Region:Global

Author(s):Geetanshi

Product Code:KRAB1102

Pages:80

Published On:January 2026

By Type:The market is segmented into various types, including moisturizers, cleansers, sunscreens, anti-aging products, exfoliators, serums, and others. Among these, moisturizers are the leading sub-segment, driven by their essential role in daily skincare routines and the increasing demand for hydration-focused products. Consumers are increasingly seeking products that offer multifunctional benefits, such as hydration combined with anti-aging properties.

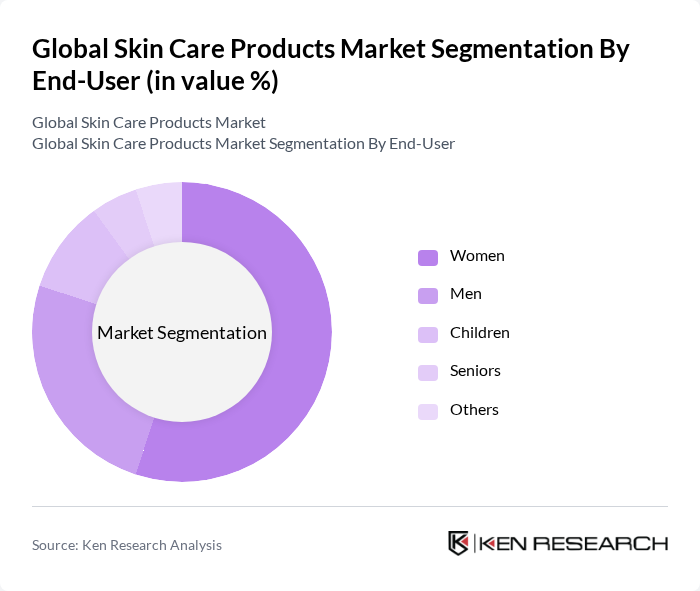

By End-User:The end-user segmentation includes women, men, children, seniors, and others. Women represent the largest segment, driven by a higher engagement in skincare routines and a broader range of product offerings tailored to their needs. The increasing awareness of skincare benefits among men is also contributing to the growth of the men's segment, as more men adopt skincare routines.

The Global Skin Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal, Estée Lauder Companies Inc., Procter & Gamble, Unilever, Johnson & Johnson, Coty Inc., Shiseido Company, Limited, Beiersdorf AG, Revlon, Inc., Amway Corporation, Mary Kay Inc., Avon Products, Inc., Neutrogena (Johnson & Johnson), Nivea (Beiersdorf AG), Clinique (Estée Lauder Companies Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The skin care products market is poised for significant transformation driven by technological advancements and sustainability initiatives. The integration of AI and smart manufacturing processes is expected to enhance production efficiency and responsiveness to consumer trends. Additionally, the growing emphasis on sustainability, including biodegradable packaging and ingredient transparency, will likely shape consumer preferences, leading brands to innovate and adapt their offerings to meet evolving market demands in the future and beyond.

| Segment | Sub-Segments |

|---|---|

| By Type | Moisturizers Cleansers Sunscreens Anti-aging products Exfoliators Serums Others |

| By End-User | Women Men Children Seniors Others |

| By Skin Type | Oily skin Dry skin Combination skin Sensitive skin Others |

| By Distribution Channel | Online retail Supermarkets/Hypermarkets Specialty stores Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Ingredient Type | Natural ingredients Synthetic ingredients Organic ingredients Others |

| By Product Formulation | Creams Gels Lotions Oils Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Skincare Preferences | 150 | Skincare Users, Beauty Enthusiasts |

| Professional Insights on Skincare Efficacy | 100 | Dermatologists, Skincare Experts |

| Market Trends in Natural Skincare | 80 | Brand Managers, Product Developers |

| Retail Insights on Skincare Sales | 70 | Retail Managers, Category Buyers |

| Consumer Attitudes Towards Sustainability | 90 | Eco-conscious Consumers, Sustainability Advocates |

The Global Skin Care Products Market is valued at approximately USD 200 billion, reflecting a significant growth trend driven by consumer preferences for organic ingredients, social media influence, and technological innovations in product formulations.