Region:Middle East

Author(s):Rebecca

Product Code:KRAD2915

Pages:88

Published On:November 2025

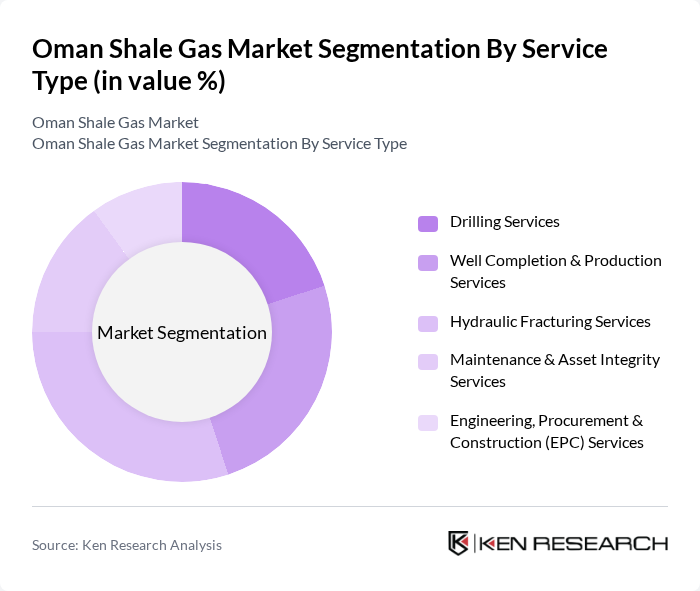

By Service Type:The service type segmentation includes various essential services that support shale gas operations. The subsegments are Drilling Services, Well Completion & Production Services, Hydraulic Fracturing Services, Maintenance & Asset Integrity Services, and Engineering, Procurement & Construction (EPC) Services. Among these, Hydraulic Fracturing Services is currently the leading subsegment due to the increasing reliance on advanced extraction techniques, such as multi-stage fracturing and horizontal drilling, to maximize production efficiency and recoverability of shale gas resources. The adoption of digital oilfield solutions and automation in hydraulic fracturing is further enhancing productivity and operational safety .

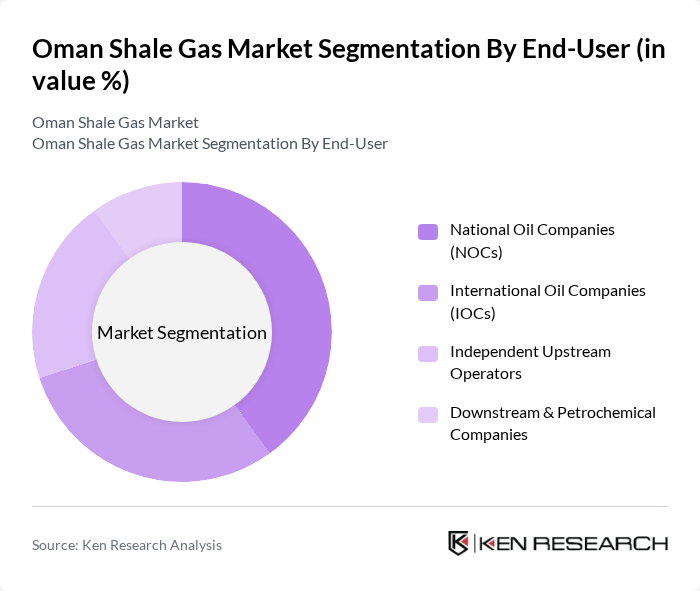

By End-User:The end-user segmentation encompasses various entities that utilize shale gas resources. The subsegments include National Oil Companies (NOCs), International Oil Companies (IOCs), Independent Upstream Operators, and Downstream & Petrochemical Companies. National Oil Companies dominate this segment due to their significant investments in exploration and production, as well as their strategic importance in national energy policies. NOCs are also leading the adoption of sustainability initiatives and digital transformation in upstream operations, further consolidating their market position .

The Oman Shale Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petroleum Development Oman (PDO), Oman Oil Company SAOC, Royal Dutch Shell plc, TotalEnergies SE, OQ (Oman Oil & Gas Services Holding Company), Occidental Petroleum Corporation, Oman Oil Marketing Company SAOG, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, National Oilwell Varco Inc., KCA Deutag, Nabors Industries Ltd., Superior Energy Services contribute to innovation, geographic expansion, and service delivery in this space.

The Oman shale gas market is poised for significant transformation as it navigates the dual challenges of environmental sustainability and economic viability. With increasing investments in technology and infrastructure, the sector is expected to enhance production efficiency while addressing environmental concerns. Strategic partnerships with international firms will likely facilitate knowledge transfer and innovation. As the global energy landscape shifts towards cleaner sources, Oman’s shale gas industry may also explore synergies with renewable energy initiatives, positioning itself as a key player in the energy transition.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Drilling Services Well Completion & Production Services Hydraulic Fracturing Services Maintenance & Asset Integrity Services Engineering, Procurement & Construction (EPC) Services |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Independent Upstream Operators Downstream & Petrochemical Companies |

| By Geographic Region | Northern Oman (Onshore) Southern Dhofar Governorate Al Batinah Region Offshore Fields |

| By Extraction Technology | Hydraulic Fracturing (Multi-stage) Horizontal Drilling Enhanced Oil Recovery (EOR) Subsea Boosting & Compact Processing |

| By Application | LNG & Gas Processing Power Generation Petrochemical Integration Blue Ammonia & Green Hydrogen |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Subsidies |

| By Service Model | Integrated Service Contracts Project-Based Services Long-Term Operations & Maintenance (O&M) Contracts Consulting & Advisory Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shale Gas Exploration Companies | 45 | Geologists, Exploration Managers |

| Energy Policy Makers | 38 | Government Officials, Regulatory Bodies |

| Environmental Impact Assessors | 32 | Environmental Scientists, Compliance Officers |

| Local Community Representatives | 28 | Community Leaders, Local Business Owners |

| Energy Sector Investors | 37 | Investment Analysts, Venture Capitalists |

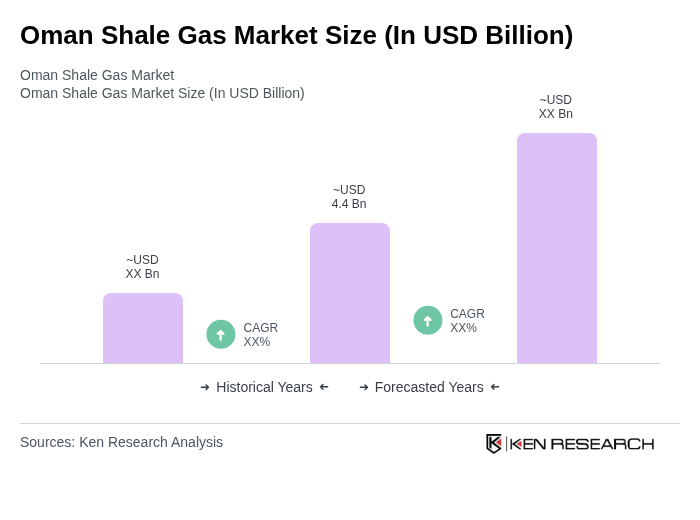

The Oman Shale Gas Market is valued at approximately USD 4.4 billion, driven by increasing energy demand, diversification of energy sources, and advancements in extraction technologies. This market is expected to grow further as investments in production capabilities continue.