Region:Asia

Author(s):Shubham

Product Code:KRAA1779

Pages:84

Published On:August 2025

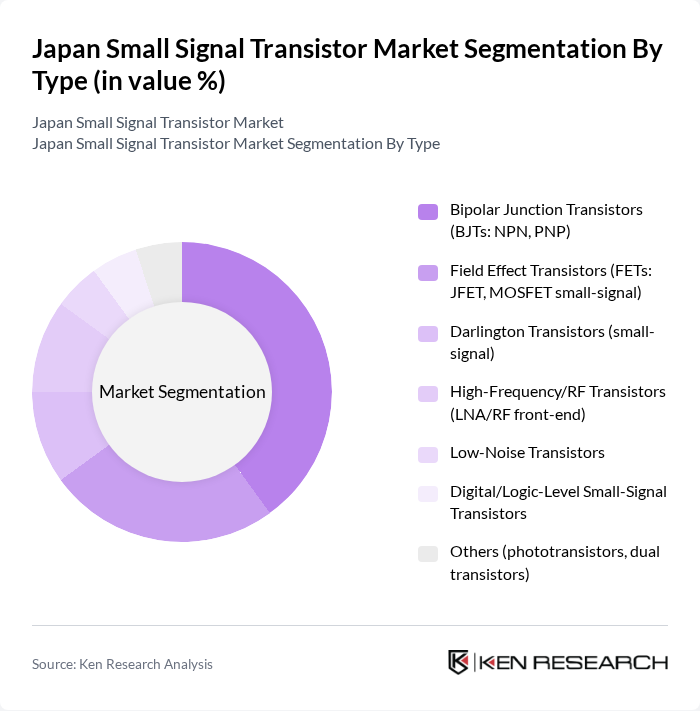

By Type:The market is segmented into various types of small signal transistors, including Bipolar Junction Transistors (BJTs), Field Effect Transistors (FETs), Darlington Transistors, High-Frequency/RF Transistors, Low-Noise Transistors, Digital/Logic-Level Small-Signal Transistors, and Others. Among these, Bipolar Junction Transistors (BJTs) remain widely used in analog front ends, general-purpose switching, and amplification due to robustness, linearity, and cost-effectiveness, while small-signal MOSFETs are preferred in low-power switching and logic-level interfaces; RF small-signal devices support wireless and high-frequency applications in handsets and base stations .

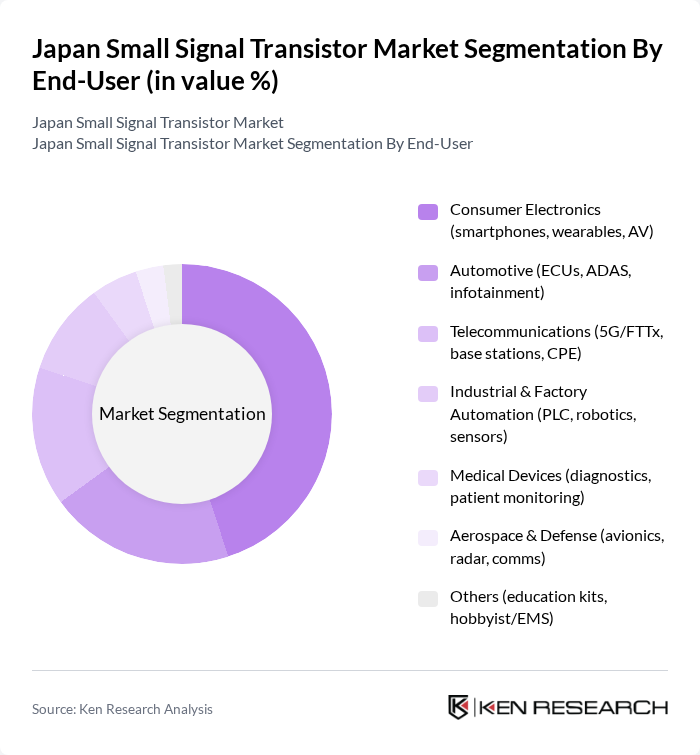

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Telecommunications, Industrial & Factory Automation, Medical Devices, Aerospace & Defense, and Others. The Consumer Electronics segment continues to lead in unit demand as smartphones, wearables, audio/visual, and home electronics integrate numerous small-signal devices; automotive electronics growth (ECUs, ADAS, infotainment) and 5G/FTTx deployments also support sustained consumption of small-signal BJTs/FETs and RF transistors in Japan .

The Japan Small Signal Transistor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toshiba Electronic Devices & Storage Corporation (Toshiba), Renesas Electronics Corporation, ROHM Co., Ltd. (ROHM Semiconductor), Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Nexperia Japan K.K., ON Semiconductor Japan Ltd. (onsemi), NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies Japan K.K., Texas Instruments Japan Limited, Panasonic Holdings Corporation, Sony Semiconductor Solutions Corporation, Microchip Technology Japan K.K., Rohde & Schwarz Japan K.K. (component distribution/solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan small signal transistor market appears promising, driven by technological advancements and increasing demand across various sectors. The integration of artificial intelligence in electronics is expected to enhance product capabilities, while the shift towards sustainable manufacturing practices will likely attract environmentally conscious consumers. Additionally, the ongoing expansion of telecommunications infrastructure will create new opportunities for innovation, ensuring that small signal transistors remain integral to the evolving electronics landscape in Japan.

| Segment | Sub-Segments |

|---|---|

| By Type | Bipolar Junction Transistors (BJTs: NPN, PNP) Field Effect Transistors (FETs: JFET, MOSFET small-signal) Darlington Transistors (small-signal) High-Frequency/RF Transistors (LNA/RF front-end) Low-Noise Transistors Digital/Logic-Level Small-Signal Transistors Others (phototransistors, dual transistors) |

| By End-User | Consumer Electronics (smartphones, wearables, AV) Automotive (ECUs, ADAS, infotainment) Telecommunications (5G/FTTx, base stations, CPE) Industrial & Factory Automation (PLC, robotics, sensors) Medical Devices (diagnostics, patient monitoring) Aerospace & Defense (avionics, radar, comms) Others (education kits, hobbyist/EMS) |

| By Application | Amplifiers (audio, RF, LNA) Switching/Level Shifting Oscillators & Timing Signal Conditioning/Processing Voltage/Current Regulation & Biasing Protection & Clamping (load/relay drivers) |

| By Distribution Channel | Direct OEM/ODM Sales Authorized Distributors (global/local) Online Distribution (e-commerce, eCatalog) Wholesale/Trading Houses Others (design-in reps, catalog houses) |

| By Price Range | Economy (high-volume SOT-23/SOT-323) Mid-Range High-End (low-noise/RF) Premium (specialized automotive/medical grade) |

| By Component | Discrete Small-Signal Transistors Arrayed/Matched Pairs & Duals Integrated Small-Signal Transistor Arrays in ICs Others (modules, hybrid packages) |

| By Technology | Silicon (Si) Small-Signal Gallium Arsenide (GaAs) RF Small-Signal Silicon-Germanium (SiGe) RF Small-Signal Others (GaN RF switches, specialty) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Managers, Procurement Specialists |

| Automotive Electronics Suppliers | 90 | Engineering Managers, Supply Chain Coordinators |

| Telecommunications Equipment Providers | 70 | Technical Directors, Operations Managers |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

| Distributors of Electronic Components | 80 | Sales Managers, Market Analysts |

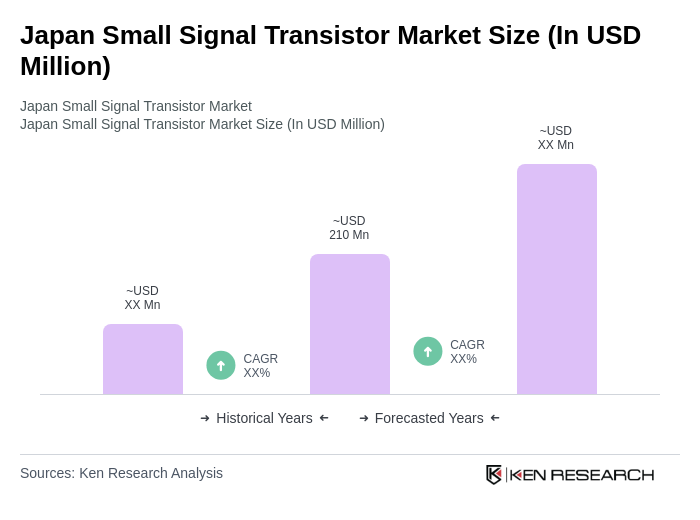

The Japan Small Signal Transistor Market is valued at approximately USD 210 million, reflecting demand from sectors such as consumer electronics, automotive electronics, and telecommunications. This valuation is consistent with various industry trackers that report a market size slightly above USD 200 million.