Region:Global

Author(s):Shubham

Product Code:KRAA3200

Pages:95

Published On:August 2025

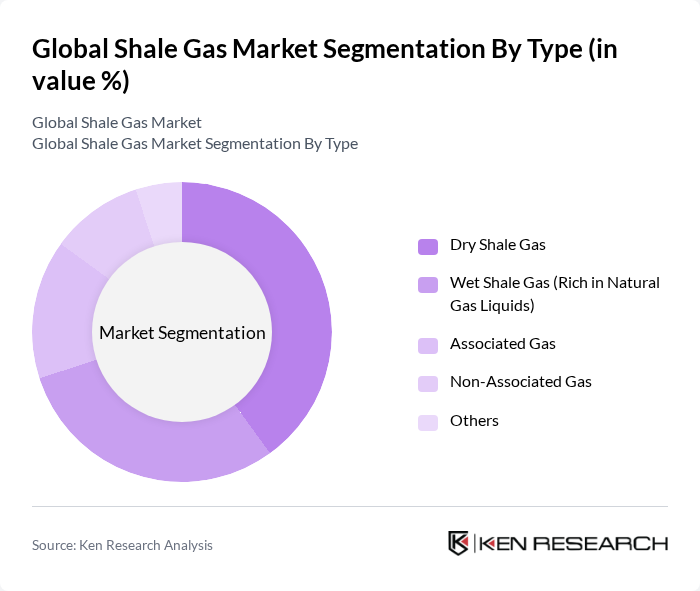

By Type:The shale gas market can be segmented into various types, including Dry Shale Gas, Wet Shale Gas, Associated Gas, Non-Associated Gas, and Others. Each type serves different purposes and has unique characteristics that cater to specific market needs.

The Dry Shale Gas segment is currently leading the market due to its high demand for electricity generation and industrial applications. This type of gas is favored for its lower carbon emissions compared to coal, making it a preferred choice for power plants. The increasing focus on reducing greenhouse gas emissions and transitioning to cleaner energy sources has further propelled the demand for dry shale gas. Additionally, advancements in extraction technologies, such as horizontal drilling and hydraulic fracturing, have made it more economically viable, solidifying its position as the dominant segment in the market .

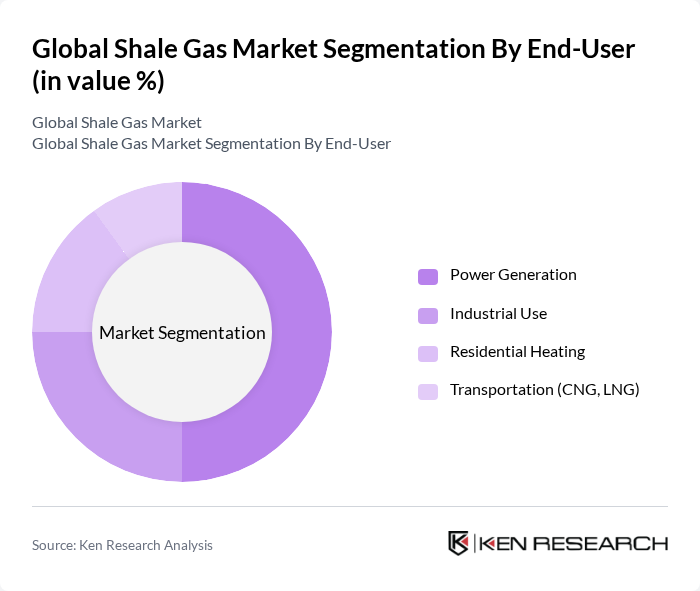

By End-User:The end-user segmentation includes Power Generation, Industrial Applications, Residential & Commercial Heating, Transportation (CNG/LNG), and Petrochemical Feedstock. Each end-user category plays a crucial role in the overall demand for shale gas.

The Power Generation segment is the largest end-user of shale gas, driven by the global shift towards cleaner energy sources. Natural gas-fired power plants are increasingly being utilized due to their efficiency and lower emissions compared to coal. This trend is further supported by government policies promoting renewable energy and reducing carbon footprints. The industrial applications segment also shows significant growth, as industries seek reliable and cost-effective energy sources to enhance productivity. Notably, the industrial sector is also a major consumer in certain regions, reflecting the versatility of shale gas in manufacturing and process industries .

The Global Shale Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Chesapeake Energy Corporation, EOG Resources, Inc., Range Resources Corporation, Coterra Energy Inc., Devon Energy Corporation, Antero Resources Corporation, Southwestern Energy Company, Ovintiv Inc., Pioneer Natural Resources Company, ConocoPhillips, TotalEnergies SE, BP p.l.c., Shell plc, Equinor ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shale gas market appears promising, driven by increasing global energy demands and a shift towards cleaner energy sources. Technological advancements will continue to enhance extraction efficiency, while regulatory frameworks will evolve to support sustainable practices. As countries strive to meet climate goals, the role of natural gas in the energy transition will grow, positioning shale gas as a critical component of the global energy landscape. Strategic investments in infrastructure will also play a vital role in shaping market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Shale Gas Wet Shale Gas Associated Gas Non-Associated Gas Others |

| By End-User | Power Generation Industrial Applications Residential & Commercial Heating Transportation (CNG/LNG) Petrochemical Feedstock |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Technology | Hydraulic Fracturing Horizontal Drilling Acidizing Microbial Enhanced Gas Recovery Others |

| By Application | Electricity Generation Chemical & Fertilizer Production Heating Transportation Fuels Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| North American Shale Gas Production | 120 | Production Managers, Geoscientists |

| European Shale Gas Exploration | 60 | Regulatory Affairs Specialists, Environmental Consultants |

| Asia-Pacific Shale Gas Market | 50 | Energy Analysts, Investment Managers |

| Technological Innovations in Shale Extraction | 40 | R&D Engineers, Technology Officers |

| Shale Gas Policy Impact Assessment | 40 | Policy Makers, Industry Advocates |

The Global Shale Gas Market is valued at approximately USD 88 billion, reflecting significant growth driven by the demand for cleaner energy sources, advancements in extraction technologies, and the need for energy security across various regions.