Region:Global

Author(s):Dev

Product Code:KRAA1671

Pages:98

Published On:August 2025

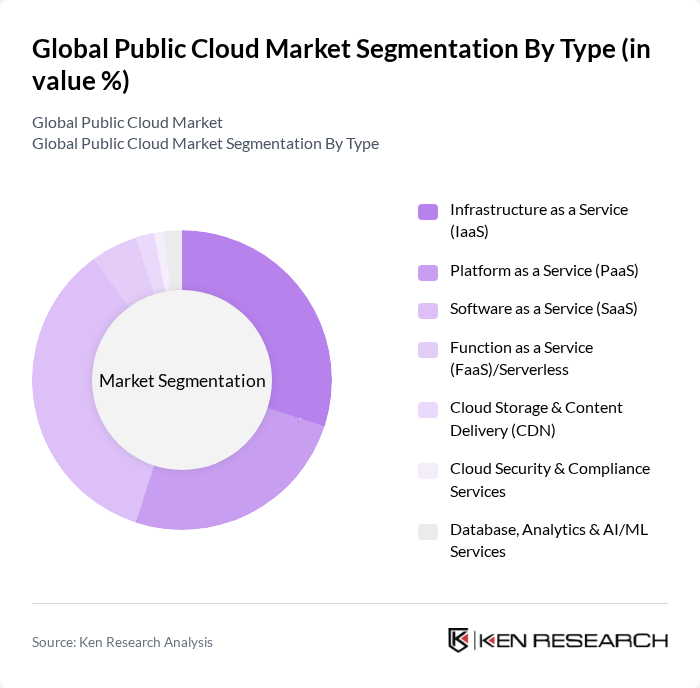

By Type:The Global Public Cloud Market can be segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Function as a Service (FaaS)/Serverless, Cloud Storage & Content Delivery (CDN), Cloud Security & Compliance Services, and Database, Analytics & AI/ML Services. Each of these segments plays a crucial role in meeting the diverse needs of businesses and organizations.

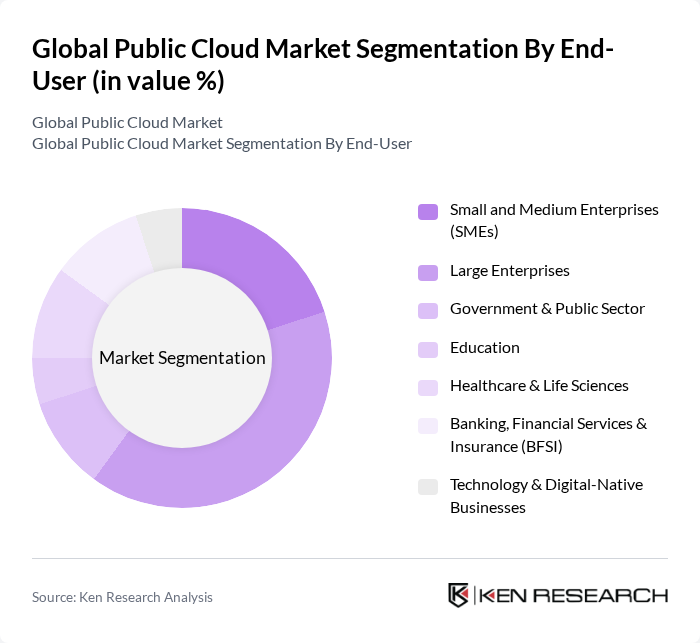

By End-User:The market can also be segmented by end-user categories, including Small and Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Education, Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), and Technology & Digital-Native Businesses. Each segment has unique requirements and drives demand for specific cloud services.

The Global Public Cloud Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc. (AWS), Microsoft Corporation (Azure), Google Cloud (Google LLC), IBM Cloud (International Business Machines Corporation), Oracle Cloud Infrastructure (OCI), Alibaba Cloud (Alibaba Group), Salesforce, Inc. (Salesforce Cloud), VMware by Broadcom (VMware Cloud), DigitalOcean Holdings, Inc., Rackspace Technology, Inc., SAP SE (SAP Business Technology Platform), Cisco Systems, Inc. (Cisco Cloud & Security), Tencent Cloud (Tencent Holdings Ltd.), Akamai Connected Cloud (Akamai Technologies, Inc.), OVHcloud (OVH Groupe SA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the public cloud market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt multi-cloud strategies, the demand for interoperability and seamless integration will rise. Additionally, sustainability initiatives will shape cloud service offerings, with providers focusing on energy-efficient solutions. The integration of AI and machine learning will further enhance cloud capabilities, enabling businesses to leverage data-driven insights for improved decision-making and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS)/Serverless Cloud Storage & Content Delivery (CDN) Cloud Security & Compliance Services Database, Analytics & AI/ML Services |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Education Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Technology & Digital-Native Businesses |

| By Industry Vertical | Information Technology & ITeS Retail & Consumer Goods Manufacturing Telecommunications Media & Entertainment Transportation & Logistics Energy & Utilities Others |

| By Deployment Pattern (Usage) | Single Public Cloud Multi-Cloud Hybrid (Public + Private) Edge & Distributed Cloud Sovereign/Region-Restricted Cloud |

| By Service Model (Ecosystem) | Managed Services (MSP/MSSP) Professional & Consulting Services Migration, Modernization & DevOps Services Support, Training & FinOps/Cost Optimization Marketplace & Third-Party ISV Services |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa China |

| By Pricing & Contract Model | Pay-as-you-go (On-Demand) Reserved/Committed Use (1–3 year) Spot/Preemptible Instances Subscription & Tiered Pricing Enterprise Agreements & Savings Plans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 120 | IT Managers, CTOs, CIOs |

| SMB Cloud Utilization | 100 | Business Owners, IT Consultants |

| Public Sector Cloud Implementation | 80 | Government IT Officials, Policy Makers |

| Cloud Security and Compliance | 70 | Security Officers, Compliance Managers |

| Cloud Service Provider Insights | 90 | Sales Directors, Product Managers |

The Global Public Cloud Market is valued at approximately USD 860 billion, reflecting significant growth driven by the increasing adoption of cloud services across various sectors, including businesses seeking scalability, flexibility, and cost efficiency.