Region:Global

Author(s):Dev

Product Code:KRAA3041

Pages:84

Published On:August 2025

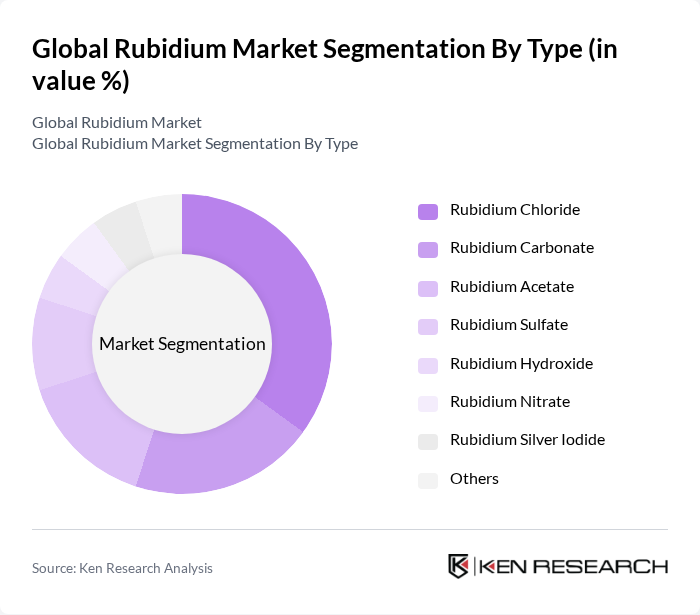

By Type:The rubidium market is segmented into various types, including Rubidium Chloride, Rubidium Carbonate, Rubidium Acetate, Rubidium Sulfate, Rubidium Hydroxide, Rubidium Nitrate, Rubidium Silver Iodide, and Others. Among these, Rubidium Chloride is the leading subsegment due to its extensive use in the production of atomic clocks and other electronic devices. The demand for Rubidium Chloride is driven by its critical role in precision timing applications, which are essential in telecommunications and GPS technologies .

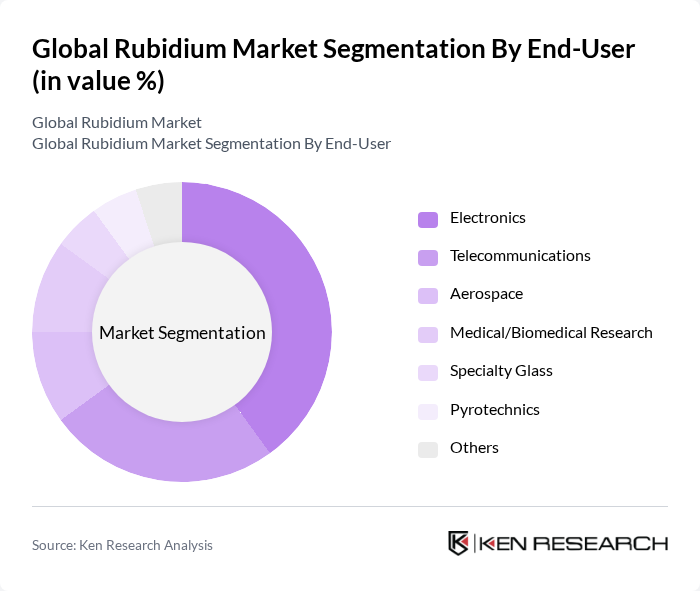

By End-User:The rubidium market is also segmented by end-user applications, including Electronics, Telecommunications, Aerospace, Medical/Biomedical Research, Specialty Glass, Pyrotechnics, and Others. The Electronics sector dominates this market segment, driven by the increasing demand for high-precision components in consumer electronics and communication devices. The rapid advancement in technology and the growing reliance on electronic devices in everyday life have significantly boosted the demand for rubidium in this sector .

The Global Rubidium Market is characterized by a dynamic mix of regional and international players. Leading participants such as American Elements, Merck KGaA (Sigma-Aldrich), GfE Metalle und Materialien GmbH, LANHIT, Ganfeng Lithium Group Co., Ltd., ESPI Metals Inc., Inorganic Ventures Inc., Lepidico Ltd., Otto Chemie Pvt. Ltd., Sinomine Resource Group Co. Ltd., Hunan Nonferrous Metals Group Co., Ltd., Jiangxi Special Electric Motor Co., Ltd., Shanghai Huayi Group Corporation, Chengdu Chemical Co., Ltd., Beijing Zhongke Yuantong Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rubidium market appears promising, driven by technological advancements and increasing applications across various sectors. As industries continue to innovate, particularly in electronics and quantum computing, the demand for high-purity rubidium is expected to rise. Furthermore, the integration of sustainable practices in production methods will likely enhance market resilience. Companies that adapt to these trends and invest in R&D will be well-positioned to capitalize on emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rubidium Chloride Rubidium Carbonate Rubidium Acetate Rubidium Sulfate Rubidium Hydroxide Rubidium Nitrate Rubidium Silver Iodide Others |

| By End-User | Electronics Telecommunications Aerospace Medical/Biomedical Research Specialty Glass Pyrotechnics Others |

| By Application | Atomic Clocks Photovoltaics/Solar Cells Medical Imaging Research and Development Specialty Glass Manufacturing Pyrotechnics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America United States Canada Mexico Europe United Kingdom Germany France Italy Spain Russia Benelux Nordics Rest of Europe Asia-Pacific China India Japan South Korea ASEAN Oceania Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East & Africa Turkey Israel GCC North Africa South Africa Rest of Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Product Form | Solid Liquid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing | 60 | Product Managers, Supply Chain Analysts |

| Medical Device Production | 50 | Quality Assurance Managers, R&D Directors |

| Research Institutions | 40 | Lead Researchers, Lab Managers |

| Specialty Chemical Suppliers | 45 | Sales Directors, Market Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Rubidium Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing demand in sectors such as biomedical research, telecommunications, and specialty glass.