Region:Middle East

Author(s):Rebecca

Product Code:KRAE0951

Pages:87

Published On:December 2025

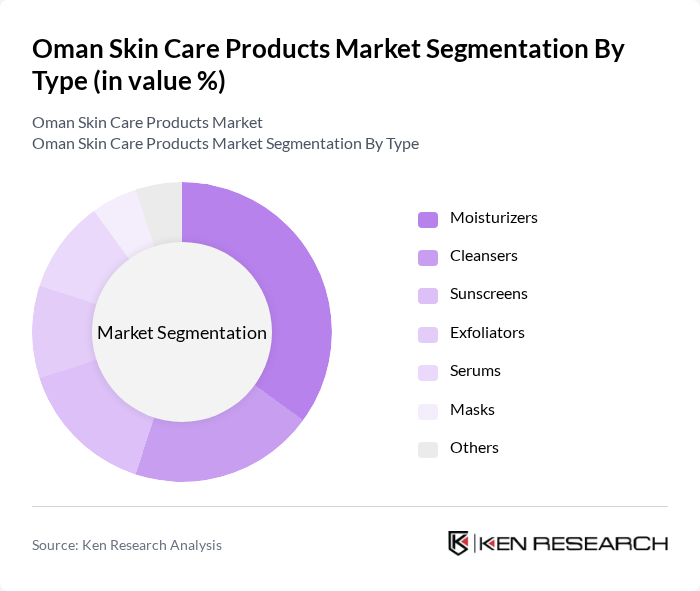

By Type:The skincare products market is segmented into various types, including moisturizers, cleansers, sunscreens, exfoliators, serums, masks, and others. Among these, moisturizers are the leading sub-segment, driven by the increasing demand for hydration and skin nourishment. Consumers are increasingly seeking products that offer multifunctional benefits, such as anti-aging properties and sun protection, which further boosts the popularity of moisturizers. The trend towards natural and organic ingredients is also influencing consumer choices, with many opting for products that align with their health and wellness values.

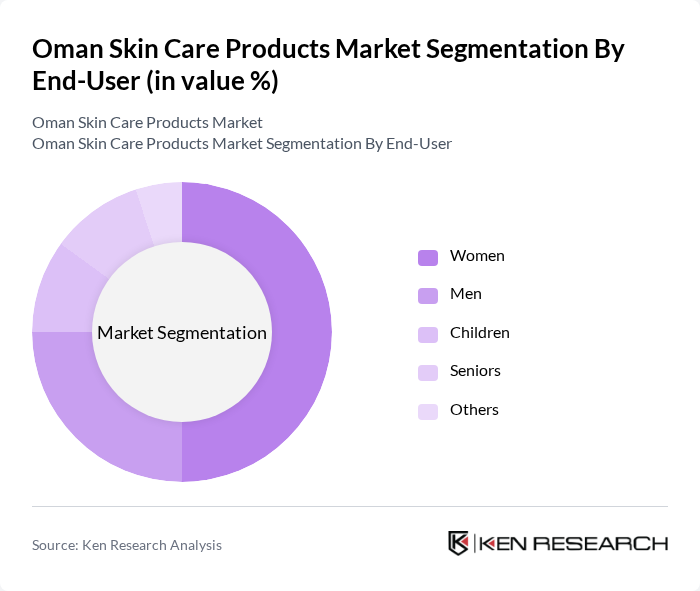

By End-User:The market is segmented by end-user demographics, including women, men, children, seniors, and others. Women represent the largest segment, driven by their higher engagement in skincare routines and a growing interest in beauty products. The increasing awareness of skincare benefits among men is also notable, leading to a rise in male-targeted products. Additionally, the children and seniors segments are gaining traction as parents and caregivers become more conscious of the importance of skincare for all age groups.

The Oman Skin Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muscat Pharmacy, Al Haramain Perfumes, Oman Oil Marketing Company, Al Ahlia Chemicals, Al Jazeera International, Al Mufeedah, Al Shamsi Group, Al Zawawi Group, Muscat Beauty contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman skincare market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized skincare solutions, brands are likely to invest in product innovation and customization. Additionally, the rise of social media influencers will continue to shape marketing strategies, enhancing brand visibility and consumer engagement. Overall, the market is expected to adapt to these trends, fostering a dynamic environment for growth and development in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Moisturizers Cleansers Sunscreens Exfoliators Serums Masks Others |

| By End-User | Women Men Children Seniors Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Price Range | Premium Mid-range Budget Others |

| By Packaging Type | Bottles Tubes Jars Sachets Others |

| By Brand Type | Local Brands International Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Skincare Products | 150 | Store Managers, Beauty Advisors |

| Consumer Preferences in Skincare | 200 | Skincare Users, Beauty Enthusiasts |

| Dermatological Insights | 50 | Dermatologists, Skincare Specialists |

| Market Trends Analysis | 100 | Market Analysts, Industry Experts |

| Product Development Feedback | 75 | Product Managers, R&D Teams |

The Oman Skin Care Products Market is valued at approximately USD 470 million. This valuation reflects the growing consumer awareness of skincare, the demand for natural ingredients, and the expansion of e-commerce platforms in the region.