Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9162

Pages:83

Published On:November 2025

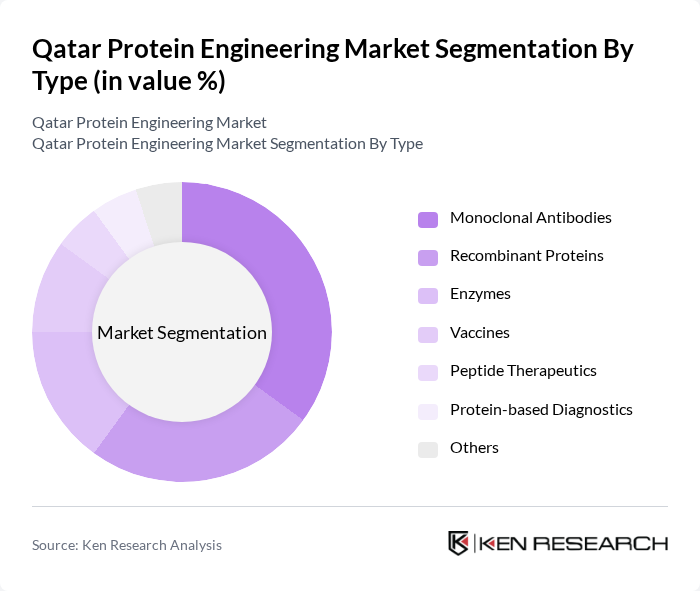

By Type:The protein engineering market can be segmented into various types, including monoclonal antibodies, recombinant proteins, enzymes, vaccines, peptide therapeutics, protein-based diagnostics, and others. Among these, monoclonal antibodies are leading the market due to their widespread application in therapeutic treatments and diagnostics, driven by increasing incidences of chronic diseases and advancements in antibody engineering technologies. Monoclonal antibodies account for approximately 25.7% of the global market share, manufactured through cell fusion techniques that provide high specificity and effectiveness with minimal side effects.

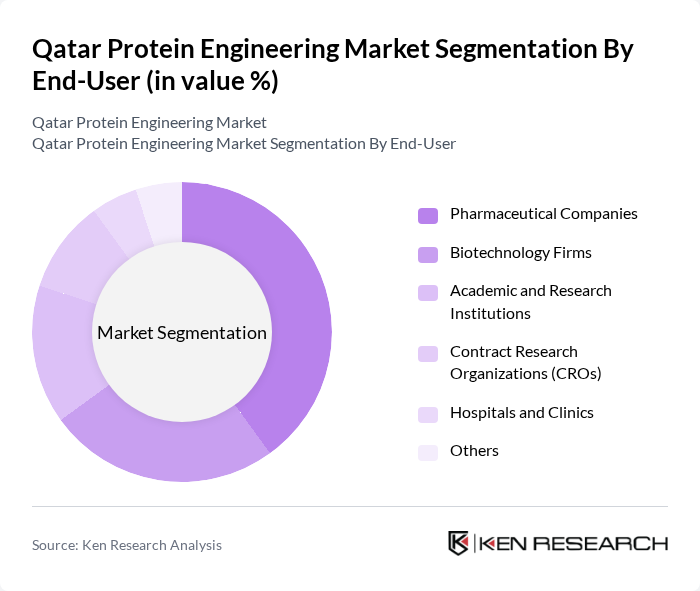

By End-User:The end-user segmentation includes pharmaceutical companies, biotechnology firms, academic and research institutions, contract research organizations (CROs), hospitals and clinics, and others. Pharmaceutical companies dominate this segment, driven by their extensive research and development capabilities and the increasing demand for innovative therapies, particularly in oncology and autoimmune diseases. Pharmaceutical and biotech firms constitute the largest end-user segment, accounting for approximately 45.6% of the global market share, owing to their extensive research investments and new product pipelines.

The Qatar Protein Engineering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Biomedical Research Institute (QBRI), Sidra Medicine, Qatar University – Biomedical Research Center, Doha Biotech, Qatar Science & Technology Park (QSTP), Hamad Bin Khalifa University (HBKU) – College of Health and Life Sciences, Qatar Foundation, Qatar National Research Fund (QNRF), Hamad Medical Corporation (HMC), Weill Cornell Medicine – Qatar, Thermo Fisher Scientific (Qatar operations), Merck KGaA (Qatar operations), GenScript Biotech (Qatar/MENA presence), Gulf Pharmaceutical Industries (Julphar), Qatar Protein Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the protein engineering market in Qatar appears promising, driven by ongoing advancements in biotechnology and increasing government support. As the demand for personalized medicine rises, companies are likely to focus on developing tailored therapeutic solutions. Furthermore, the integration of artificial intelligence in protein design is expected to streamline research processes, enhancing efficiency and innovation. These trends indicate a dynamic market landscape poised for significant growth in the coming years, fostering a robust environment for biopharmaceutical development.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Recombinant Proteins Enzymes Vaccines Peptide Therapeutics Protein-based Diagnostics Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Contract Research Organizations (CROs) Hospitals and Clinics Others |

| By Application | Therapeutics Diagnostics Research and Development Industrial Applications Agriculture & Food Others |

| By Technology | CRISPR/Cas9 Technology Synthetic Biology Directed Evolution Rational Protein Design Protein Purification Techniques Others |

| By Source | Animal-Derived Plant-Derived Microbial-Derived Cell-Free Expression Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biotechnology Firms | 60 | CEOs, R&D Directors |

| Academic Institutions | 50 | Professors, Research Scientists |

| Food Industry Stakeholders | 40 | Product Development Managers, Quality Assurance Heads |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| Investment Firms in Biotechnology | 40 | Investment Analysts, Portfolio Managers |

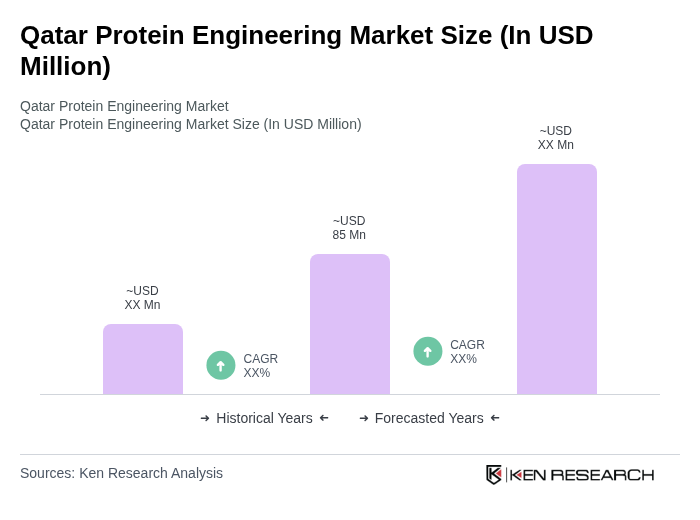

The Qatar Protein Engineering Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by advancements in biotechnology and increasing demand for therapeutic proteins.