Global Sealants Market Overview

- The Global Sealants Market is valued at USD 16.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for sealants in the construction and automotive industries, as well as the rising need for energy-efficient and sustainable building materials. The market is also influenced by technological advancements in sealant formulations, which enhance performance and application versatility. Key growth trends include the shift from mechanical fasteners to sealant solutions, rapid expansion in infrastructure projects, and the adoption of lightweight and electric vehicles in the automotive sector. Additionally, the growing electronics sector and renewable energy initiatives are further supporting market demand .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust manufacturing capabilities, extensive construction activities, and significant automotive production. The presence of major companies and a strong distribution network further contribute to their market leadership, making these regions critical hubs for sealant production and innovation. The Asia-Pacific region, led by China, is the largest and fastest-growing market, driven by urbanization, infrastructure development, and industrial manufacturing .

- In 2023, the European Union implemented regulations aimed at reducing volatile organic compounds (VOCs) in sealants and adhesives. This regulation mandates that all sealant products must comply with strict VOC limits, promoting the use of eco-friendly materials and encouraging manufacturers to innovate towards greener alternatives .

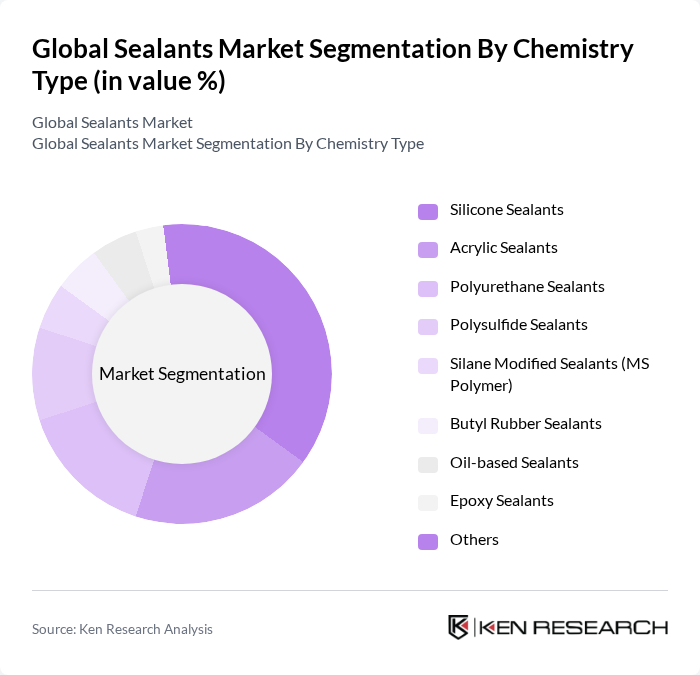

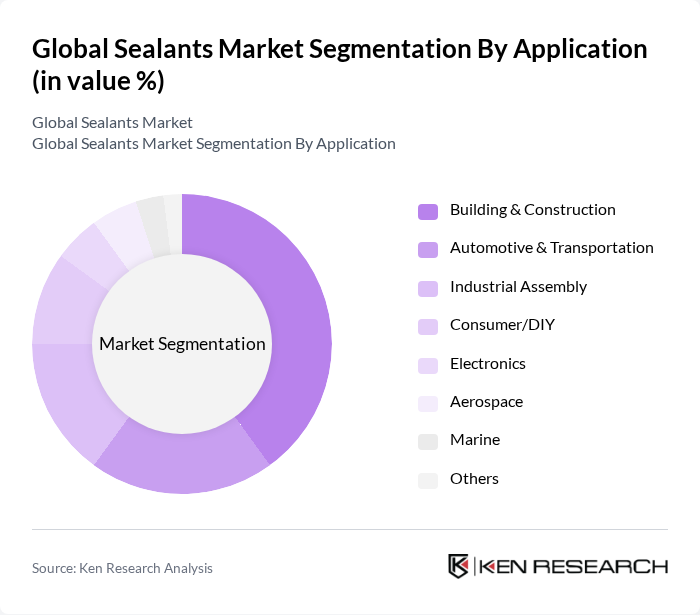

Global Sealants Market Segmentation

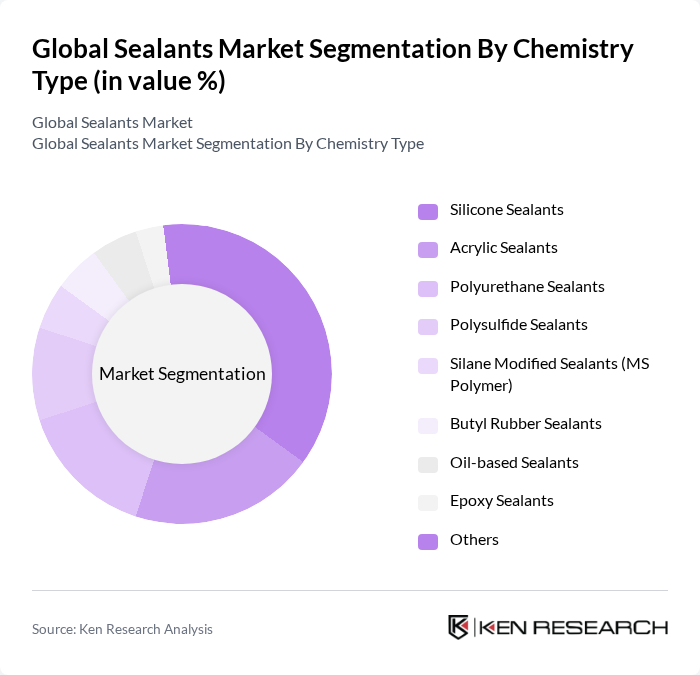

By Chemistry Type:The chemistry type segmentation includes various subsegments such as Silicone Sealants, Acrylic Sealants, Polyurethane Sealants, Polysulfide Sealants, Silane Modified Sealants (MS Polymer), Butyl Rubber Sealants, Oil-based Sealants, Epoxy Sealants, and Others. Among these, Silicone Sealants are leading the market due to their excellent adhesion, flexibility, and resistance to extreme temperatures, making them ideal for a wide range of applications. The demand for silicone sealants is further supported by their durability and suitability for both interior and exterior environments, especially in construction, automotive, and electronics sectors .

By Application:The application segmentation encompasses Building & Construction, Automotive & Transportation, Industrial Assembly, Consumer/DIY, Electronics, Aerospace, Marine, and Others. The Building & Construction sector is the dominant application area, driven by the increasing construction activities globally, which require effective sealing solutions for various materials and structures. The demand for sealants in this sector is further propelled by urbanization, infrastructure upgrades, and the need for energy-efficient buildings .

Global Sealants Market Competitive Landscape

The Global Sealants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, Sika AG, 3M Company, BASF SE, Dow Inc., Bostik SA (Arkema Group), RPM International Inc., PPG Industries, Inc., Huntsman Corporation, Illinois Tool Works Inc. (ITW), H.B. Fuller Company, Momentive Performance Materials Inc., Wacker Chemie AG, Covestro AG, Everbuild Building Products Ltd. (Sika Group) contribute to innovation, geographic expansion, and service delivery in this space.

Global Sealants Market Industry Analysis

Growth Drivers

- Increasing Demand from Construction Industry:The construction sector is projected to contribute significantly to the sealants market, with global construction spending expected to reach $14 trillion in future. This growth is driven by urbanization and infrastructure projects, particularly in developing regions. For instance, the Asian Development Bank estimates that Asia alone will require $26 trillion in infrastructure investments from 2016 to 2030, creating a robust demand for sealants in various applications.

- Rising Automotive Production:The automotive industry is a key driver for sealants, with global vehicle production anticipated to exceed 100 million units in future. This surge is attributed to increasing consumer demand for vehicles and advancements in automotive technology. According to the International Organization of Motor Vehicle Manufacturers, the production of electric vehicles is also on the rise, further boosting the need for specialized sealants that enhance vehicle performance and durability.

- Technological Advancements in Sealant Formulations:Innovations in sealant formulations are enhancing product performance, leading to increased adoption across various industries. For example, the development of high-performance sealants that offer superior adhesion and flexibility is expected to drive market growth. The global investment in research and development for sealant technologies is projected to reach $1.5 billion in future, reflecting the industry's commitment to improving product efficacy and sustainability.

Market Challenges

- Fluctuating Raw Material Prices:The sealants market faces challenges due to the volatility of raw material prices, particularly for petrochemical-based products. In future, the price of key raw materials like acrylics and silicones saw fluctuations of up to 20%, impacting production costs. This instability can lead to increased prices for end consumers and may hinder market growth, as manufacturers struggle to maintain profit margins while competing on price.

- Stringent Environmental Regulations:Regulatory frameworks aimed at reducing VOC emissions are becoming increasingly stringent, particularly in developed regions. For instance, the European Union's REACH regulations impose strict compliance requirements on sealant manufacturers. In future, companies may face fines exceeding €1 million for non-compliance, which could deter new entrants and increase operational costs for existing players, ultimately affecting market dynamics.

Global Sealants Market Future Outlook

The future of the sealants market appears promising, driven by a growing emphasis on sustainability and innovation. As consumers and industries increasingly prioritize eco-friendly products, the demand for bio-based and low-VOC sealants is expected to rise. Additionally, advancements in smart building technologies will likely integrate sealants into more sophisticated applications, enhancing their functionality and performance. This trend will create new avenues for growth and investment in the sealants sector, particularly in emerging markets.

Market Opportunities

- Expansion in Emerging Economies:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for sealant manufacturers. With urbanization rates projected to reach 60% in future in these regions, the demand for construction materials, including sealants, is expected to surge. This growth is supported by government initiatives aimed at improving infrastructure and housing, creating a favorable environment for market expansion.

- Development of Eco-Friendly Sealants:The increasing consumer preference for sustainable products is driving the development of eco-friendly sealants. The market for green sealants is projected to grow significantly, with investments in R&D expected to exceed $500 million in future. This shift not only aligns with regulatory trends but also meets the rising demand for environmentally responsible construction practices, positioning companies favorably in a competitive landscape.