Region:Global

Author(s):Dev

Product Code:KRAD0520

Pages:90

Published On:August 2025

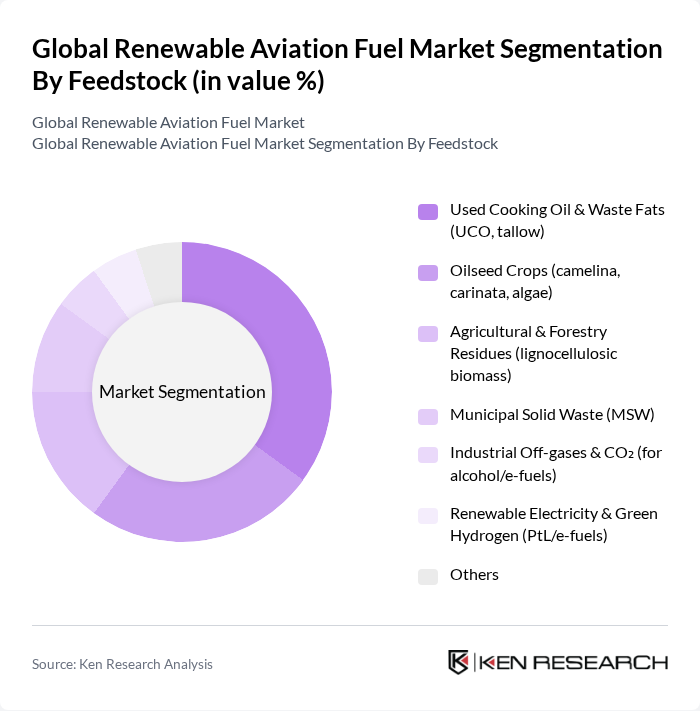

By Feedstock:The feedstock segment includes various sources used to produce renewable aviation fuel. The subsegments are Used Cooking Oil & Waste Fats (UCO, tallow), Oilseed Crops (camelina, carinata, algae), Agricultural & Forestry Residues (lignocellulosic biomass), Municipal Solid Waste (MSW), Industrial Off-gases & CO? (for alcohol/e-fuels), Renewable Electricity & Green Hydrogen (PtL/e-fuels), and Others. Among these, Used Cooking Oil & Waste Fats is currently the leading subsegment due to its availability and cost-effectiveness, making it a preferred choice for many producers.

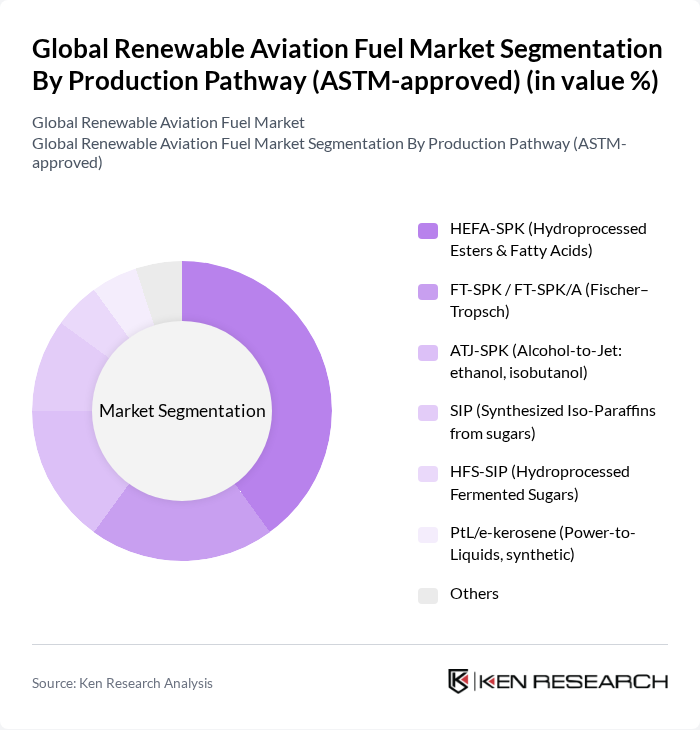

By Production Pathway (ASTM-approved):The production pathway segment encompasses various methods approved for producing renewable aviation fuel. The subsegments include HEFA-SPK (Hydroprocessed Esters & Fatty Acids), FT-SPK / FT-SPK/A (Fischer–Tropsch), ATJ-SPK (Alcohol-to-Jet: ethanol, isobutanol), SIP (Synthesized Iso-Paraffins from sugars), HFS-SIP (Hydroprocessed Fermented Sugars), PtL/e-kerosene (Power-to-Liquids, synthetic), and Others. The HEFA-SPK pathway is currently the most dominant due to its established technology and compatibility with existing aviation fuel infrastructure.

The Global Renewable Aviation Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neste Oyj, World Energy LLC, TotalEnergies SE, Shell plc (Shell Aviation), BP p.l.c. (Air bp), Honeywell UOP, Chevron Renewable Energy Group, LanzaTech Global, Inc., LanzaJet, Inc., Gevo, Inc., Fulcrum BioEnergy, Inc., Aemetis, Inc., Velocys plc, SkyNRG, Virent, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable aviation fuel market appears promising, driven by increasing regulatory pressures and a collective commitment to sustainability within the aviation industry. As airlines and governments collaborate to meet emission reduction targets, the market is expected to witness significant growth. Innovations in fuel production technology and infrastructure development will play a crucial role in overcoming existing challenges, paving the way for broader adoption of sustainable aviation fuels and enhancing their market presence in future.

| Segment | Sub-Segments |

|---|---|

| By Feedstock | Used Cooking Oil & Waste Fats (UCO, tallow) Oilseed Crops (camelina, carinata, algae) Agricultural & Forestry Residues (lignocellulosic biomass) Municipal Solid Waste (MSW) Industrial Off-gases & CO? (for alcohol/e-fuels) Renewable Electricity & Green Hydrogen (PtL/e-fuels) Others |

| By Production Pathway (ASTM-approved) | HEFA-SPK (Hydroprocessed Esters & Fatty Acids) FT-SPK / FT-SPK/A (Fischer–Tropsch) ATJ-SPK (Alcohol-to-Jet: ethanol, isobutanol) SIP (Synthesized Iso-Paraffins from sugars) HFS-SIP (Hydroprocessed Fermented Sugars) PtL/e-kerosene (Power-to-Liquids, synthetic) Others |

| By Blending Capacity | Up to 10% blend %–30% blend %–50% blend Above 50% (neat trials/specific approvals) |

| By Application | Commercial Aircraft Business & General Aviation Defense/Military Aircraft Unmanned Aerial Vehicles (UAVs) |

| By Distribution Channel | Direct Offtake with Airlines Through Fuel Suppliers/Into-Plane Operators Airport Hydrant & Storage Systems |

| By Policy Mechanism | Blending Mandates & Quotas Tax Credits & Incentives (e.g., IRA, ReFuelEU) Carbon Pricing & Credit Schemes (CORSIA, ETS) Offsetting/Book-and-Claim Programs |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Adoption | 140 | Fleet Managers, Sustainability Officers |

| Fuel Suppliers and Producers | 100 | Business Development Managers, Technical Directors |

| Regulatory Bodies and Policy Makers | 80 | Government Officials, Environmental Analysts |

| Aviation Industry Associations | 70 | Executive Directors, Research Analysts |

| Research Institutions and Academia | 60 | Lead Researchers, Professors in Sustainable Energy |

The Global Renewable Aviation Fuel Market is valued at approximately USD 1.41.5 billion, reflecting the scale of sustainable aviation fuel sales and production capacity, driven by environmental regulations and advancements in fuel production technologies.