Region:Middle East

Author(s):Rebecca

Product Code:KRAD2717

Pages:84

Published On:November 2025

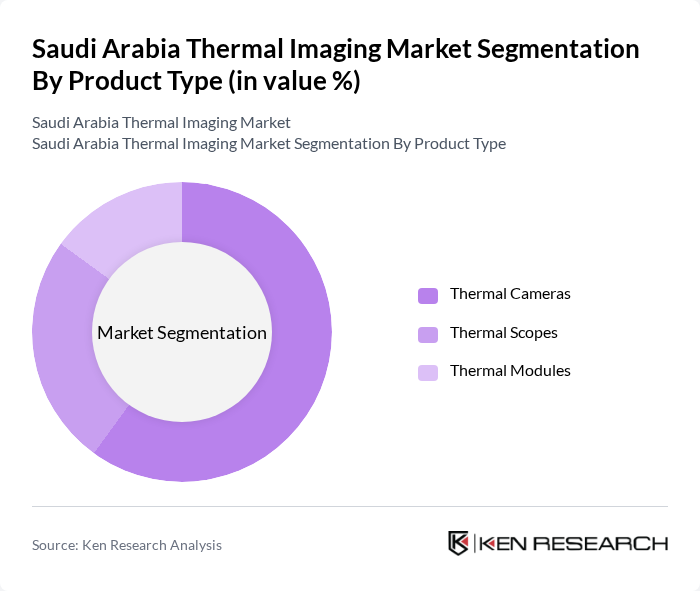

By Product Type:The product type segmentation includes Thermal Cameras, Thermal Scopes, and Thermal Modules. Among these, Thermal Cameras are the most widely used due to their versatility and effectiveness in various applications, including security and surveillance, monitoring, and inspection. The increasing need for high-resolution imaging and advanced features in security applications drives the demand for thermal cameras, making them the leading sub-segment in the market.

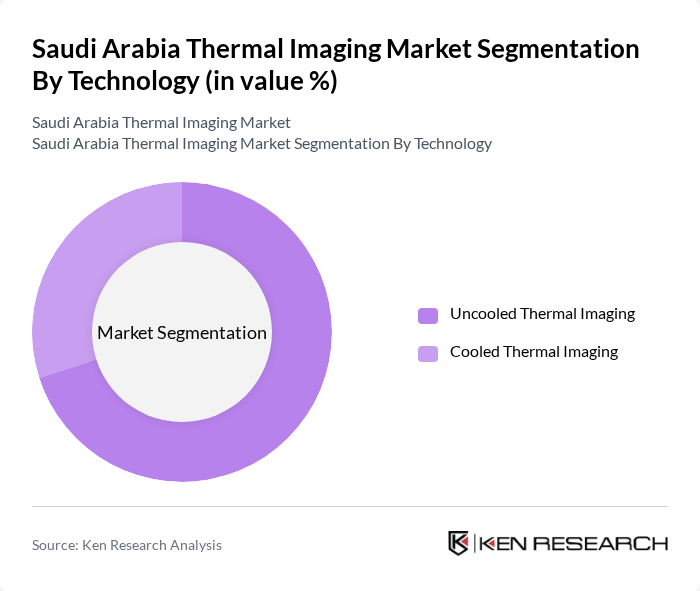

By Technology:The technology segmentation consists of Uncooled Thermal Imaging and Cooled Thermal Imaging. Uncooled Thermal Imaging is the dominant technology due to its lower cost, compact size, and ease of use, making it suitable for a wide range of applications, including security and surveillance. The growing demand for portable and cost-effective thermal imaging solutions further solidifies the position of uncooled thermal imaging as the leading sub-segment in the market.

The Saudi Arabia Thermal Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as FLIR Systems, Inc., Testo SE & Co. KGaA, Raytheon Technologies Corporation, L3Harris Technologies, Inc., Opgal Optronic Industries Ltd., Seek Thermal, Inc., Infrared Cameras Inc., AMETEK, Inc., Fluke Corporation, BAE Systems plc, Hikvision Digital Technology Co., Ltd., Axis Communications AB, Dali Technology Co., Ltd., Thermoteknix Systems Ltd., and Elbit Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermal imaging market in Saudi Arabia appears promising, driven by ongoing technological advancements and increasing government support for smart city initiatives. As the nation invests in infrastructure and security, the integration of thermal imaging systems is expected to become more prevalent across various sectors. Additionally, the growing focus on healthcare diagnostics and industrial applications will further enhance market dynamics, creating a robust environment for innovation and investment in thermal imaging technologies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Thermal Cameras Thermal Scopes Thermal Modules |

| By Technology | Uncooled Thermal Imaging Cooled Thermal Imaging |

| By Wavelength | Long-wave Infrared (LWIR) Mid-wave Infrared (MWIR) Short-wave Infrared (SWIR) |

| By Application | Security & Surveillance Monitoring & Inspection Detection & Measurement Search & Rescue Thermography |

| By End-User Industry | Aerospace & Defense Oil & Gas Healthcare and Life Sciences Automotive Manufacturing Law Enforcement Others |

| By Focusing Mechanism | Manual Focus Automatic Focus |

| By Resolution | x 240 x 480 Higher Resolution (>640 x 480) |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Applications | 60 | Medical Device Managers, Radiologists |

| Industrial Applications | 50 | Facility Managers, Safety Officers |

| Military and Defense | 40 | Defense Procurement Officers, Technology Specialists |

| Construction and Building Inspection | 45 | Construction Managers, Building Inspectors |

| Research and Development | 40 | R&D Managers, Product Development Engineers |

The Saudi Arabia Thermal Imaging Market is valued at approximately USD 1.1 billion, driven by increasing demand for advanced surveillance systems and investments in defense and security, as well as the adoption of thermal imaging technology across various industries.