Global Serverless Computing Market Overview

- The Global Serverless Computing Market is valued at USD 22 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of cloud services, the need for cost-effective computing solutions, the proliferation of microservices architecture, and the expansion of 5G networks, which enable real-time data processing and lower latency. Organizations are leveraging serverless computing to enhance operational efficiency, accelerate application development, and reduce infrastructure management burdens.

- Key players in this market include the United States, China, and Germany, which dominate due to their advanced technological infrastructure, significant investments in cloud computing, and a high concentration of leading tech companies. The presence of major cloud service providers in these regions, as well as rapid digital transformation initiatives and the adoption of artificial intelligence and IoT, further accelerate market growth and innovation.

- In 2023, the European Union implemented the Digital Services Act, which mandates stricter regulations on data privacy and security for cloud service providers. This regulation aims to enhance user protection and ensure that serverless computing services comply with high standards of data governance, thereby influencing market dynamics and service offerings.

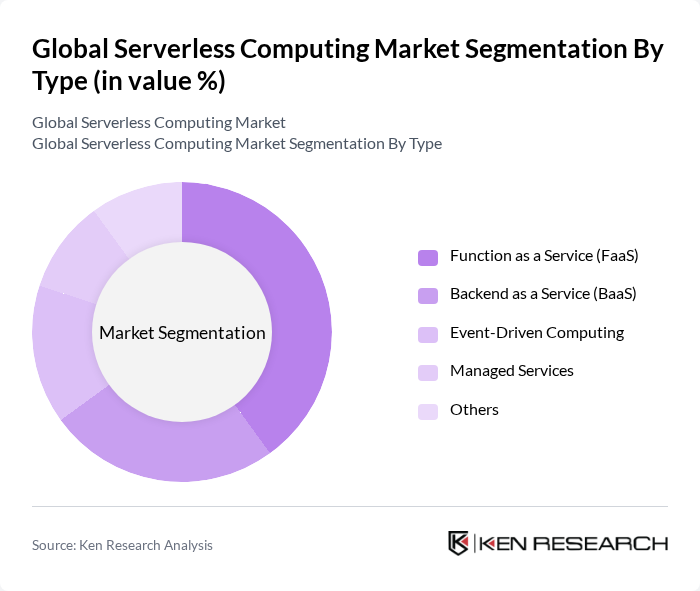

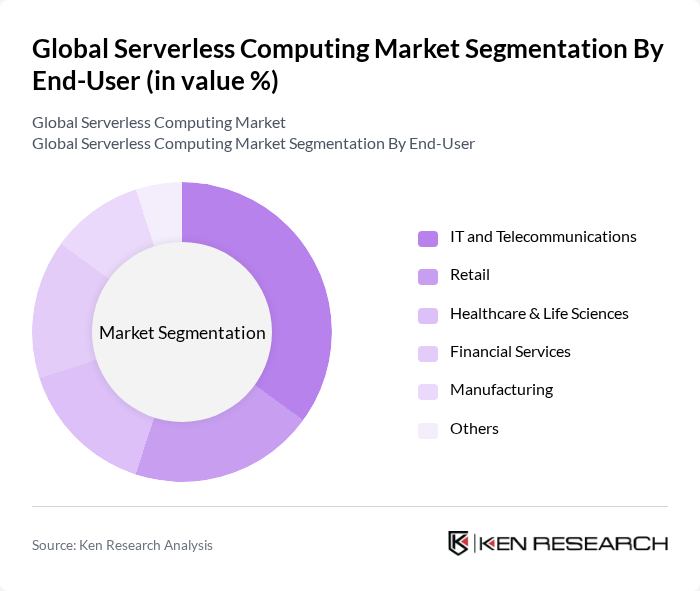

Global Serverless Computing Market Segmentation

By Type:The serverless computing market can be segmented into Function as a Service (FaaS), Backend as a Service (BaaS), Event-Driven Computing, Managed Services, and Others. Function as a Service (FaaS) is the leading sub-segment, favored for its flexibility, scalability, and cost-effectiveness, enabling developers to execute code in response to events without server management. This approach is particularly attractive to startups and enterprises seeking rapid innovation and operational efficiency.

By End-User:The end-user segmentation includes IT and Telecommunications, Retail, Healthcare & Life Sciences, Financial Services, Manufacturing, and Others. The IT and Telecommunications sector is the dominant segment, driven by the need for scalable, efficient, and resilient computing solutions. Organizations in this sector are rapidly adopting serverless architectures to streamline service delivery, support digital transformation, and improve operational agility.

Global Serverless Computing Market Competitive Landscape

The Global Serverless Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc., Microsoft Corporation, Google Cloud Platform, IBM Corporation, Oracle Corporation, Alibaba Cloud, DigitalOcean, LLC, Red Hat, Inc., Cloudflare, Inc., Heroku, Inc. (Salesforce, Inc.), Netlify, Inc., Vercel, Inc., Twilio, Inc., Firebase (Google LLC), Serverless, Inc., Fastly, Inc., Tencent Cloud, StackPath, LLC contribute to innovation, geographic expansion, and service delivery in this space.

Global Serverless Computing Market Industry Analysis

Growth Drivers

- Increased Demand for Scalable Applications:The global shift towards digital transformation has led to a significant increase in demand for scalable applications. In future, the global IT spending is projected to reach $4.5 trillion, with a substantial portion allocated to cloud services. This trend is driven by businesses seeking to enhance operational efficiency and customer engagement, leading to a projected increase in serverless computing adoption by 30% in the next year, as organizations prioritize scalability and flexibility in their application development.

- Cost Efficiency in IT Operations:Serverless computing offers substantial cost savings, as organizations only pay for the compute time they consume. According to a report by Gartner, companies can reduce their operational costs by up to 40% by adopting serverless architectures. In future, the average cost savings for enterprises utilizing serverless solutions is expected to exceed $1 billion collectively, as they eliminate the need for extensive infrastructure management and maintenance, allowing for reallocation of resources to innovation and growth.

- Rapid Development and Deployment Cycles:The demand for faster application development is driving the adoption of serverless computing. In future, organizations are expected to reduce their time-to-market by 50% through serverless architectures, as they enable developers to focus on code rather than infrastructure. This acceleration is supported by the increasing availability of serverless platforms, which facilitate continuous integration and deployment, allowing businesses to respond swiftly to market changes and customer needs.

Market Challenges

- Security and Compliance Concerns:As serverless computing grows, so do concerns regarding security and compliance. In future, 60% of organizations report that security is their primary concern when adopting serverless solutions. The complexity of managing data across multiple cloud environments increases the risk of breaches, with the average cost of a data breach projected to reach $4.45 million. This challenge necessitates robust security measures and compliance frameworks to protect sensitive information and maintain regulatory standards.

- Vendor Lock-in Issues:Vendor lock-in remains a significant challenge for organizations adopting serverless computing. In future, 55% of enterprises express concerns about being tied to a single cloud provider, which can limit flexibility and increase costs. The lack of standardization across serverless platforms complicates migration efforts, with potential costs of switching providers estimated at $1.2 million per organization. This challenge highlights the need for multi-cloud strategies to mitigate risks associated with vendor dependency.

Global Serverless Computing Market Future Outlook

The future of serverless computing is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly adopt multi-cloud strategies, the demand for interoperability among serverless platforms will grow. Additionally, the integration of AI and machine learning into serverless architectures will enhance automation and efficiency. In future, the focus on security solutions tailored for serverless environments will intensify, addressing the growing concerns around data protection and compliance, ultimately fostering a more secure cloud ecosystem.

Market Opportunities

- Integration with AI and Machine Learning:The convergence of serverless computing with AI and machine learning presents a lucrative opportunity. In future, the AI market is expected to reach $190 billion, with serverless architectures enabling real-time data processing and analytics. This integration will empower businesses to leverage predictive analytics and enhance decision-making, driving innovation and competitive advantage across various sectors.

- Expansion in Emerging Markets:Emerging markets are increasingly adopting cloud technologies, creating opportunities for serverless computing growth. In future, the cloud services market in Asia-Pacific is projected to grow by 25%, driven by digital transformation initiatives. This expansion offers serverless providers a chance to tap into new customer bases, fostering innovation and economic development in these regions while addressing local business needs.