Region:Global

Author(s):Shubham

Product Code:KRAA2656

Pages:85

Published On:August 2025

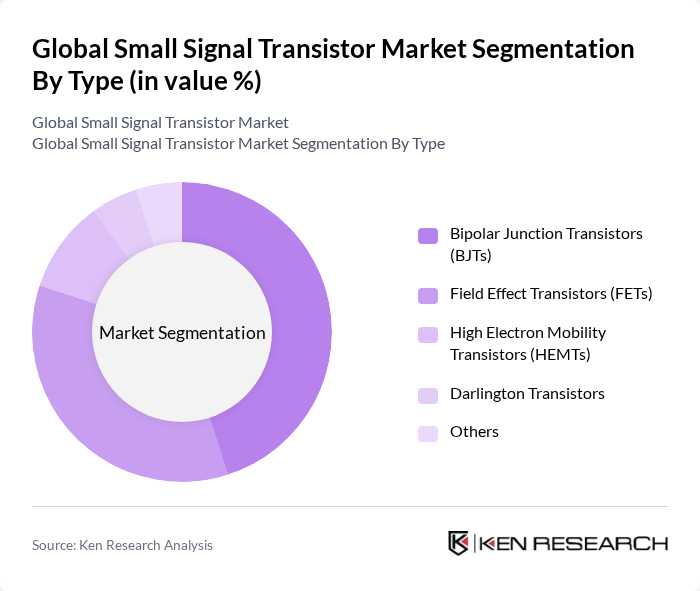

By Type:The market is segmented into Bipolar Junction Transistors (BJTs), Field Effect Transistors (FETs), High Electron Mobility Transistors (HEMTs), Darlington Transistors, and Others. BJTs and FETs are the most widely used due to their versatility and efficiency. BJTs are favored for high current gain and reliable amplification in analog circuits, while FETs are preferred for their high input impedance, low power consumption, and suitability for digital and high-frequency applications. The ongoing shift toward FETs is driven by demand for energy-efficient solutions in IoT, automotive, and next-generation communication systems .

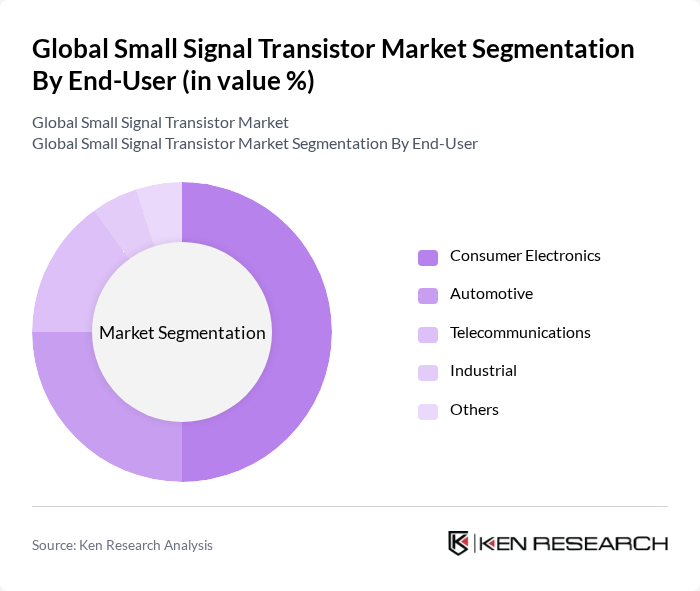

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Telecommunications, Industrial, and Others. The Consumer Electronics segment holds a significant share, fueled by the surge in smartphones, wearables, and smart home devices. Automotive demand is rapidly increasing due to electric vehicles and advanced driver-assistance systems (ADAS), while telecommunications growth is propelled by 5G infrastructure and high-speed data applications. Industrial automation and IoT adoption also contribute to market expansion .

The Global Small Signal Transistor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Incorporated, ON Semiconductor Corporation (onsemi), NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Analog Devices, Inc., Vishay Intertechnology, Inc., Microchip Technology Incorporated, Renesas Electronics Corporation, Broadcom Inc., Maxim Integrated Products, Inc. (now part of Analog Devices, Inc.), Fairchild Semiconductor International, Inc. (now part of ON Semiconductor), Diodes Incorporated, Cree, Inc. (now Wolfspeed, Inc.), ROHM Semiconductor, Toshiba Electronic Devices & Storage Corporation, Panasonic Holdings Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd., Taiwan Semiconductor Manufacturing Company Limited (TSMC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the small signal transistor market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of IoT devices is expected to enhance demand for efficient electronic components, with an estimated 35 billion connected devices in future. Additionally, the push for energy-efficient solutions will likely lead to innovations in semiconductor technology, fostering growth opportunities for manufacturers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bipolar Junction Transistors (BJTs) Field Effect Transistors (FETs) High Electron Mobility Transistors (HEMTs) Darlington Transistors Others |

| By End-User | Consumer Electronics Automotive Telecommunications Industrial Others |

| By Application | Amplifiers Switches Signal Processing Voltage Regulation Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Analog Technology Digital Technology Mixed-Signal Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Applications | 100 | Product Managers, Design Engineers |

| Automotive Electronics | 80 | Procurement Managers, R&D Engineers |

| Telecommunications Equipment | 60 | Network Engineers, Product Development Heads |

| Industrial Automation | 50 | Operations Managers, Technical Directors |

| IoT Devices | 40 | System Architects, Product Strategy Managers |

The Global Small Signal Transistor Market is valued at approximately USD 900 million, driven by the increasing demand for compact and energy-efficient components across various sectors, including consumer electronics, automotive, and telecommunications.