Global Ski Gear and Equipment Market Overview

- The Global Ski Gear and Equipment Market is valued at USD 15.9 billion, based on a five-year historical analysis. This growth is primarily driven by increasing participation in winter sports, rising disposable incomes, and advancements in technology that enhance the performance and safety of ski gear. The market has seen a surge in demand for high-quality equipment as consumers become more health-conscious and seek outdoor recreational activities. Notably, the integration of smart equipment, wearable sensors, and eco-friendly materials is reshaping product innovation and consumer preferences .

- Key players in this market include countries with established ski resorts and a strong winter sports culture, such as the United States, Canada, Switzerland, and Austria. These regions dominate due to their extensive infrastructure, investment in ski tourism, and a large base of recreational and professional skiers. The presence of renowned ski brands and a robust retail network further solidify their market position. Expansion of ski resorts in Europe, North America, and emerging Asian destinations continues to stimulate demand for both recreational and professional gear .

- In 2023, the European Union implemented Regulation (EU) 2016/425 on personal protective equipment, issued by the European Parliament and the Council. This regulation mandates that all ski gear sold within the EU, including helmets and protective equipment, must meet specific safety criteria such as impact resistance and performance standards for skis and snowboards. The regulation requires manufacturers to conduct conformity assessments, affix CE markings, and provide technical documentation to ensure compliance, thereby improving overall safety for winter sports enthusiasts .

Global Ski Gear and Equipment Market Segmentation

By Type:The market is segmented into various types of ski gear and equipment, including skis, snowboards, ski boots, ski poles, protective gear, apparel, and accessories. Among these, skis and snowboards are the most popular, driven by the increasing number of recreational skiers and snowboarders. The demand for protective gear has also risen significantly due to heightened awareness of safety among consumers. The market is further influenced by the adoption of smart helmets, advanced materials, and ergonomic designs to enhance user experience and safety .

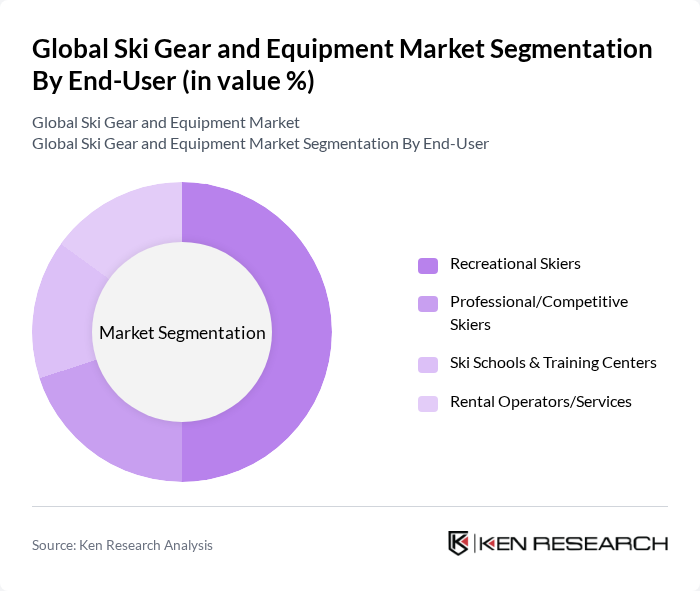

By End-User:The end-user segmentation includes recreational skiers, professional/competitive skiers, ski schools and training centers, and rental operators/services. Recreational skiers dominate the market, driven by the growing popularity of skiing as a leisure activity. Professional skiers and ski schools also contribute significantly, as they require specialized equipment and training gear. Rental operators are seeing increased demand due to the rise in tourism and short-term ski experiences .

Global Ski Gear and Equipment Market Competitive Landscape

The Global Ski Gear and Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Völkl, Rossignol, Salomon, Atomic, K2 Sports, Burton Snowboards, Head, Fischer Sports, Nordica, Elan, Black Diamond Equipment, Tecnica Group, Mammut Sports Group, Dakine, Outdoor Research, Alpina Sports (Uvex Sports Group GmbH & Co. KG), Amer Sports (Anta Sports), Clarus Corporation, Coalition Snow, Decathlon, Helly Hansen (Canadian Tire Corporation Limited), Volcom LLC (Authentic Brands Group), Columbia Sportswear, Spyder contribute to innovation, geographic expansion, and service delivery in this space.

Global Ski Gear and Equipment Market Industry Analysis

Growth Drivers

- Increasing Participation in Winter Sports:The global participation in winter sports has surged, with over 120 million people engaging in skiing and snowboarding annually. This increase is driven by a growing interest in outdoor activities, particularly among millennials and Gen Z. According to the International Ski Federation, ski resort visits reached 400 million in future, indicating a robust demand for ski gear and equipment. This trend is expected to continue, bolstered by promotional campaigns and increased accessibility to ski resorts.

- Technological Advancements in Gear:The ski gear industry is witnessing rapid technological innovations, with investments exceeding $1.1 billion in R&D in future. Enhanced materials, such as lightweight composites and smart technology integration, are improving performance and safety. For instance, smart ski equipment featuring GPS and performance tracking is gaining traction, appealing to tech-savvy consumers. This trend is expected to drive sales, as consumers increasingly seek high-performance gear that enhances their skiing experience.

- Rising Disposable Income:Global disposable income is projected to rise by 5.5% in future, particularly in emerging markets. This increase allows consumers to spend more on leisure activities, including skiing. In regions like Asia-Pacific, where disposable income growth is expected to reach $1.6 trillion, the demand for premium ski gear is likely to increase. As more individuals prioritize travel and winter sports, the ski gear market will benefit from this economic uplift.

Market Challenges

- High Cost of Equipment:The average cost of high-quality ski gear can exceed $1,250, which poses a barrier for many potential participants. This high price point limits access to skiing for lower-income demographics, particularly in regions where winter sports are not a cultural norm. As a result, the market faces challenges in expanding its consumer base, especially in price-sensitive markets where affordability is a significant concern.

- Seasonal Demand Fluctuations:The ski gear market is heavily influenced by seasonal demand, with sales peaking during winter months. In future, sales dropped by 30% during the off-season, leading to inventory challenges for retailers. This fluctuation complicates inventory management and financial planning for businesses. Companies must develop strategies to mitigate these seasonal impacts, such as diversifying product offerings or enhancing off-season marketing efforts.

Global Ski Gear and Equipment Market Future Outlook

The future of the ski gear market appears promising, driven by increasing participation in winter sports and technological advancements. As disposable incomes rise, particularly in emerging markets, more consumers are likely to invest in high-quality ski equipment. Additionally, the trend towards eco-friendly products and smart technology integration will shape consumer preferences. Companies that adapt to these trends and address seasonal challenges will be well-positioned to capitalize on the growing demand for ski gear in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia-Pacific, present significant growth opportunities. With a projected increase in winter sports participation by 25% in these regions, companies can tap into a new consumer base. Establishing partnerships with local ski resorts and promoting winter sports can enhance brand visibility and drive sales in these markets.

- Eco-Friendly Gear Development:The demand for sustainable products is rising, with 75% of consumers willing to pay more for eco-friendly gear. Companies that invest in developing biodegradable materials and sustainable manufacturing processes can attract environmentally conscious consumers. This shift not only meets consumer demand but also aligns with global sustainability goals, enhancing brand reputation and market share.