Region:Asia

Author(s):Dev

Product Code:KRAC0379

Pages:87

Published On:August 2025

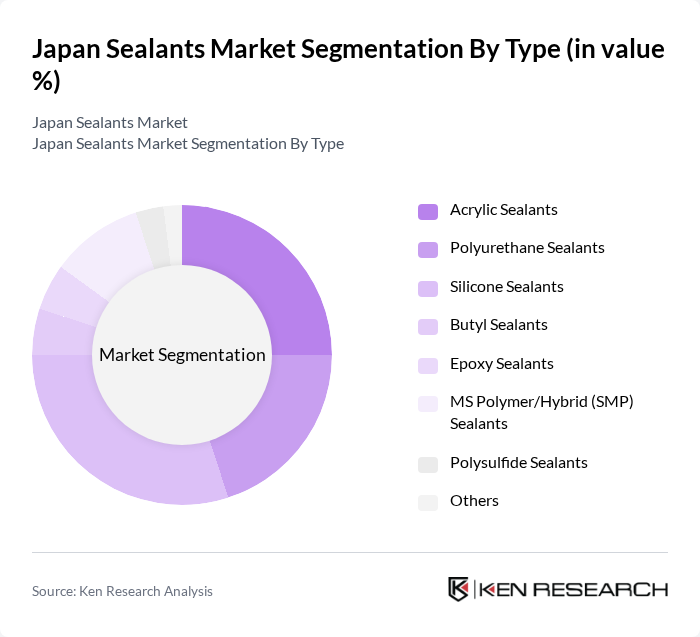

By Type:The sealants market can be segmented into various types, including Acrylic Sealants, Polyurethane Sealants, Silicone Sealants, Butyl Sealants, Epoxy Sealants, MS Polymer/Hybrid (SMP) Sealants, Polysulfide Sealants, and Others. Each type serves different applications and industries, with specific characteristics that cater to diverse consumer needs. Recent sources indicate silicone and polyurethane remain widely used in construction and automotive, while SMP/hybrids gain share due to low-VOC and weatherability advantages in Japan .

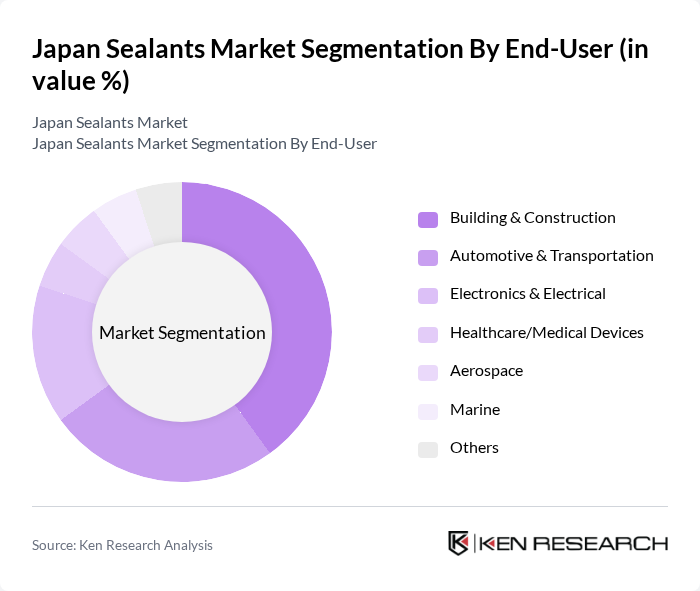

By End-User:The end-user segmentation includes Building & Construction, Automotive & Transportation, Electronics & Electrical, Healthcare/Medical Devices, Aerospace, Marine, and Others. Each sector has unique requirements for sealants, influencing the types and volumes of products used. Construction and automotive remain the largest demand centers in Japan, supported by ongoing infrastructure/commercial activity and the country’s established vehicle manufacturing footprint; electronics applications also contribute given Japan’s precision manufacturing base .

The Japan Sealants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shin-Etsu Chemical Co., Ltd., Cemedine Co., Ltd., Sika AG (including Sika Japan Ltd.; Hamatite), Henkel AG & Co. KGaA, 3M Company, Momentive Performance Materials Inc., Wacker Chemie AG, The Yokohama Rubber Co., Ltd. (Hamatite legacy), Konishi Co., Ltd., COVALENCE ADHESIVES K.K. (former Bostik Japan), Kaneka Corporation, Dow Inc., Nihon Chisso Engineering Co., Ltd. (sealant systems), Nichiban Co., Ltd. (industrial sealants/tapes), Pidilite Industries Ltd. (Araldite/Huntsman-legacy Japan distribution) contribute to innovation, geographic expansion, and service delivery in this space .

The Japan sealants market is poised for significant growth, driven by increasing construction activities and a shift towards sustainable building practices. The demand for energy-efficient solutions will continue to rise, supported by government initiatives aimed at reducing carbon emissions. Additionally, technological advancements in sealant formulations will enhance product performance and application versatility. As the market evolves, companies that prioritize innovation and sustainability will likely capture a larger share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Acrylic Sealants Polyurethane Sealants Silicone Sealants Butyl Sealants Epoxy Sealants MS Polymer/Hybrid (SMP) Sealants Polysulfide Sealants Others |

| By End-User | Building & Construction Automotive & Transportation Electronics & Electrical Healthcare/Medical Devices Aerospace Marine Others |

| By Application | Glazing & Weatherproofing Insulation & HVAC Sealing Flooring, Expansion Joints & Concrete Automotive Body-in-White, Trim & Glass Electronics Potting, Encapsulation & Conformal Coating Assembly, Packaging & Industrial Maintenance Others |

| By Distribution Channel | Direct Sales to OEM/Projects Industrial Distributors Online (B2B Portals & E-commerce) Retail/DIY Stores |

| By Price Range | Economy Mid-range Premium |

| By Packaging Type | Cartridges/Tubes Sausages/Foil Packs Cans/Pails Drums/Bulk |

| By Region | Kanto Kansai Chubu Chugoku & Shikoku Kyushu & Okinawa Hokkaido & Tohoku |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Sealant Usage | 140 | Project Managers, Site Supervisors |

| Automotive Sealant Applications | 110 | Manufacturing Engineers, Quality Control Managers |

| Adhesive and Sealant Distributors | 90 | Sales Managers, Distribution Coordinators |

| Consumer Preferences for Sealants | 120 | Homeowners, DIY Enthusiasts |

| Research and Development in Sealant Technologies | 70 | R&D Managers, Product Development Specialists |

The Japan Sealants Market is valued at approximately USD 590 million, with projections indicating it could range between USD 590 million and USD 630 million. This growth is primarily driven by demand from the construction and automotive sectors.