Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2418

Pages:80

Published On:October 2025

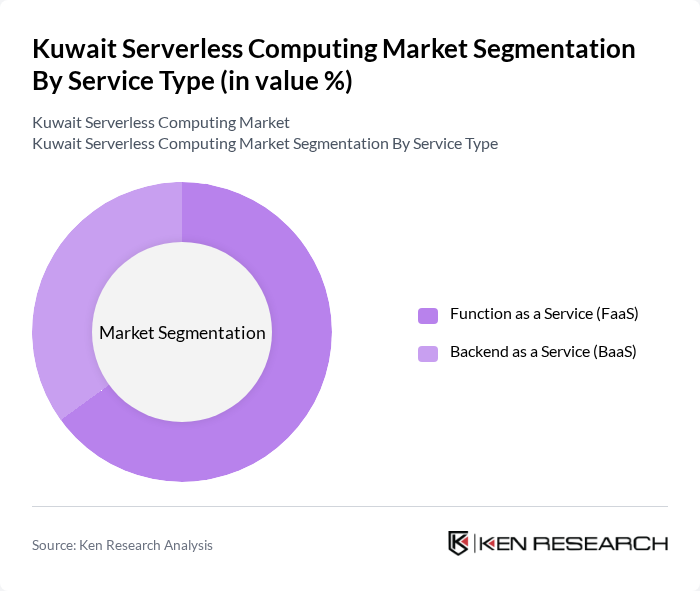

By Service Type:

The service type segmentation includes Function as a Service (FaaS) and Backend as a Service (BaaS). Among these, Function as a Service (FaaS) is currently the leading sub-segment, driven by its ability to allow developers to run code in response to events without the complexity of managing servers. This model is particularly appealing to startups and enterprises looking to streamline their development processes and reduce costs. The flexibility and scalability offered by FaaS solutions are key factors contributing to its dominance in the market. The segmentation aligns with global trends, where FaaS is widely recognized as the core of serverless computing due to its event-driven, scalable nature.

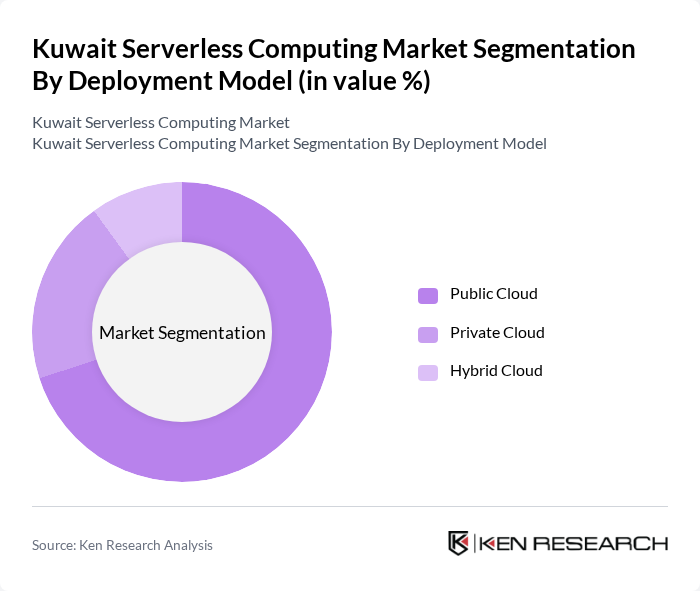

By Deployment Model:

The deployment model segmentation includes Public Cloud, Private Cloud, and Hybrid Cloud. The Public Cloud segment is the most prominent, as it offers cost-effective solutions and easy scalability for businesses of all sizes. Organizations are increasingly opting for public cloud services due to their flexibility and the reduced need for on-premises infrastructure. The growing trend of remote work and digital services has further accelerated the adoption of public cloud solutions in Kuwait. Public cloud revenue in Kuwait is projected to reach USD 287.78 million, with Software as a Service (SaaS) dominating this segment, indicating robust demand for cloud-native, serverless platforms. Cloud solutions are the fastest-growing segment in Kuwait’s ICT market, driven by government cloud-first mandates and the need for agile, scalable IT infrastructure.

The Kuwait Serverless Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM Cloud, Oracle Cloud Infrastructure, Alibaba Cloud, Zain Kuwait (Cloud Services Division), Ooredoo Kuwait (Cloud Solutions), stc Kuwait (Cloud and Data Center Services), Gulfnet Communications Company, Solutions by STC, Huawei Cloud, Red Hat OpenShift, VMware Cloud Services, Cloudflare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the serverless computing market in Kuwait appears promising, driven by ongoing digital transformation initiatives and increasing investments in technology. As businesses continue to prioritize agility and cost-effectiveness, serverless solutions are likely to gain traction. Furthermore, the integration of advanced technologies such as AI and IoT will enhance the capabilities of serverless architectures, enabling organizations to innovate and respond to market demands more effectively. The focus on security and compliance will also shape the development of this market.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Function as a Service (FaaS) Backend as a Service (BaaS) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By End-User Type | Startups Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies |

| By Industry Vertical | Healthcare Retail and E-commerce Financial Services and Banking IT and Telecommunications Media and Entertainment Transportation and Logistics Government and Public Sector Others |

| By Application | Web Applications Mobile Applications IoT and Edge Computing Data Processing and Analytics API Management DevOps and Automation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Adoption of Serverless Computing | 100 | IT Managers, Cloud Architects |

| SME Utilization of Cloud Services | 60 | Business Owners, IT Consultants |

| Government Sector Cloud Initiatives | 50 | Public Sector IT Directors, Policy Makers |

| Educational Institutions' Cloud Strategies | 40 | IT Administrators, Academic Researchers |

| Healthcare Sector Cloud Implementations | 50 | Healthcare IT Managers, System Administrators |

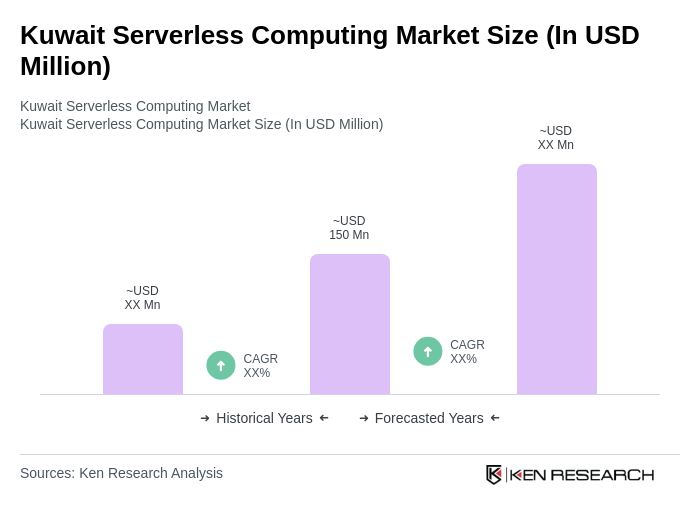

The Kuwait Serverless Computing Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing adoption of cloud technologies and the demand for scalable, cost-effective computing solutions.