Region:Global

Author(s):Shubham

Product Code:KRAA2667

Pages:80

Published On:August 2025

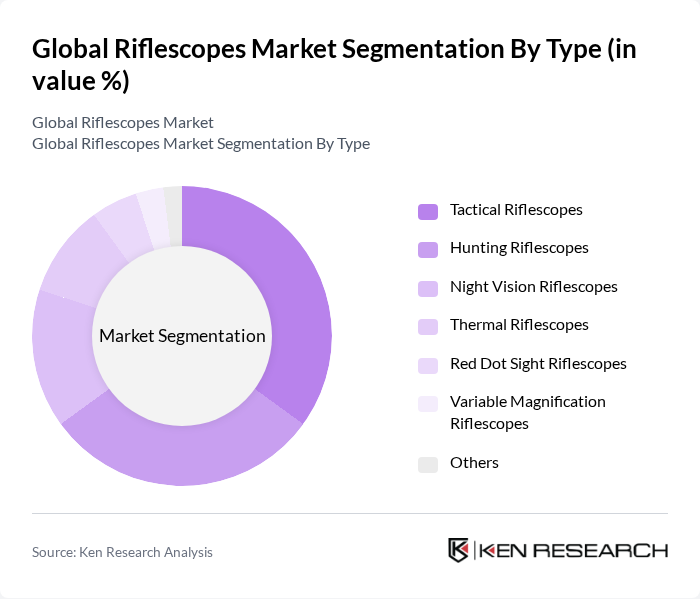

By Type:The market is segmented into various types of riflescopes, including Tactical Riflescopes, Hunting Riflescopes, Night Vision Riflescopes, Thermal Riflescopes, Red Dot Sight Riflescopes, Variable Magnification Riflescopes, and Others. Among these, Tactical Riflescopes are currently leading the market due to their extensive use in military and law enforcement applications, where precision, durability, and adaptability are critical. The demand for advanced features such as illuminated reticles, ballistic calculators, and ruggedized construction drives consumers towards these high-performance scopes. Hunting Riflescopes also hold a significant share, fueled by the growing popularity of hunting as a recreational activity and the increasing adoption of variable magnification and low-light performance technologies .

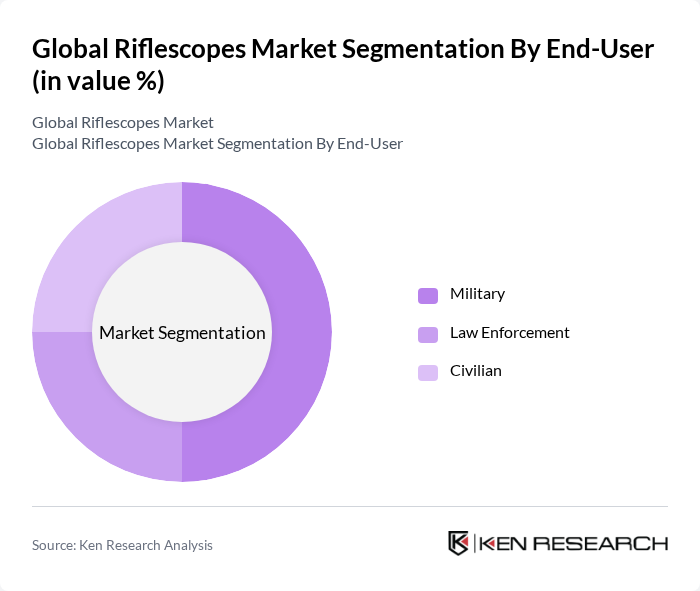

By End-User:The end-user segmentation includes Military, Law Enforcement, and Civilian sectors. The Military segment dominates the market, driven by increasing defense budgets, modernization programs, and the need for advanced optical equipment in combat scenarios. Law Enforcement agencies also contribute significantly, as they require reliable optics for tactical operations and public safety missions. The Civilian segment is growing steadily, fueled by the rising interest in hunting, competitive shooting, and recreational marksmanship among the general public .

The Global Riflescopes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Leupold & Stevens, Inc., Vortex Optics, Nikon Corporation, Bushnell Corporation, Trijicon, Inc., Carl Zeiss AG, Swarovski Optik, Burris Company, Inc., Athlon Optics, Primary Arms LLC, Nightforce Optics, Sig Sauer, Inc., Aimpoint AB, Hawke Optics, Steiner Optik GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the riflescopes market appears promising, driven by technological advancements and a growing consumer base. As digital integration becomes more prevalent, manufacturers are likely to focus on developing smart riflescopes that offer enhanced features. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential. These regions are witnessing an increase in outdoor activities, which will further stimulate demand for high-quality riflescopes.

| Segment | Sub-Segments |

|---|---|

| By Type | Tactical Riflescopes Hunting Riflescopes Night Vision Riflescopes Thermal Riflescopes Red Dot Sight Riflescopes Variable Magnification Riflescopes Others |

| By End-User | Military Law Enforcement Civilian |

| By Application | Hunting Competitive Shooting Tactical Operations Wildlife Observation |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Direct Sales |

| By Price Range | Low-End Riflescopes Mid-Range Riflescopes High-End Riflescopes |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Brand | Premium Brands Mid-Tier Brands Budget Brands |

| By Function | Day Sights Night Sights |

| By Range | Short Range (50 to 100 Yards) Medium Range (100 to 500 Yards) Long Range (>500 Yards) |

| By Sight Type | Telescopic Reflex |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Riflescopes | 80 | Store Managers, Sales Representatives |

| Manufacturing Insights | 60 | Production Managers, Quality Control Engineers |

| Consumer Preferences in Hunting | 70 | Hunting Enthusiasts, Outdoor Sports Participants |

| Military and Law Enforcement Procurement | 40 | Procurement Officers, Tactical Equipment Specialists |

| Market Trends in Shooting Sports | 50 | Competitive Shooters, Shooting Range Operators |

The Global Riflescopes Market is valued at approximately USD 7 billion, reflecting a significant growth driven by advancements in optical technology and increasing demand for precision shooting in military and civilian sectors.