Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8288

Pages:82

Published On:November 2025

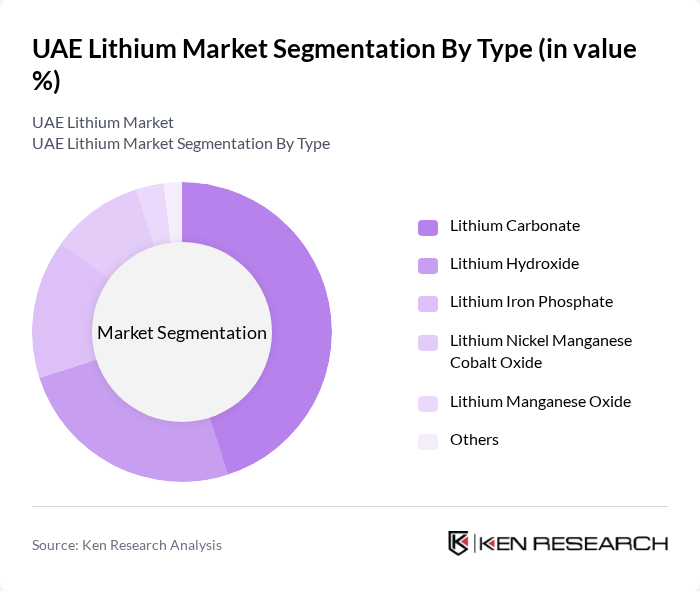

By Type:The lithium market can be segmented into various types, including Lithium Carbonate, Lithium Hydroxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Lithium Manganese Oxide, and Others. Among these,Lithium Carbonateremains the most dominant sub-segment due to its extensive use in battery production for electric vehicles and consumer electronics. The increasing adoption of EVs and grid-scale energy storage in the UAE has significantly boosted demand for Lithium Carbonate, making it a key driver in the market .

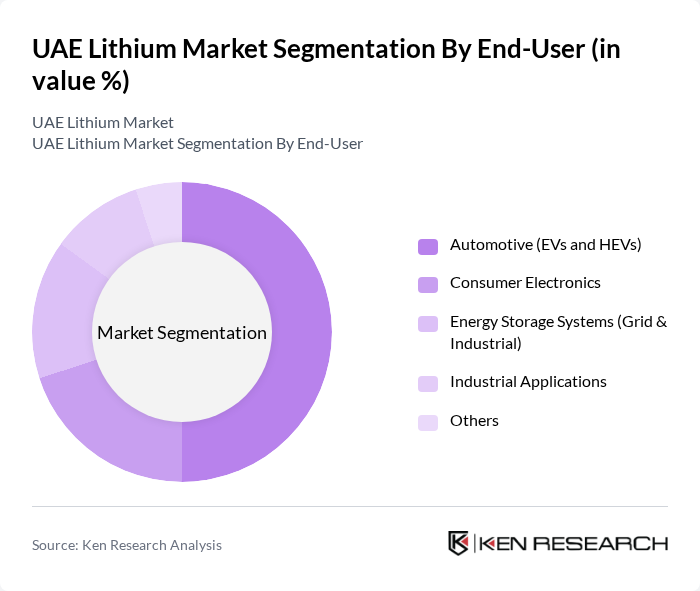

By End-User:The end-user segmentation includes Automotive (EVs and HEVs), Consumer Electronics, Energy Storage Systems (Grid & Industrial), Industrial Applications, and Others. TheAutomotive sector, particularly electric vehicles, is the leading end-user of lithium, driven by the global shift towards sustainable transportation. The UAE’s rapid EV adoption and government-backed initiatives for clean mobility have led to a surge in lithium demand, making it a critical component for battery manufacturers and integrators .

The UAE Lithium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, SQM (Sociedad Química y Minera de Chile S.A.), Livent Corporation, Ganfeng Lithium Co., Ltd., Tianqi Lithium Industries, Inc., Orocobre Limited (now Allkem Limited), Galaxy Resources Limited (now part of Allkem Limited), Nemaska Lithium Inc., Piedmont Lithium Inc., Lithium Americas Corp., American Battery Technology Company, Titan Lithium (UAE), KEZAD Group (Abu Dhabi, UAE – lithium processing), Emirates Global Aluminium (EGA) – Battery Materials Division, Sayona Mining Limited contribute to innovation, geographic expansion, and service delivery in this space.

The UAE lithium market is poised for significant transformation as the demand for electric vehicles and renewable energy storage solutions continues to rise. With government initiatives promoting sustainable development and substantial investments in green technologies, the market is expected to evolve rapidly. However, challenges such as supply chain disruptions and environmental regulations may impact growth. Overall, the UAE's strategic focus on lithium production and processing will likely position it as a key player in the global lithium landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium Carbonate Lithium Hydroxide Lithium Iron Phosphate Lithium Nickel Manganese Cobalt Oxide Lithium Manganese Oxide Others |

| By End-User | Automotive (EVs and HEVs) Consumer Electronics Energy Storage Systems (Grid & Industrial) Industrial Applications Others |

| By Application | Batteries (Primary & Secondary) Pharmaceuticals Grease and Lubricants Glass & Ceramics Air Treatment Others |

| By Source | Hard Rock Mining (Imported) Brine Extraction (Imported) Recycled Lithium Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Abu Dhabi Dubai Sharjah Others |

| By Policy Support | Subsidies Tax Incentives Grants for Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Lithium Extraction Companies | 60 | CEOs, Operations Managers, Environmental Compliance Officers |

| Battery Manufacturers | 50 | Production Managers, R&D Directors, Supply Chain Analysts |

| Electric Vehicle Producers | 40 | Product Development Managers, Procurement Officers, Marketing Heads |

| Regulatory Bodies | 40 | Policy Makers, Environmental Analysts, Industry Regulators |

| Industry Associations | 40 | Executive Directors, Research Analysts, Advocacy Managers |

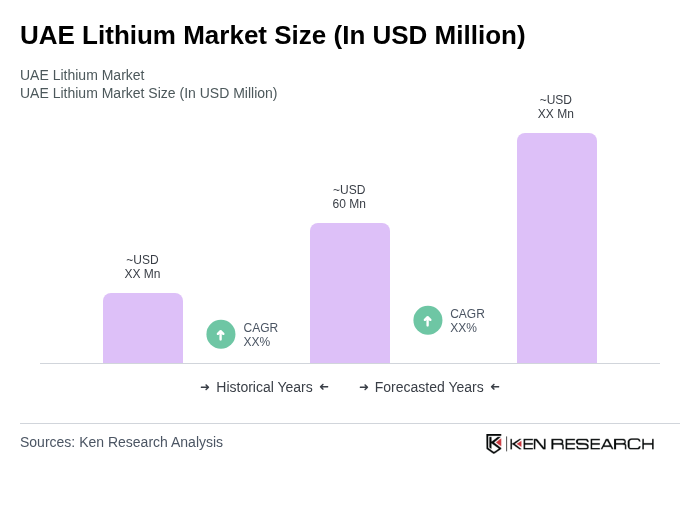

The UAE Lithium Market is valued at approximately USD 60 million, driven by the increasing demand for electric vehicles and energy storage solutions, as well as strategic initiatives to diversify the economy away from oil dependency.