Region:Middle East

Author(s):Shubham

Product Code:KRAB5066

Pages:97

Published On:October 2025

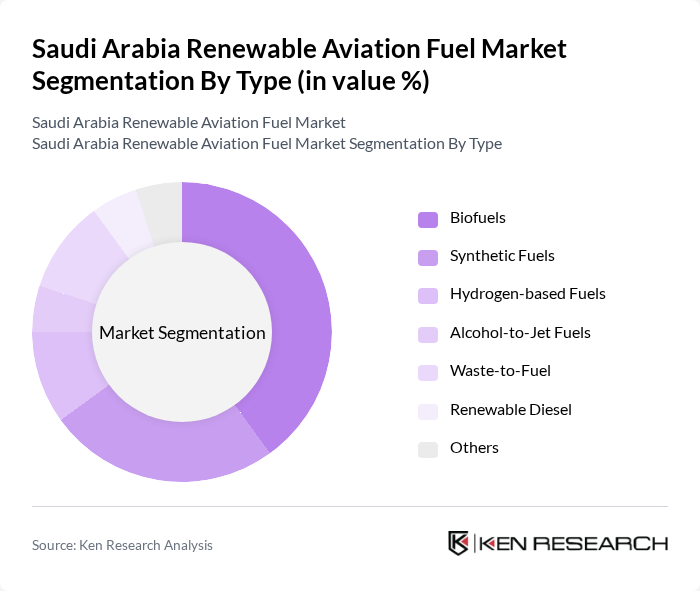

By Type:The market is segmented into various types of renewable aviation fuels, including Biofuels, Synthetic Fuels, Hydrogen-based Fuels, Alcohol-to-Jet Fuels, Waste-to-Fuel, Renewable Diesel, and Others. Among these, Biofuels are currently the leading subsegment due to their established production processes and compatibility with existing aviation infrastructure. The increasing focus on sustainability and the reduction of carbon footprints are driving airlines to adopt biofuels as a viable alternative to conventional jet fuels.

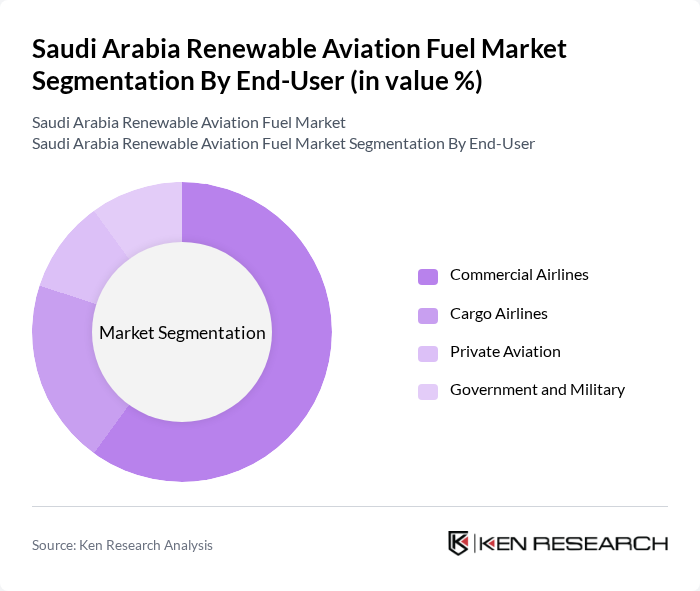

By End-User:The end-user segmentation includes Commercial Airlines, Cargo Airlines, Private Aviation, and Government and Military. Commercial Airlines dominate this segment, driven by the high volume of passenger traffic and the increasing pressure to adopt sustainable practices. The shift towards renewable aviation fuels is being accelerated by consumer demand for greener travel options and regulatory requirements aimed at reducing emissions.

The Saudi Arabia Renewable Aviation Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Oil Company (Saudi Aramco), SABIC, Air Products and Chemicals, Inc., Neste Corporation, LanzaTech, Gevo, Inc., TotalEnergies SE, World Energy, Velocys, Aemetis, Inc., Green Plains Inc., Renewable Energy Group, Inc., Fulcrum BioEnergy, Inc., Biochemtex S.p.A., Climeworks AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable aviation fuel market in Saudi Arabia appears promising, driven by increasing government support and technological advancements. By future, the country aims to have established several local production facilities, enhancing fuel availability. Additionally, as global pressure to reduce carbon emissions intensifies, Saudi Arabia's commitment to sustainable aviation solutions will likely attract international partnerships, fostering innovation and investment in the sector, ultimately leading to a more sustainable aviation landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Biofuels Synthetic Fuels Hydrogen-based Fuels Alcohol-to-Jet Fuels Waste-to-Fuel Renewable Diesel Others |

| By End-User | Commercial Airlines Cargo Airlines Private Aviation Government and Military |

| By Application | Domestic Flights International Flights Charter Services Cargo Transport |

| By Distribution Channel | Direct Sales to Airlines Partnerships with Fuel Suppliers B2B Sales Others |

| By Investment Source | Private Investments Government Funding International Grants Joint Ventures |

| By Policy Support | Subsidies for Renewable Fuels Tax Incentives Research Grants Regulatory Support |

| By Technology | Fischer-Tropsch Synthesis Hydroprocessing Alcohol-to-Jet Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Fuel Procurement | 100 | Fuel Managers, Procurement Officers |

| Renewable Fuel Producers | 80 | Production Managers, R&D Heads |

| Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Aviation Industry Associations | 60 | Association Executives, Industry Analysts |

| Technology Providers for Renewable Fuels | 70 | Technical Directors, Business Development Managers |

The Saudi Arabia Renewable Aviation Fuel Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for sustainable aviation fuels and government initiatives aimed at reducing carbon emissions in the aviation sector.