Labs Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Technology | Rational Design (Structure- and Computer-Aided) Directed Evolution (Library Generation & Screening) Recombinant DNA & Expression Systems CRISPR and Gene Editing-Enabled Engineering Protein Design & Simulation Software (AI/ML-enabled) High-Throughput Screening & Display Technologies (Phage/Yeast/Mammalian) Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Development | 120 | R&D Directors, Biotech Project Managers |

| Academic Research in Protein Engineering | 100 | University Professors, Research Scientists |

| Industrial Applications of Protein Engineering | 80 | Product Development Managers, Process Engineers |

| Regulatory Affairs in Biotechnology | 70 | Regulatory Affairs Specialists, Compliance Officers |

| Investment and Funding in Protein Engineering | 60 | Venture Capital Analysts, Biotechnology Investors |

The Global Protein Engineering Market is valued at approximately USD 5 billion, driven by advancements in biotechnology, increasing demand for therapeutic proteins, and significant investments in research and development.